Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Using the information below, fill in the blanks in the far right column with the amount of each item that is included in

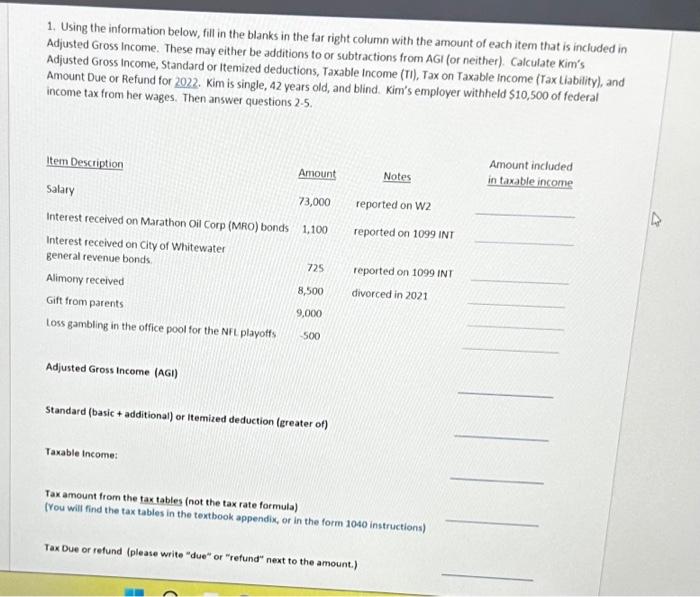

1. Using the information below, fill in the blanks in the far right column with the amount of each item that is included in Adjusted Gross Income. These may either be additions to or subtractions from AGI (or neither). Calculate Kim's Adjusted Gross Income, Standard or Itemized deductions, Taxable Income (TI), Tax on Taxable Income (Tax Liability), and Amount Due or Refund for 2022. Kim is single, 42 years old, and blind. Kim's employer withheld $10,500 of federal income tax from her wages. Then answer questions 2-5. Amount included Item Description Amount Notes in taxable income Salary 73,000 reported on W2 Interest received on Marathon Oil Corp (MRO) bonds 1,100 reported on 1099 INT Interest received on City of Whitewater general revenue bonds 725 reported on 1099 INT Alimony received 8,500 divorced in 2021 Gift from parents 9,000 Loss gambling in the office pool for the NFL playoffs 500 Adjusted Gross Income (AGI) Standard (basic+ additional) or Itemized deduction (greater of) Taxable Income: Tax amount from the tax tables (not the tax rate formula) (You will find the tax tables in the textbook appendix, or in the form 1040 instructions) Tax Due or refund (please write "due" or "refund" next to the amount.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started