Answered step by step

Verified Expert Solution

Question

1 Approved Answer

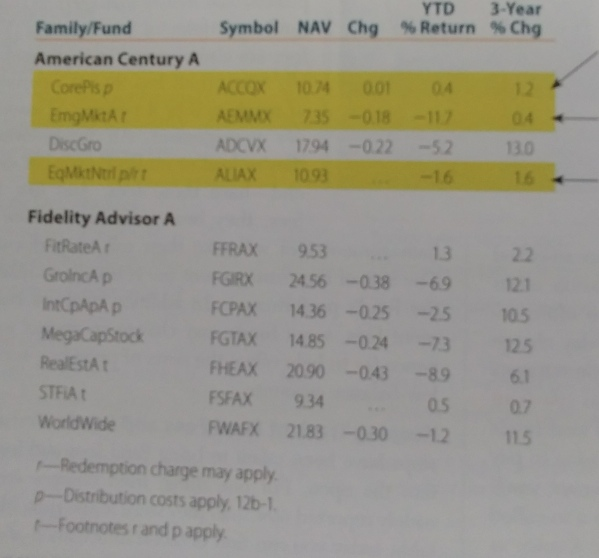

1. Using the mitral fund quotes in Exhibit 13.3 from the textbook, and assuming you can buy these funds at their quoted NAVs, how much

1. Using the mitral fund quotes in Exhibit 13.3 from the textbook, and assuming you can buy these funds at their quoted NAVs, how much would you have to pay to buy each of the following funds? a. FWAFX b. ADCVX c. FCPAX d. FSFAX

According to the quotes, which of these four funds have 12b-1 fees? Which have redemption fees? Are any of them no loads? Which fund has the highest year-to-date return? Which has the lowest?

YTD 3-Year Family/Fund American Century A Symbol NAV Chg %Return %Chg ACCOX 1074 001 ADCVX 1794 -02252 CorePs p 12 AEMMX 35 -018 -1104 130 16 EqMktNtl pt ALIAX 1093 -16 Fidelity Advisor A FitRateAr GrolncA p FFRAX 95313 GRX 2456 -0.38 -69121 CPAX 1436-025 -25 105 MegaCapStock FGTAX 1485 -024-73 125 RealEstA t STFIA t WorldWide FHEAX 2090 -043 -89 FSFAX 934 WAFX 2183-0.30 -1211 6.1 07 05 r--Redemption charge may apply p--Distribution costs apply. 12b-1 1--Footnotes r and p applyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started