Question

1) Using the table, what is the commission if an investor buys 15 call option contracts with a strike price of $30, if the option

1) Using the table, what is the commission if an investor buys 15 call option contracts with a strike price of $30, if the option price is $4.00?

2)Now lets assume the day before the option expires, the stock is trading at $40 per share. If the investor sells the options for $10.05 (makes the offsetting trade), how much is the net profit?

**I am Not understanding how I will use strike price in part 1 and stock price in the part 2

contract size= 100

I know it is ambiguous, but that is how it was posted in lecture notes examples.

Another similar example done in class; for reference;

If you buy 100 call option contracts that cost $0.50 per option, what is the commission? What if the option costs $5.00 each?

Solution:

Option price = $0.50

Total dollar amount = ($0.50)*(100 contracts)*(100 options/contract) = $5,000

Commission = $45+(1%)*($5,000) = $95

Compare this to the minimum and maximum commission:

Minimum = $30*1 + $2*99 = $228

Maximum = $30*5+$20*95 = $2,050

Therefore the commission will be $228 (since $95 is below the minimum)

Option price = $5.00

Total dollar amount = ($5.00)*100*100 = $50,000

Commission = $120 + 0.25%*($50,000) = $245 Therefore the commission will be $245. (Note: since this is still 100 contracts, the max and min are the same as in the first part)

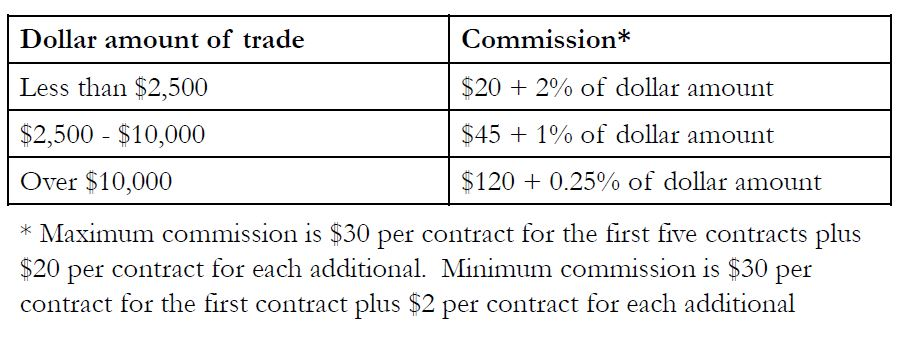

Dollar amount of trade Less than $2,500 $2,500 $10,000 Over $10,000 Commission* $20 + 2% of dollar amount $45 + 1% of dollar amount $120 + 0.25% of dollar amount * Maximum commission is $30 per contract for the first five contracts plus $20 per contract for each additional. Minimum commission is $30 per contract for the first contract plus $2 per contract for each additionalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started