Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Using the T-accounts template, set up the T-accounts with the balances from the Balance Sheet below. 2. Input the transactions below into each

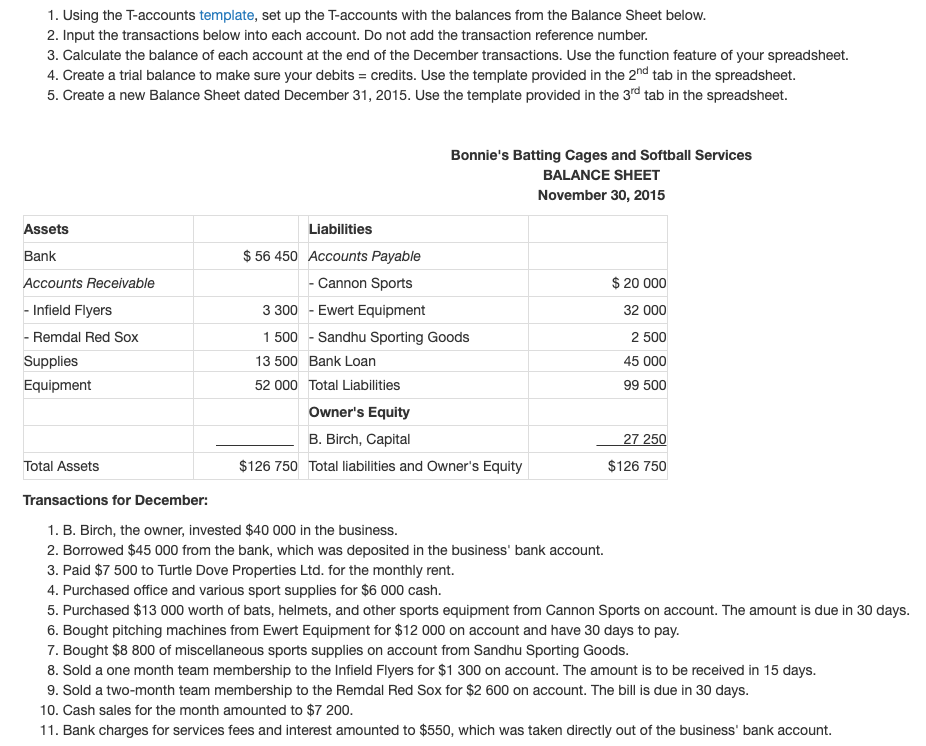

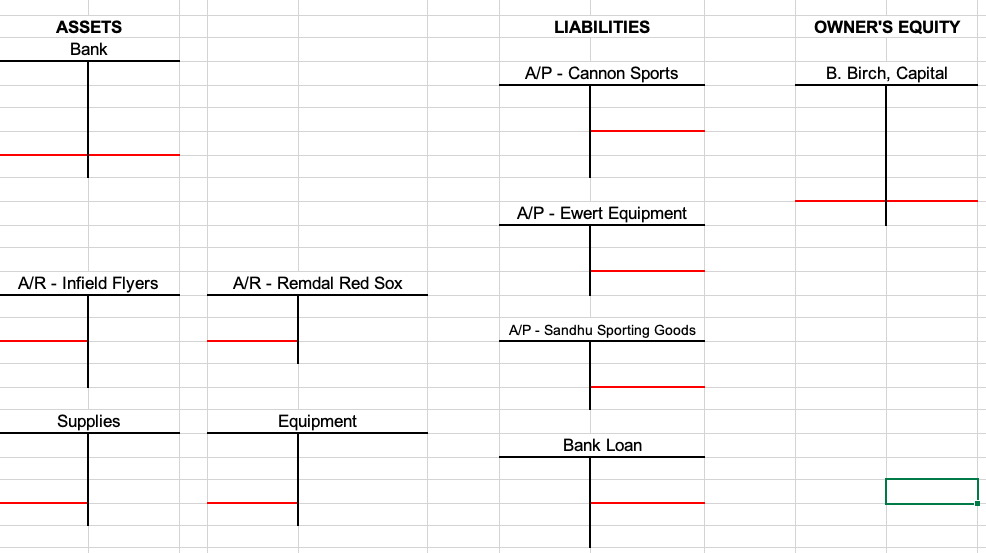

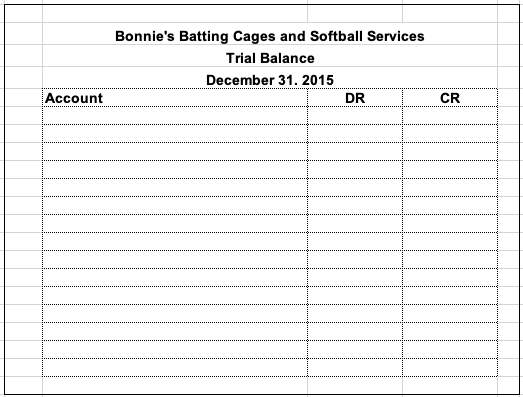

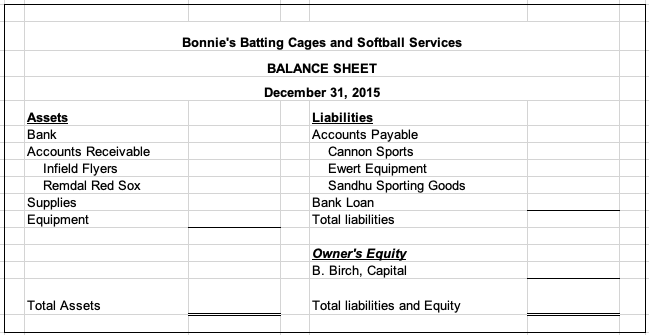

1. Using the T-accounts template, set up the T-accounts with the balances from the Balance Sheet below. 2. Input the transactions below into each account. Do not add the transaction reference number. 3. Calculate the balance of each account at the end of the December transactions. Use the function feature of your spreadsheet. 4. Create a trial balance to make sure your debits = credits. Use the template provided in the 2nd tab in the spreadsheet. 5. Create a new Balance Sheet dated December 31, 2015. Use the template provided in the 3rd tab in the spreadsheet. Bonnie's Batting Cages and Softball Services BALANCE SHEET November 30, 2015 Assets Bank Accounts Receivable - Infield Flyers - Remdal Red Sox Supplies Equipment Liabilities $ 56 450 Accounts Payable - Cannon Sports 3 300 Ewert Equipment 1500 - Sandhu Sporting Goods 13 500 Bank Loan 52 000 Total Liabilities Total Assets Transactions for December: Owner's Equity $ 20 000 32 000 2 500 45 000 99 500 B. Birch, Capital 27 250 $126 750 Total liabilities and Owner's Equity $126 750 1. B. Birch, the owner, invested $40 000 in the business. 2. Borrowed $45 000 from the bank, which was deposited in the business' bank account. 3. Paid $7 500 to Turtle Dove Properties Ltd. for the monthly rent. 4. Purchased office and various sport supplies for $6 000 cash. 5. Purchased $13 000 worth of bats, helmets, and other sports equipment from Cannon Sports on account. The amount is due in 30 days. 6. Bought pitching machines from Ewert Equipment for $12 000 on account and have 30 days to pay. 7. Bought $8 800 of miscellaneous sports supplies on account from Sandhu Sporting Goods. 8. Sold a one month team membership to the Infield Flyers for $1 300 on account. The amount is to be received in 15 days. 9. Sold a two-month team membership to the Remdal Red Sox for $2 600 on account. The bill is due in 30 days. 10. Cash sales for the month amounted to $7 200. 11. Bank charges for services fees and interest amounted to $550, which was taken directly out of the business' bank account. ASSETS Bank A/R - Infield Flyers A/R - Remdal Red Sox Supplies Equipment LIABILITIES A/P Cannon Sports OWNER'S EQUITY B. Birch, Capital A/P - Ewert Equipment A/P - Sandhu Sporting Goods Bank Loan Account Bonnie's Batting Cages and Softball Services Trial Balance December 31. 2015 DR CR Assets Bank Accounts Receivable Infield Flyers Remdal Red Sox Supplies Equipment Total Assets Bonnie's Batting Cages and Softball Services BALANCE SHEET December 31, 2015 Liabilities Accounts Payable Cannon Sports Ewert Equipment Sandhu Sporting Goods Bank Loan Total liabilities Owner's Equity B. Birch, Capital Total liabilities and Equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started