Answered step by step

Verified Expert Solution

Question

1 Approved Answer

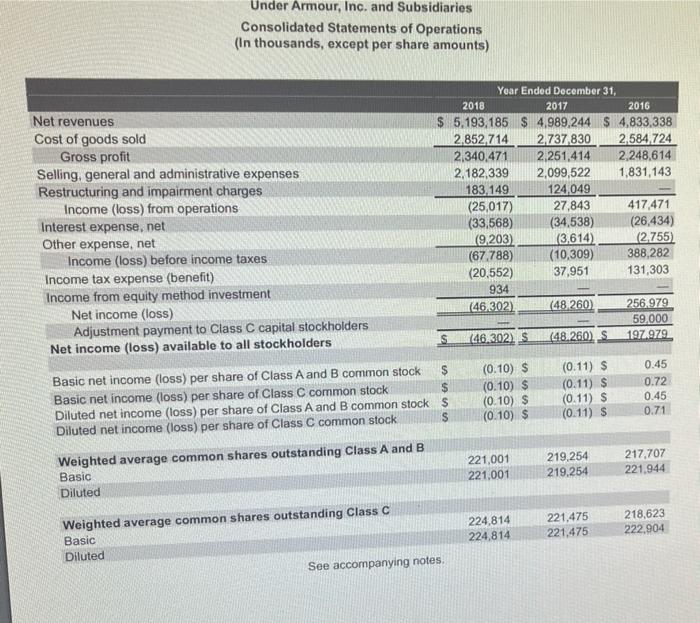

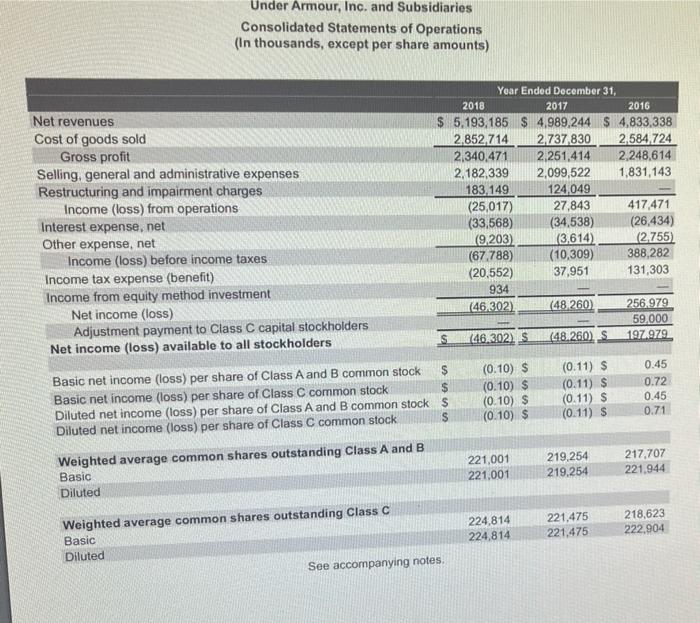

1) using the under armour financial statements, what was the sales growth rate between 2017 and 2018? express as a decimal rounded to 3 decimal

1) using the under armour financial statements, what was the sales growth rate between 2017 and 2018? express as a decimal rounded to 3 decimal points.

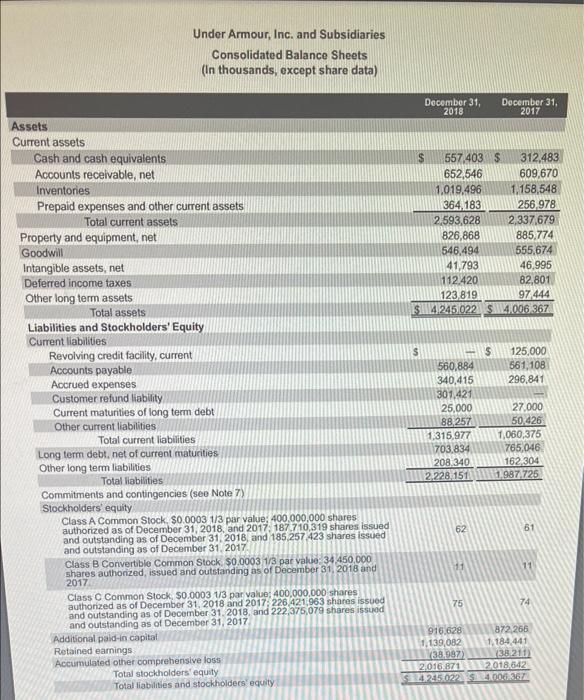

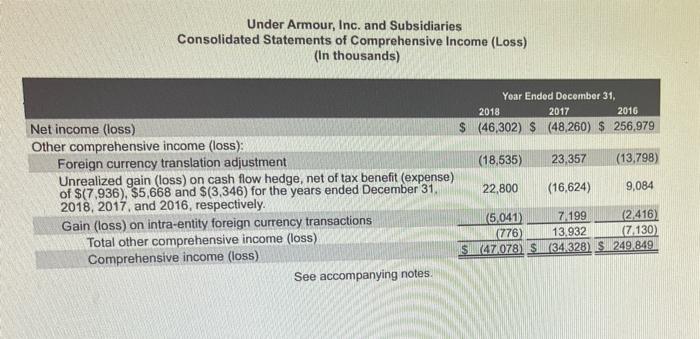

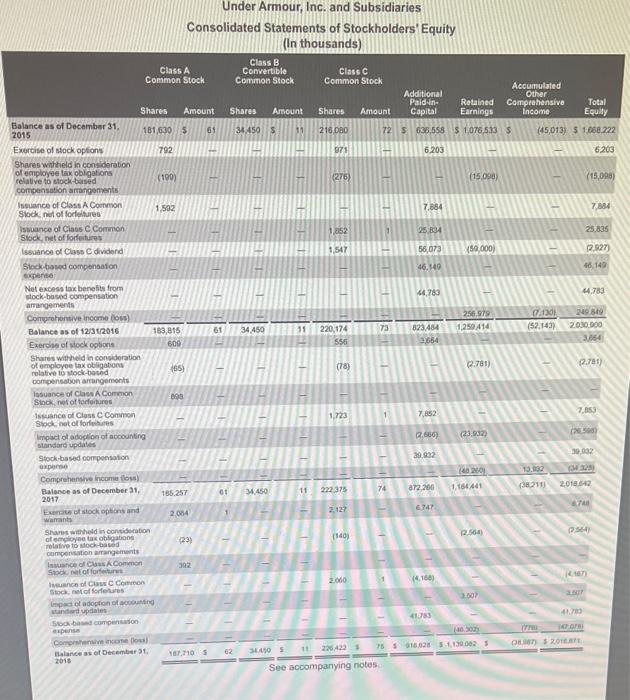

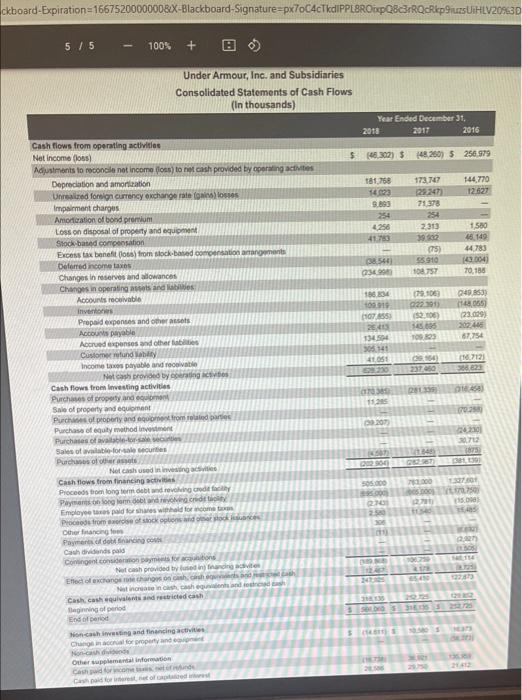

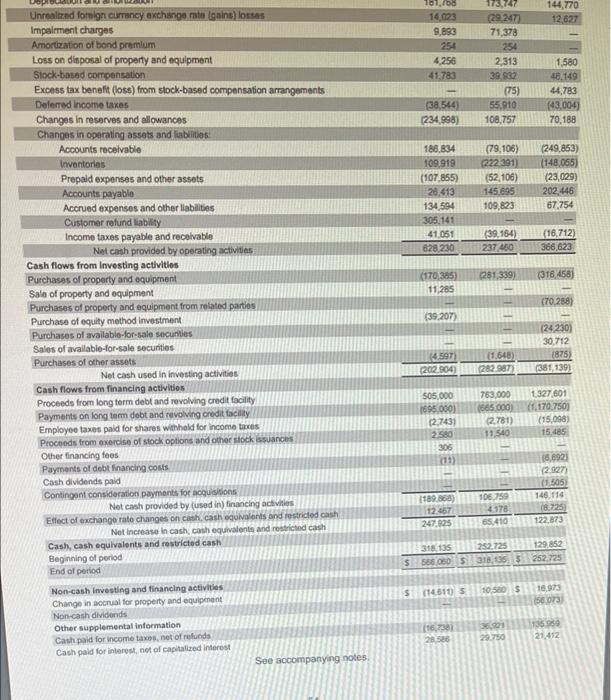

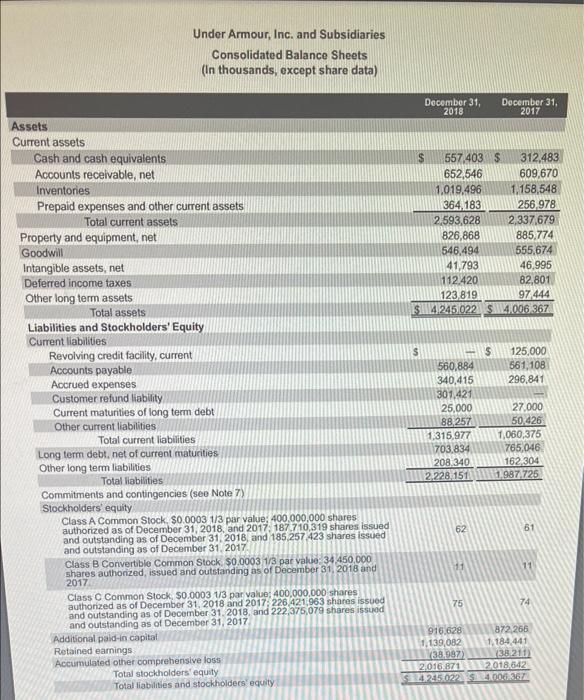

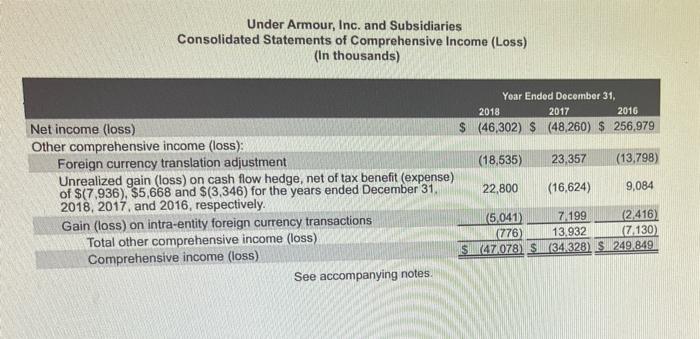

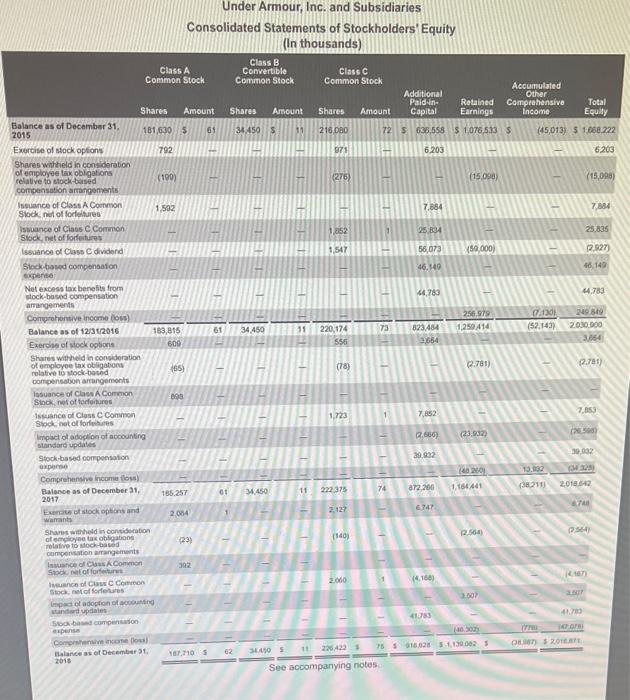

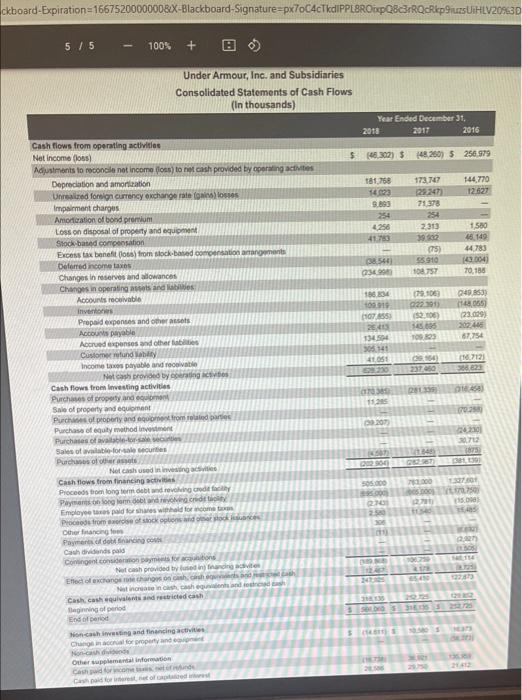

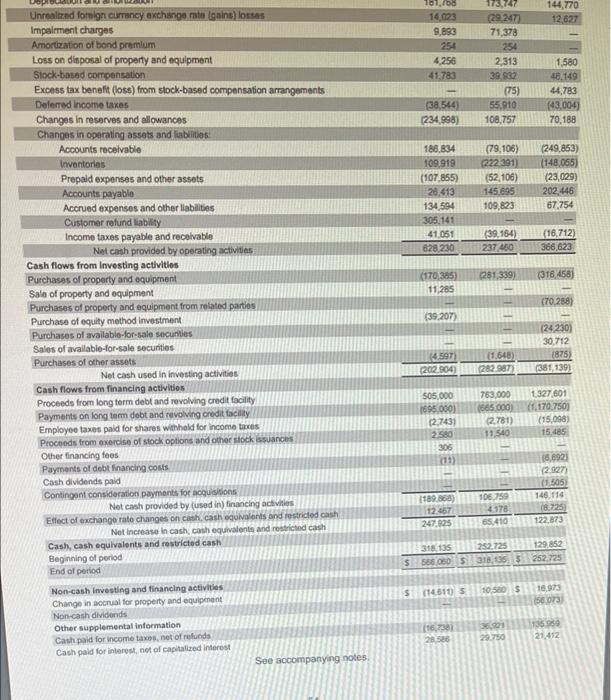

Under Armour, Inc. and Subsidiaries Consolidated Balance Sheets (In thousands, except share data) Under Armour, Inc. and Subsidiaries Consolidated Statements of Operations (In thousands, except per share amounts) Under Armour, Inc. and Subsidiaries Consolidated Statements of Comprehensive Income (Loss) (In thousands) Under Armour, Inc. and Subsidiaries Under Armour, Inc. and Subsidiaries Consolidated Statements of Cash Flows (In thousands) Unrealizod fotwion cumancy axchangen rate lanins) losts Impairment charges Anortization of bond premlum Loss on disposal of property and equipment Excens tax benefit (loss) from slock-based compensation arrangements Delerred income taxes Changes in reserves and allowances Changes in operating assets and liabilites: \begin{tabular}{l} Accounis receivable \\ invontories \\ Prepaid expenses and other assots \\ Acoounts payablie \\ Accrued expenses and other labilites \\ Customer refund liablity \\ Income taxes payable and recolvable \\ \hline Net cath provided by operating activites \end{tabular} Cash flows from investing activitios Not increase in cash, cash equ End of period Non-cash investing and tinancing activitios Chango in accual for property and equipnent Non-cash dividends. Other supplemental information Cath paid for income tawes, not of relunds Cash paia for intorose, net of captalized interest 5 (14.610 5 : 10,500 s 5:16,973 (202,804)(4.597)(262987)(1,648)1381,139)(3875) See accompanying notes. Under Armour, Inc. and Subsidiaries Consolidated Balance Sheets (In thousands, except share data) Under Armour, Inc. and Subsidiaries Consolidated Statements of Operations (In thousands, except per share amounts) Under Armour, Inc. and Subsidiaries Consolidated Statements of Comprehensive Income (Loss) (In thousands) Under Armour, Inc. and Subsidiaries Under Armour, Inc. and Subsidiaries Consolidated Statements of Cash Flows (In thousands) Unrealizod fotwion cumancy axchangen rate lanins) losts Impairment charges Anortization of bond premlum Loss on disposal of property and equipment Excens tax benefit (loss) from slock-based compensation arrangements Delerred income taxes Changes in reserves and allowances Changes in operating assets and liabilites: \begin{tabular}{l} Accounis receivable \\ invontories \\ Prepaid expenses and other assots \\ Acoounts payablie \\ Accrued expenses and other labilites \\ Customer refund liablity \\ Income taxes payable and recolvable \\ \hline Net cath provided by operating activites \end{tabular} Cash flows from investing activitios Not increase in cash, cash equ End of period Non-cash investing and tinancing activitios Chango in accual for property and equipnent Non-cash dividends. Other supplemental information Cath paid for income tawes, not of relunds Cash paia for intorose, net of captalized interest 5 (14.610 5 : 10,500 s 5:16,973 (202,804)(4.597)(262987)(1,648)1381,139)(3875) See accompanying notes 2) now, use that same annual growth rate to forecast what sales will be in 2020. keep unit in thousands and round to zero decimal points.

3) find the cost of goods sold as a percantage lf sales in 2018. express as a decimal and round to three decimal points.

4) assume that this percentage improves by 0.5 by 2020. for example if the number you found on 3 is .255, it would improve (lower) to .205. use this and your answer to #2 to forecast what gross profit will be in 2020. keep units in thousands and round to zero decimal points( after calculations are complete)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started