Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Using the Chart of Accounts provided, record the transactions for month of June in the General Journal. Do not add new accounts. 2.

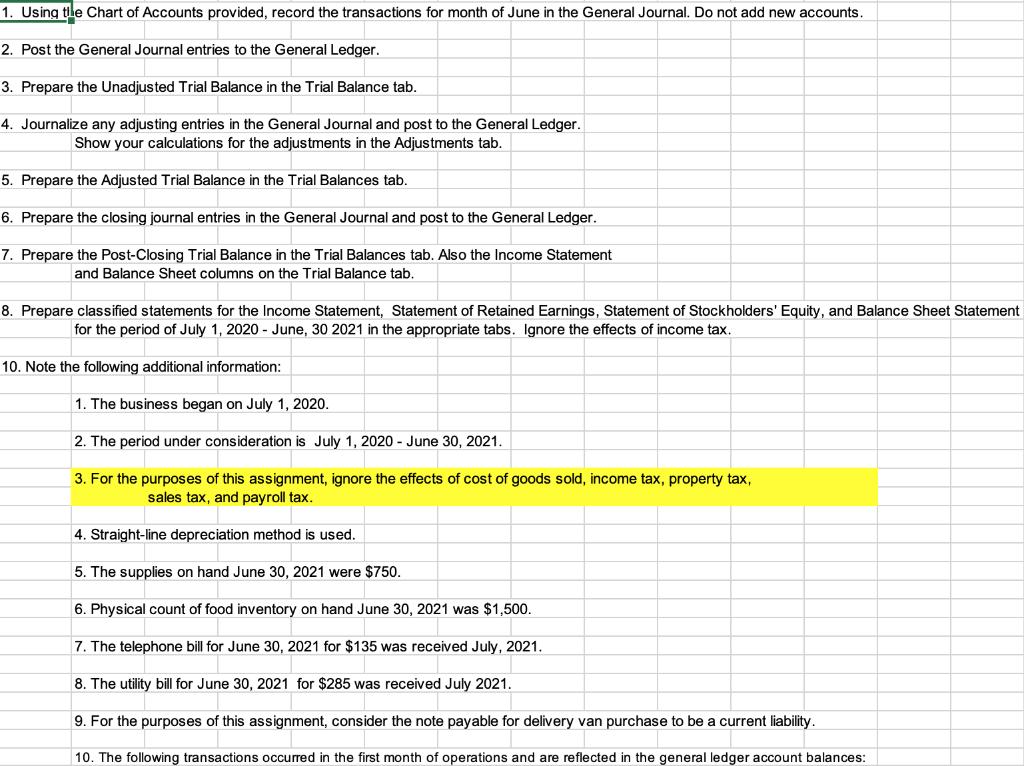

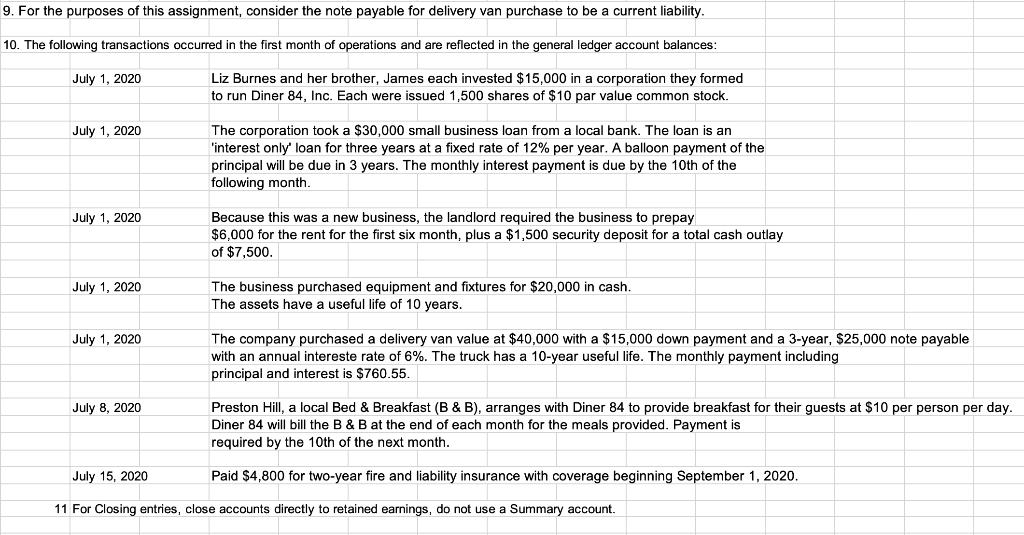

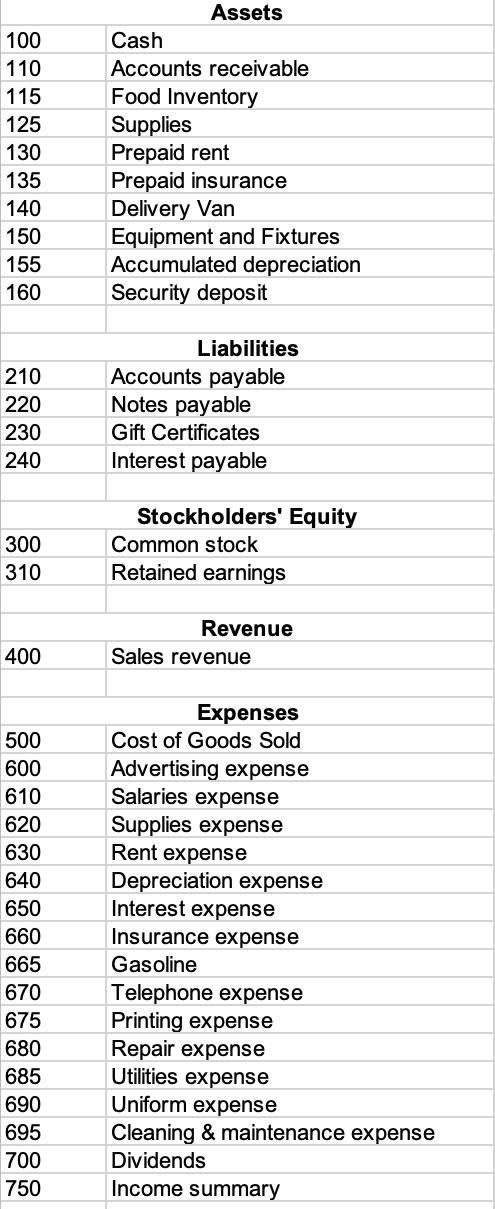

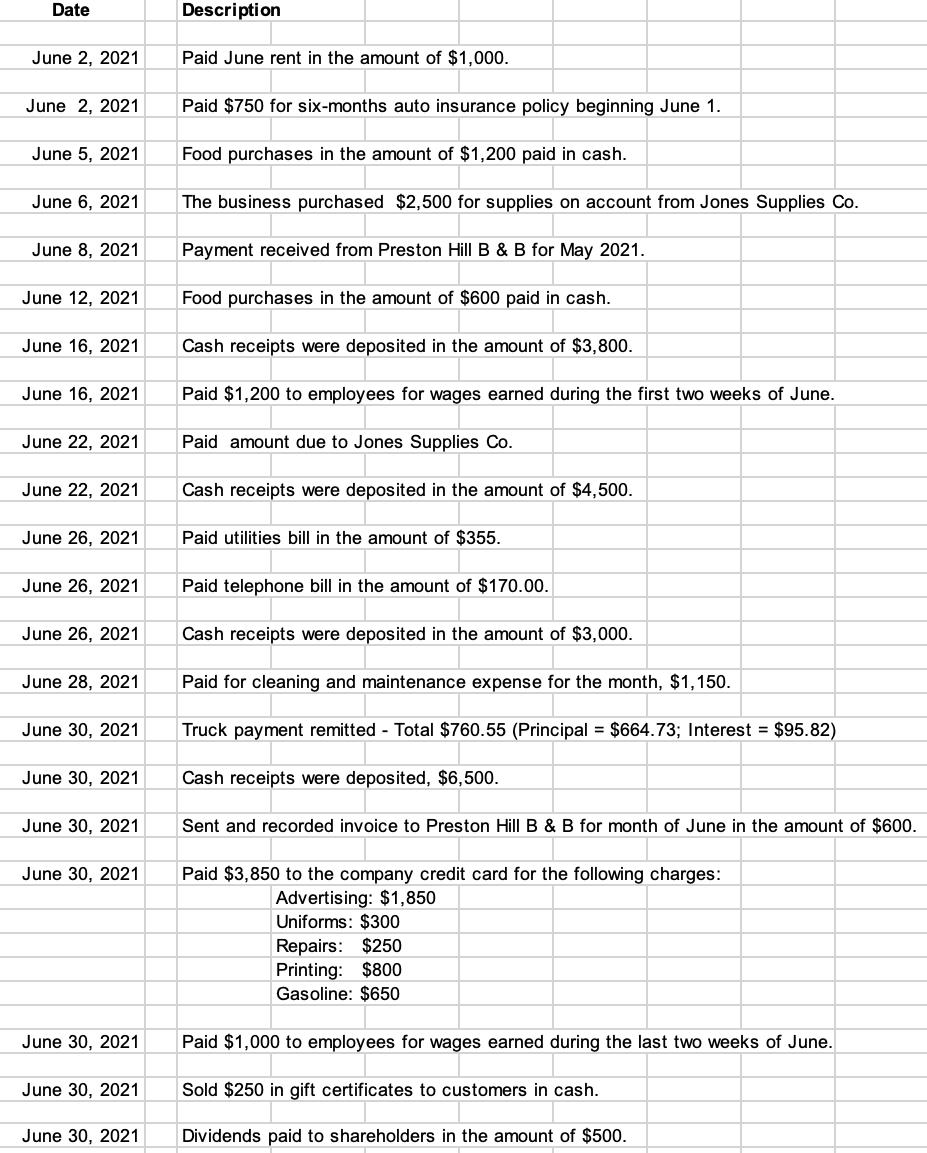

1. Using the Chart of Accounts provided, record the transactions for month of June in the General Journal. Do not add new accounts. 2. Post the General Journal entries to the General Ledger. 3. Prepare the Unadjusted Trial Balance in the Trial Balance tab. 4. Journalize any adjusting entries in the General Journal and post to the General Ledger. Show your calculations for the adjustments in the Adjustments tab. 5. Prepare the Adjusted Trial Balance in the Trial Balances tab. 6. Prepare the closing journal entries in the General Journal and post to the General Ledger. 7. Prepare the Post-Closing Trial Balance in the Trial Balances tab. Also the Income Statement and Balance Sheet columns on the Trial Balance tab. 8. Prepare classified statements for the Income Statement, Statement of Retained Earnings, Statement of Stockholders' Equity, and Balance Sheet Statement for the period of July 1, 2020 - June, 30 2021 in the appropriate tabs. Ignore the effects of income tax. 10. Note the following additional information: 1. The business began on July 1, 2020. 2. The period under consideration is July 1, 2020 - June 30, 2021. 3. For the purposes of this assignment, ignore the effects of cost of goods sold, income tax, property tax, sales tax, and payroll tax. 4. Straight-line depreciation method is used. 5. The supplies on hand June 30, 2021 were $750. 6. Physical count of food inventory on hand June 30, 2021 was $1,500. 7. The telephone bill for June 30, 2021 for $135 was received July, 2021. 8. The utility bill for June 30, 2021 for $285 was received July 2021. 9. For the purposes of this assignment, consider the note payable for delivery van purchase to be a current liability. 10. The following transactions occurred in the first month of operations and are reflected in the general ledger account balances: 9. For the purposes of this assignment, consider the note payable for delivery van purchase to be a current liability. 10. The following transactions occurred in the first month of operations and are reflected in the general ledger account balances: July 1, 2020 Liz Burnes and her brother, James each invested $15,000 in a corporation they formed to run Diner 84, Inc. Each were issued 1,500 shares of $10 par value common stock. July 1, 2020 July 1, 2020 July 1, 2020 July 1, 2020 July 8, 2020 The corporation took a $30,000 small business loan from a local bank. The loan is an 'interest only' loan for three years at a fixed rate of 12% per year. A balloon payment of the principal will be due in 3 years. The monthly interest payment is due by the 10th of the following month. Because this was a new business, the landlord required the business to prepay $6,000 for the rent for the first six month, plus a $1,500 security deposit for a total cash outlay of $7,500. The business purchased equipment and fixtures for $20,000 in cash. The assets have a useful life of 10 years. The company purchased a delivery van value at $40,000 with a $15,000 down payment and a 3-year, $25,000 note payable with an annual intereste rate of 6%. The truck has a 10-year useful life. The monthly payment including principal and interest is $760.55. Preston Hill, a local Bed & Breakfast (B & B), arranges with Diner 84 to provide breakfast for their guests at $10 per person per day. Diner 84 will bill the B & B at the end of each month for the meals provided. Payment is required by the 10th of the next month. July 15, 2020 11 For Closing entries, close accounts directly to retained earnings, do not use a Summary account. Paid $4,800 for two-year fire and liability insurance with coverage beginning September 1, 2020. 100 110 115 125 130 135 140 150 155 160 210 220 230 240 300 310 400 500 600 610 620 630 640 650 660 665 670 675 680 685 690 695 700 750 Assets Cash Accounts receivable Food Inventory Supplies Prepaid rent Prepaid insurance Delivery Van Equipment and Fixtures Accumulated depreciation Security deposit Liabilities Accounts payable Notes payable Gift Certificates Interest payable Stockholders' Equity Common stock Retained earnings Revenue Sales revenue Expenses Cost of Goods Sold Advertising expense Salaries expense Supplies expense Rent expense Depreciation expense Interest expense Insurance expense Gasoline Telephone expense Printing expense Repair expense Utilities expense Uniform expense Cleaning & maintenance expense Dividends Income summary Date June 2, 2021 June 2, 2021 June 5, 2021 June 6, 2021 June 8, 2021 June 12, 2021 June 16, 2021 June 16, 2021 June 22, 2021 June 22, 2021 June 26, 2021 June 26, 2021 June 26, 2021 June 28, 2021 June 30, 2021 June 30, 2021 June 30, 2021 June 30, 2021 June 30, 2021 June 30, 2021 June 30, 2021 Description Paid June rent in the amount of $1,000. Paid $750 for six-months auto insurance policy beginning June 1. Food purchases in the amount of $1,200 paid in cash. The business purchased $2,500 for supplies on account from Jones Supplies Co. Payment received from Preston Hill B & B for May 2021. Food purchases in the amount of $600 paid in cash. Cash receipts were deposited in the amount of $3,800. Paid $1,200 to employees for wages earned during the first two weeks of June. Paid amount due to Jones Supplies Co. Cash receipts were deposited in the amount of $4,500. Paid utilities bill in the amount of $355. Paid telephone bill in the amount of $170.00. Cash receipts were deposited in the amount of $3,000. Paid for cleaning and maintenance expense for the month, $1,150. Truck payment remitted - Total $760.55 (Principal = $664.73; Interest = $95.82) Cash receipts were deposited, $6,500. Sent and recorded invoice to Preston Hill B & B for month of June in the amount of $600. Paid 3,850 to the company credit card for the following charges: Advertising: $1,850 Uniforms: $300 Repairs: $250 Printing: $800 Gasoline: $650 Paid $1,000 to employees for wages earned during the last two weeks of June. Sold $250 in gift certificates to customers in cash. Dividends paid to shareholders in the amount of $500.

Step by Step Solution

★★★★★

3.58 Rating (183 Votes )

There are 3 Steps involved in it

Step: 1

1 Using the Chart of Accounts provided record the transactions for month of June in ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started