Question

1- Using Walgreens financials, calculate a horizontal analysis ($ and %) on the income statement including gross profit (you will have to calculate). I recommend

1- Using Walgreens financials, calculate a horizontal analysis ($ and %) on the income statement including gross profit (you will have to calculate). I recommend using the EXCEL spreadsheet to do this question.

2- Using Walgreens financials, then do the vertical analysis for the balance sheet for 2018 and 2017). I recommend using the EXCEL spreadsheet to do this question.

3- What do you notice about the change from year to year on the income statement and the change in the balances compared to the prior year? Be as specific as possible.

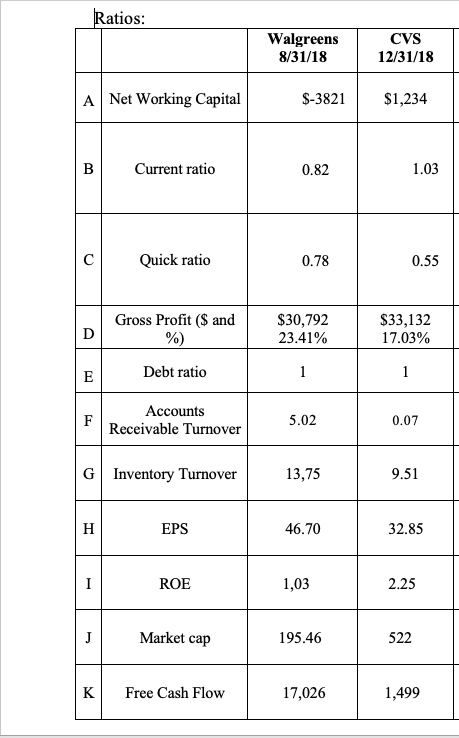

4- Which company would you invest, Walgreens or CVS, based on the financial statement analysis? Give me at least two sentences on how much and why.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started