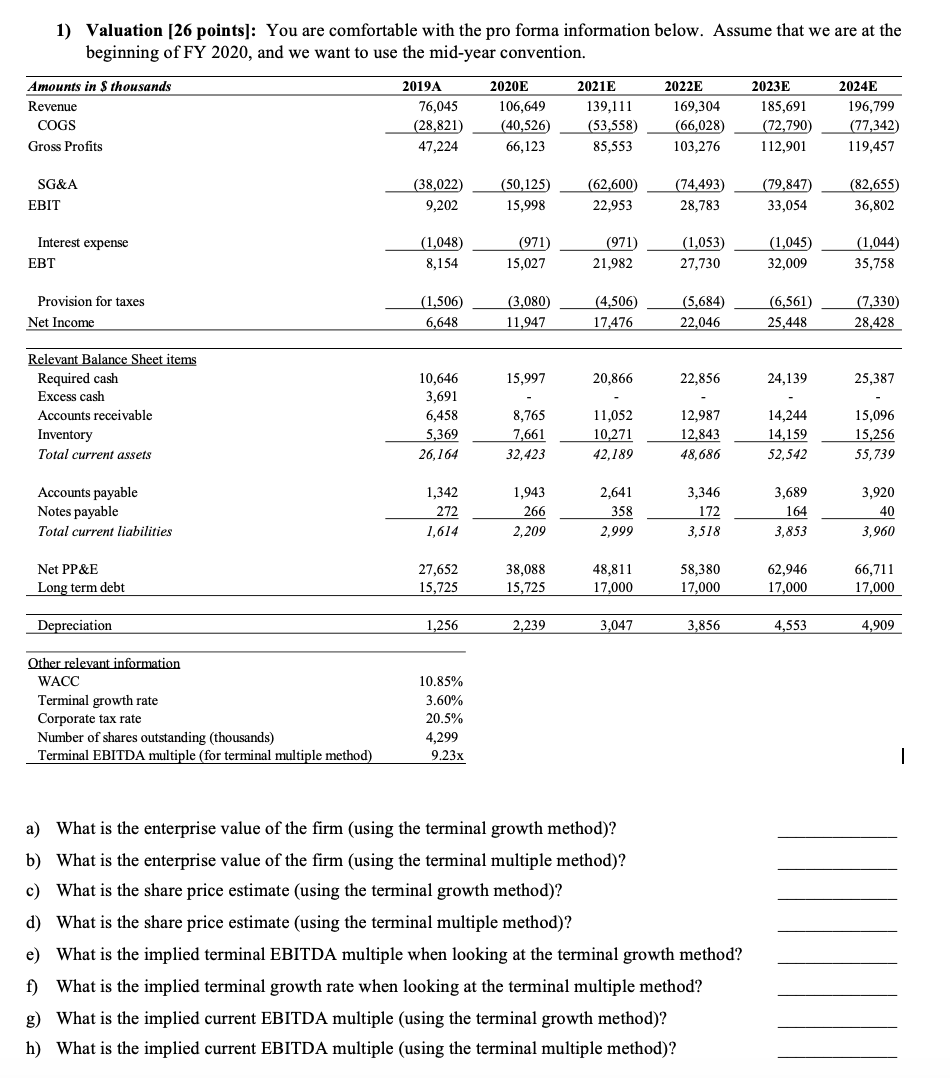

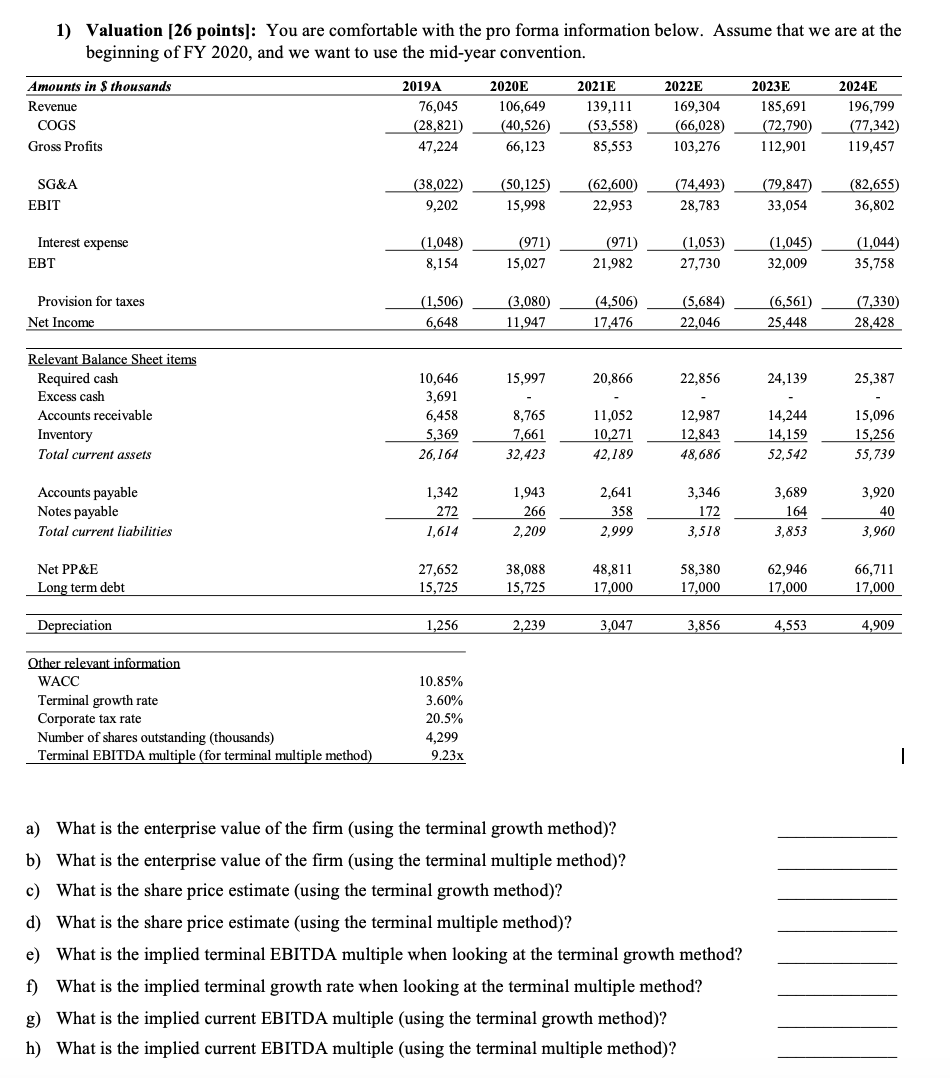

1) Valuation [26 points]: You are comfortable with the pro forma information below. Assume that we are at the beginning of FY 2020, and we want to use the mid-year convention. 2019A Amounts in $ thousands Revenue COGS Gross Profits 76,045 (28,821) 47,224 2020E 106,649 (40,526) 66,123 2021 139,111 (53,558) 85,553 2022 169,304 (66,028) 103,276 2023 185,691 (72,790) 112,901 2024E 196,799 (77,342) 119,457 SG&A EBIT (38,022) 9,202 (50,125) 15,998 (62,600 22,953 (74,493) 28,783 (79,847) 33,054 (82,655) 36,802 Interest expense EBT (1,048) 8,154 (971) 15,027 (971) 21,982 (1,053) 27,730 (1,045) 32,009 (1,044) 35,758 Provision for taxes Net Income (1,506 6,648 (3,080) 11,947 (4,506 17,476 - 29.084 (5,684) 22,046 (6,561) 25,448 (7,330 28,428 15,997 20,866 22,856 24,139 25,387 Relevant Balance Sheet items Required cash Excess cash Accounts receivable Inventory Total current assets 10,646 3,691 6,458 5,369 8,765 7,661 32,423 11,052 10,271 42,189 12,987 12,843 48,686 14,244 14,159 52,542 15,096 15,256 55,739 26,164 1,943 Accounts payable Notes payable Total current liabilities 1,342 272 1,614 266 2,641 358 2,999 3,346 172 3,518 3,689 164 3,853 3,920 40 3,960 2,209 Net PP&E Long term debt 27,652 15,725 38,088 15,725 48,811 17,000 58,380 17,000 62,946 17,000 66,711 17,000 Depreciation 1,256 2,239 3,047 3 ,856 4,553 4,909 Other relevant information WACC Terminal growth rate Corporate tax rate Number of shares outstanding (thousands) Terminal EBITDA multiple (for terminal multiple method) 10.85% 3.60% 20.5% 4,299 9.23x a) What is the enterprise value of the firm (using the terminal growth method)? b) What is the enterprise value of the firm (using the terminal multiple method)? c) What is the share price estimate (using the terminal growth method)? d) What is the share price estimate (using the terminal multiple method)? e) What is the implied terminal EBITDA multiple when looking at the terminal growth method? f) What is the implied terminal growth rate when looking at the terminal multiple method? g) What is the implied current EBITDA multiple (using the terminal growth method)? h) What is the implied current EBITDA multiple (using the terminal multiple method)