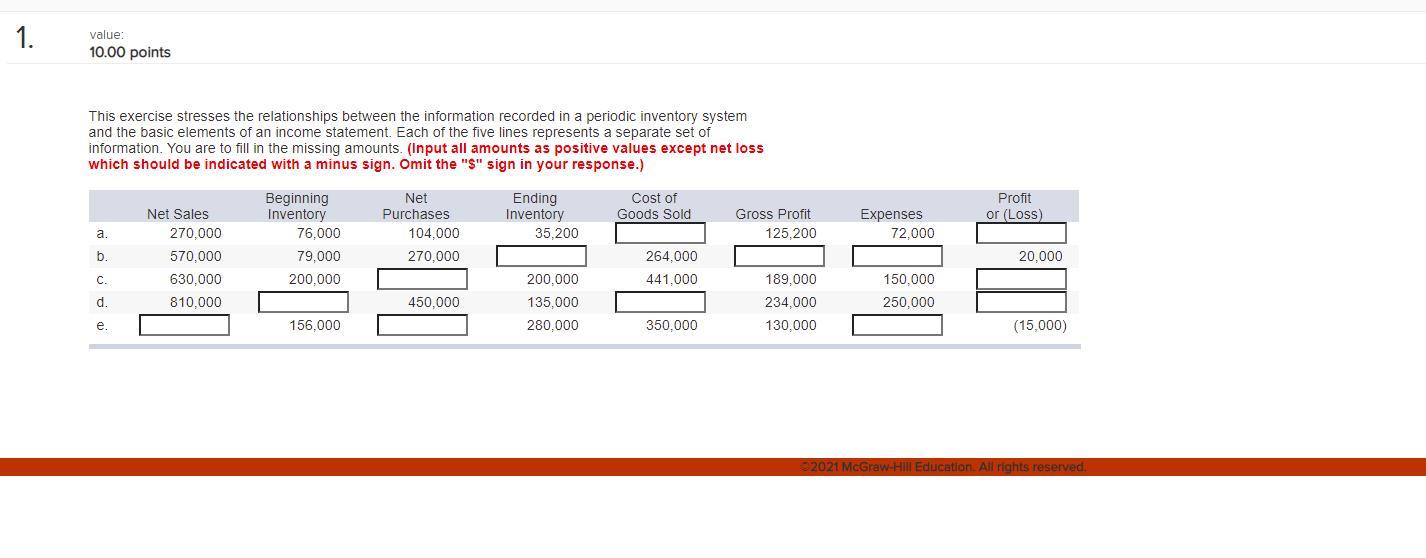

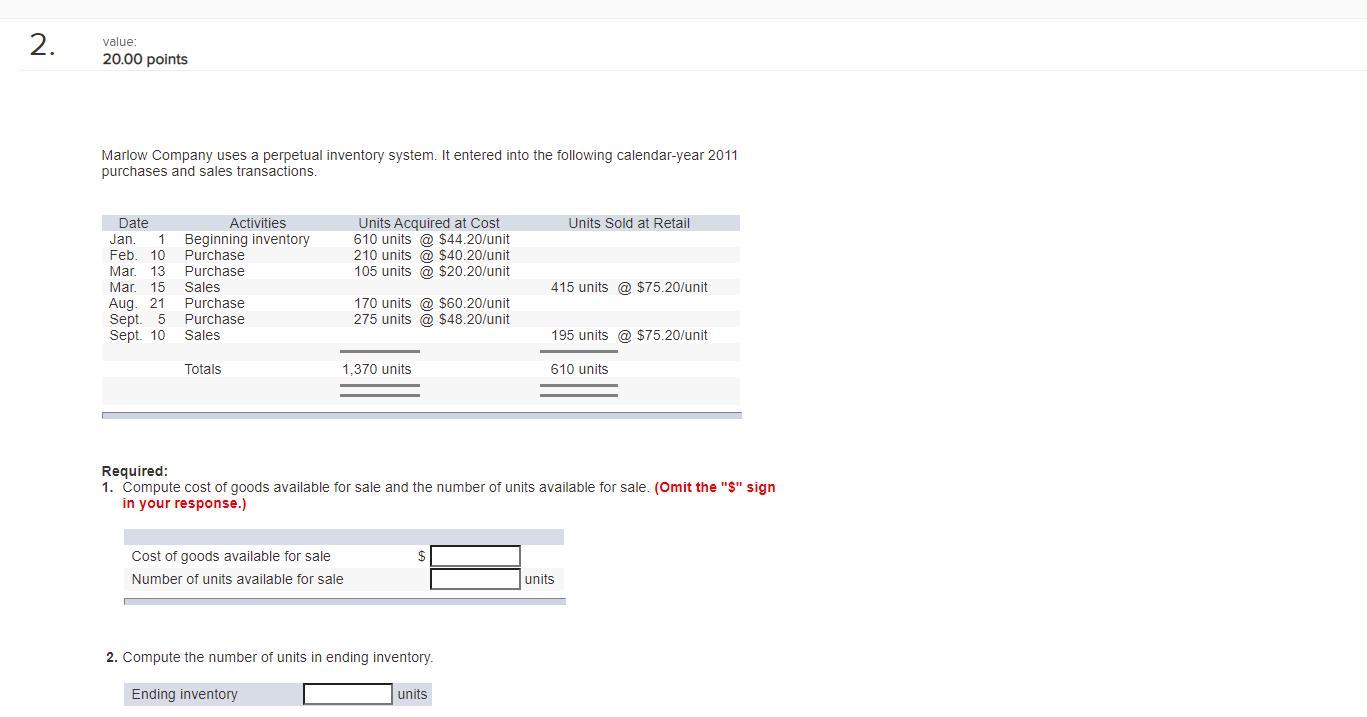

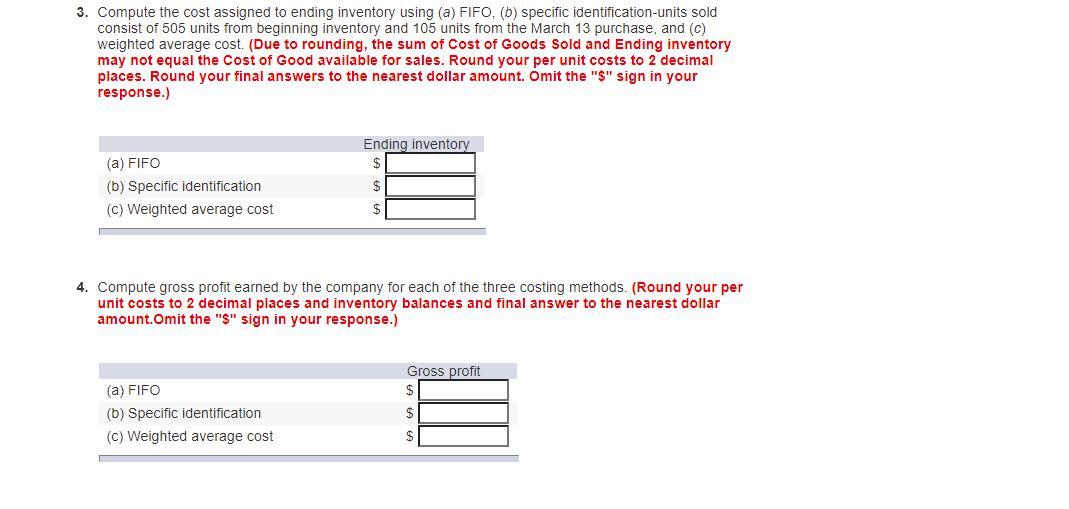

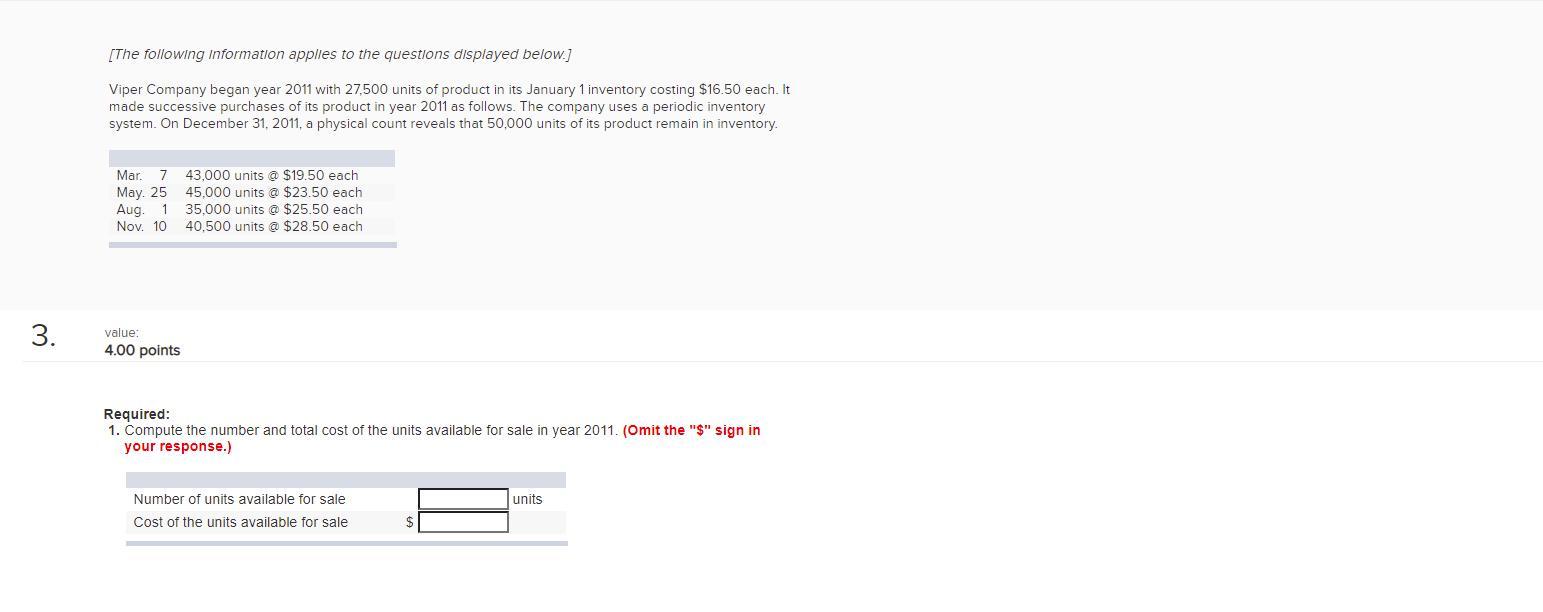

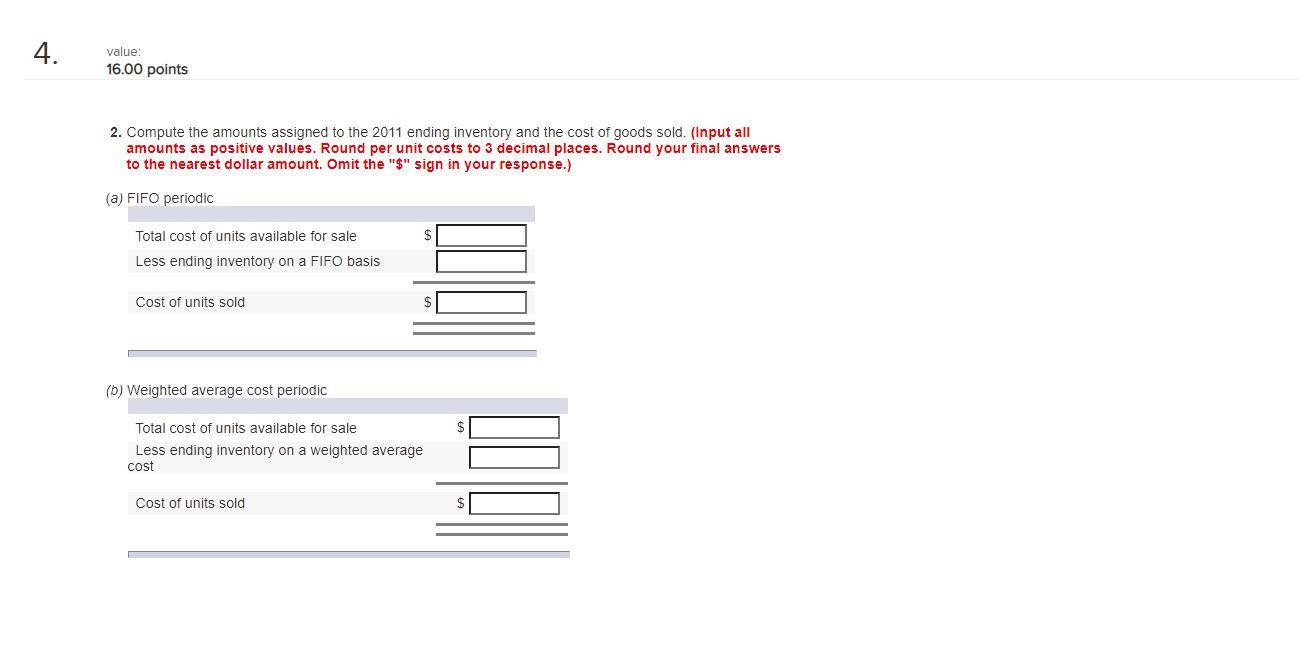

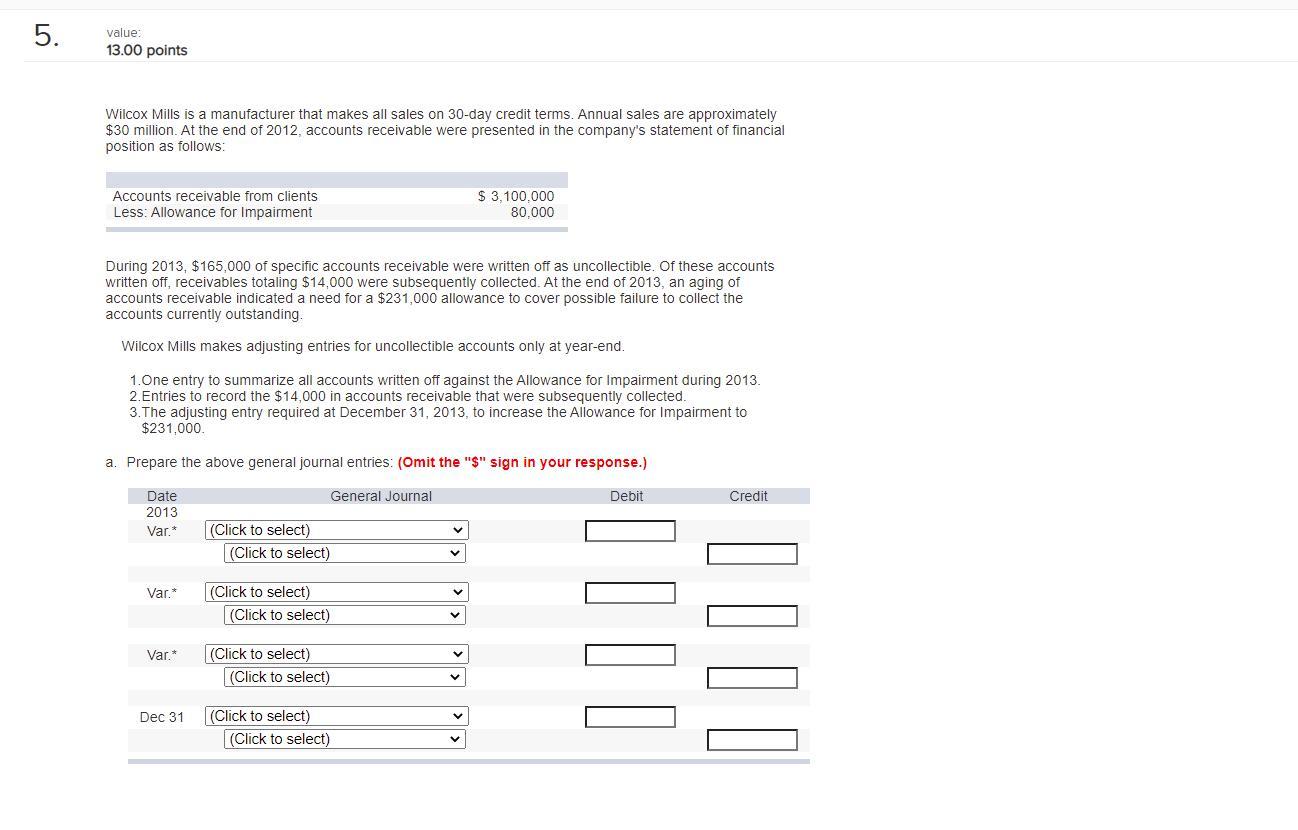

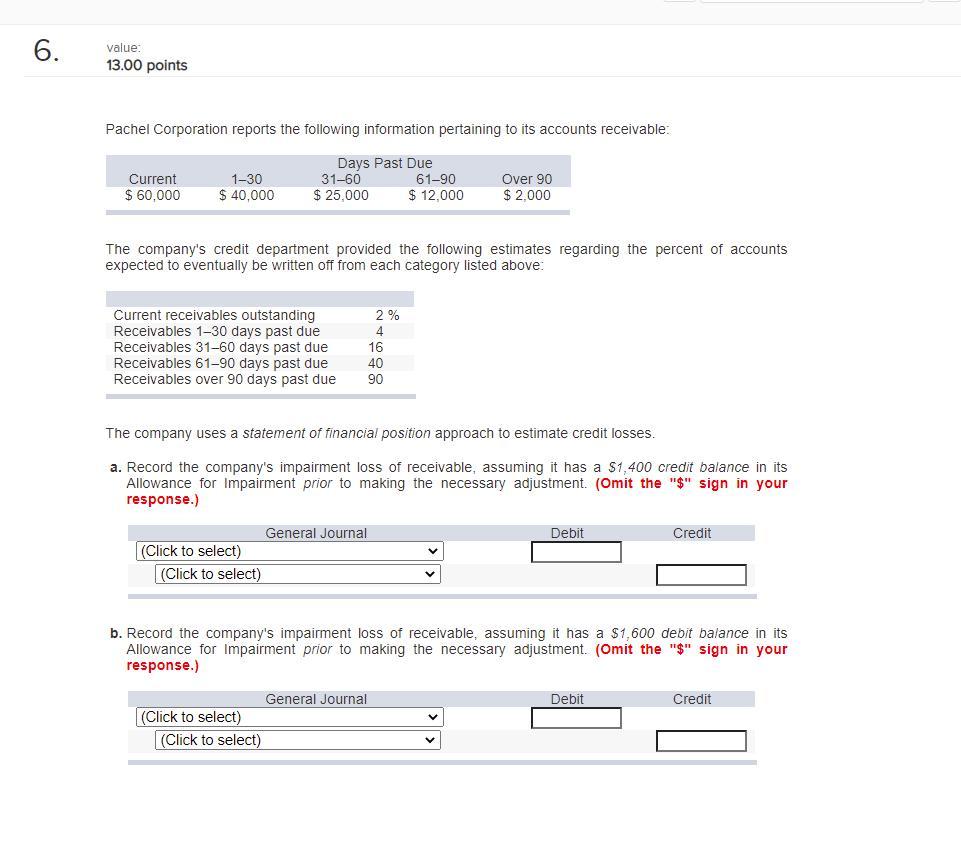

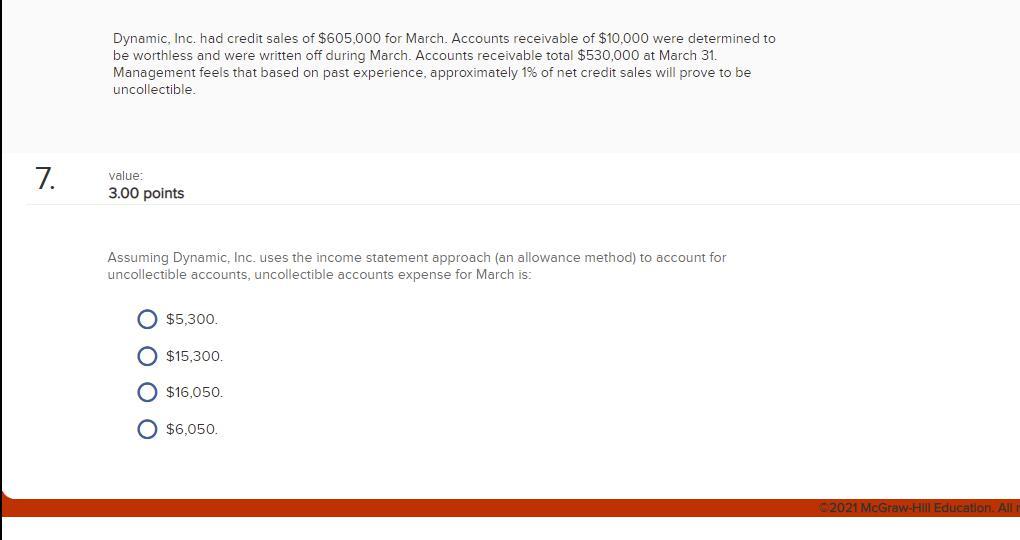

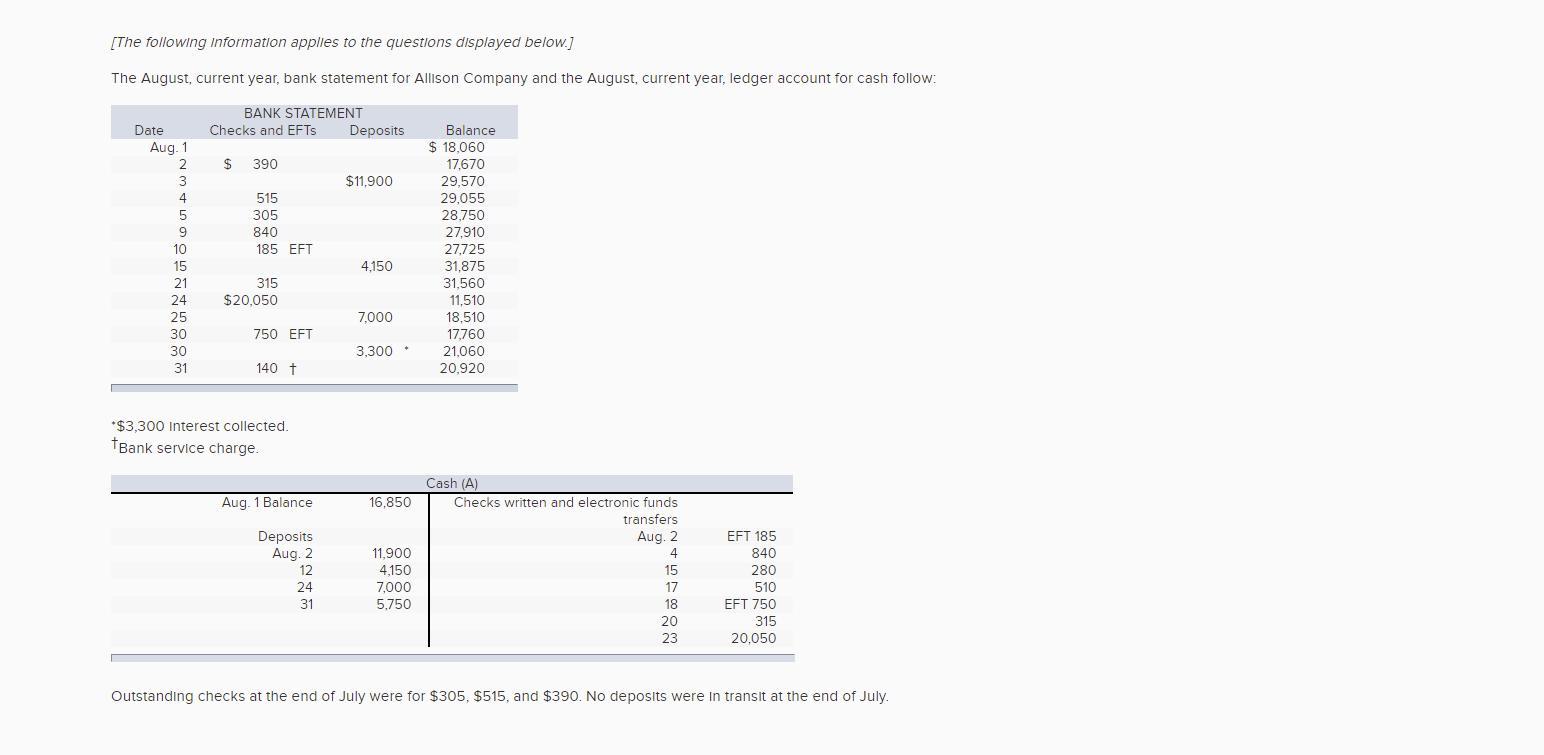

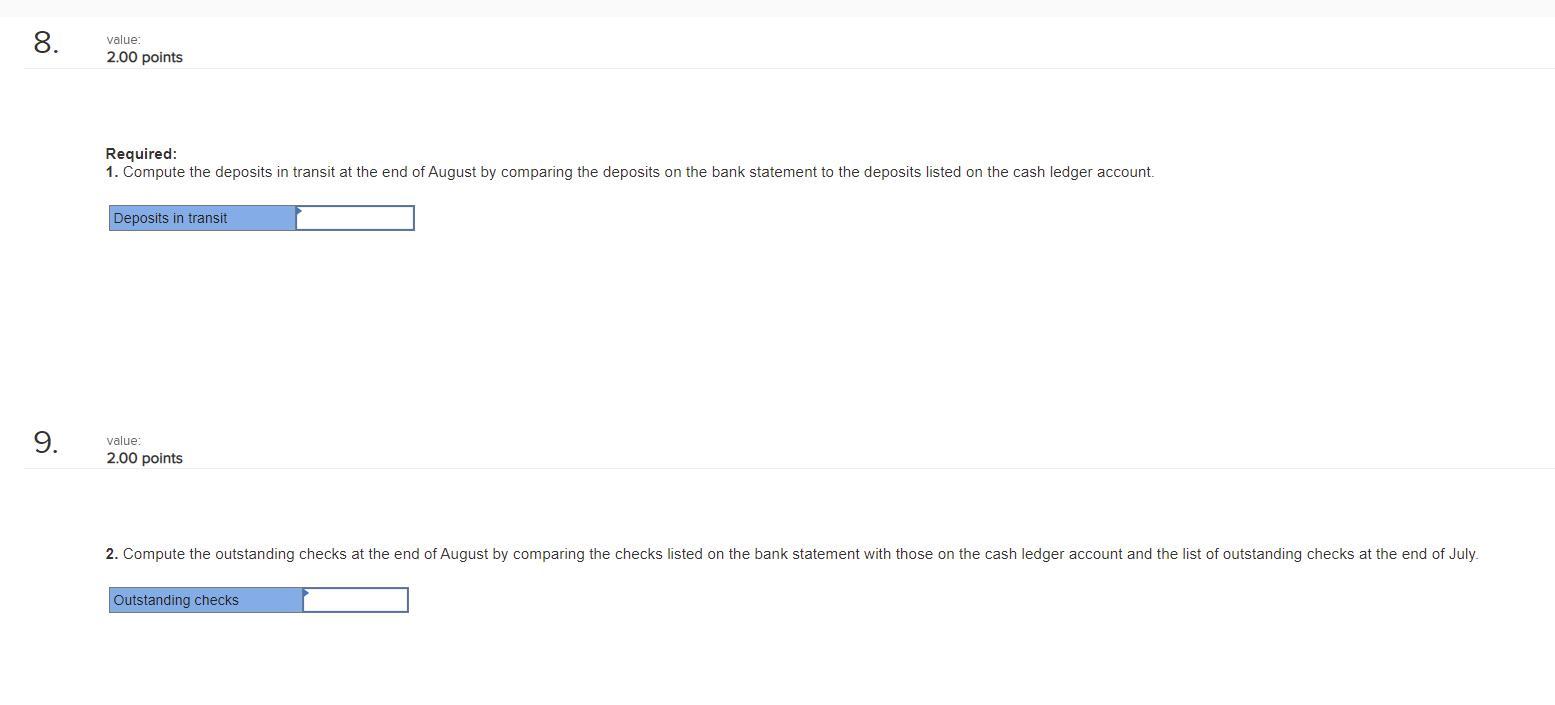

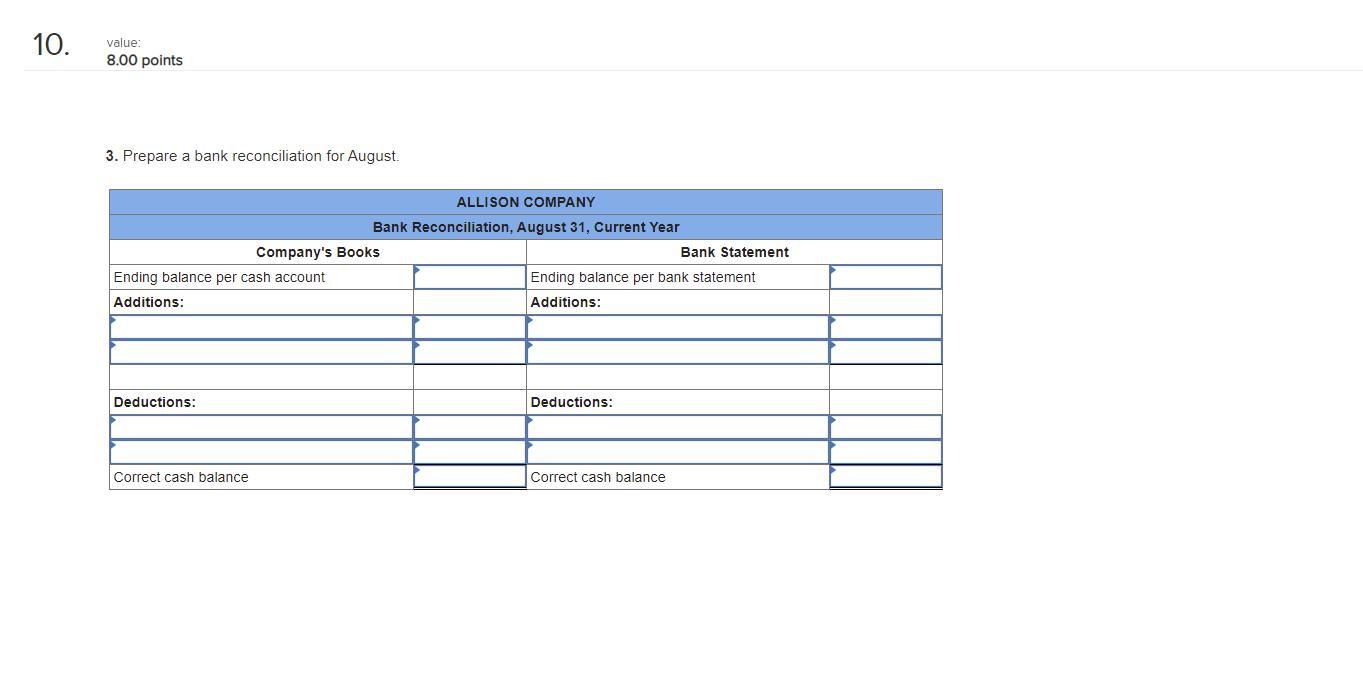

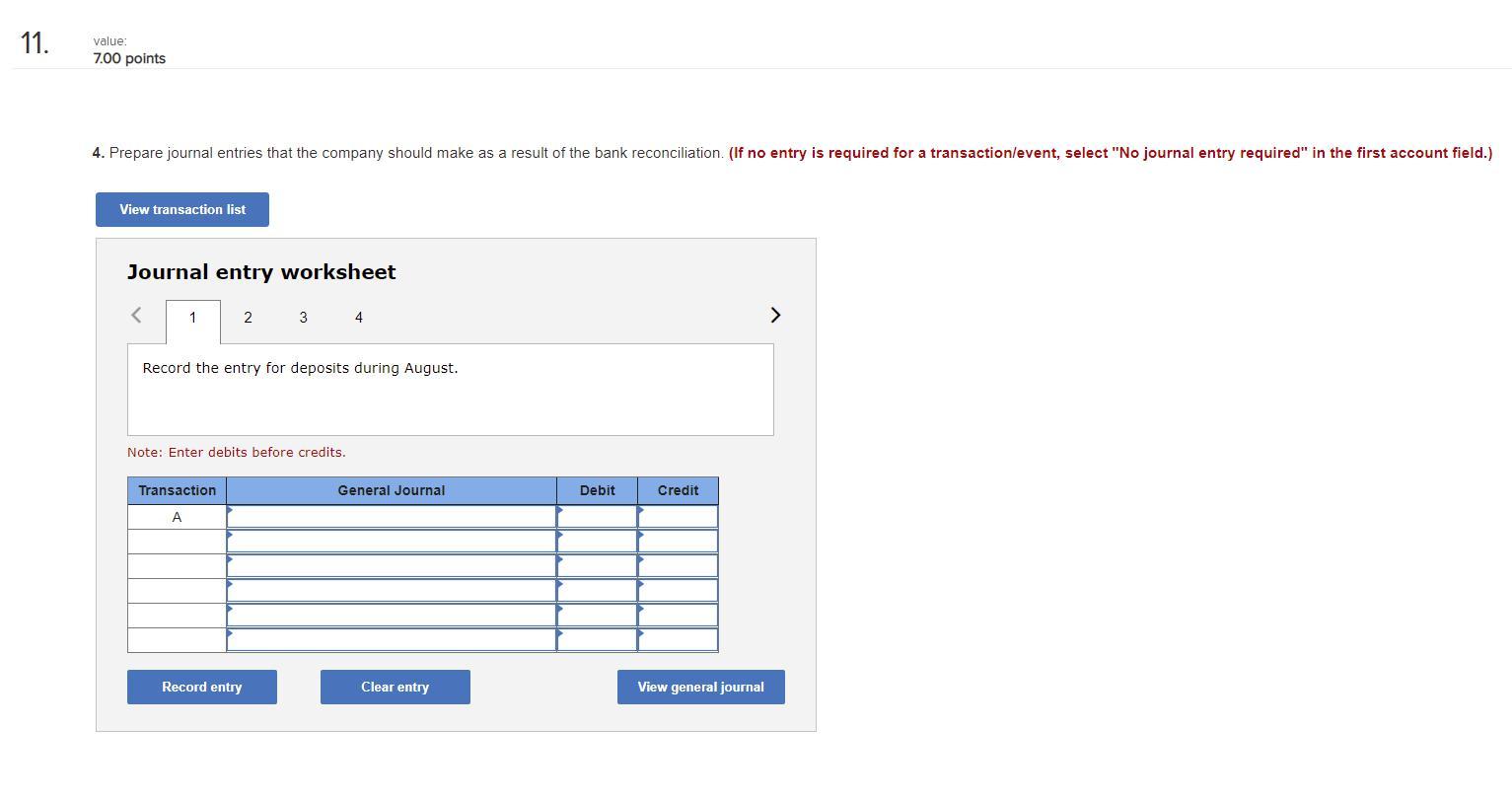

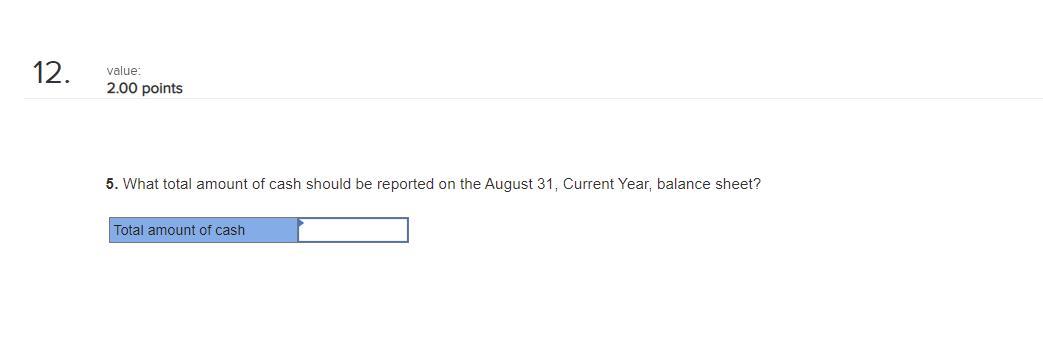

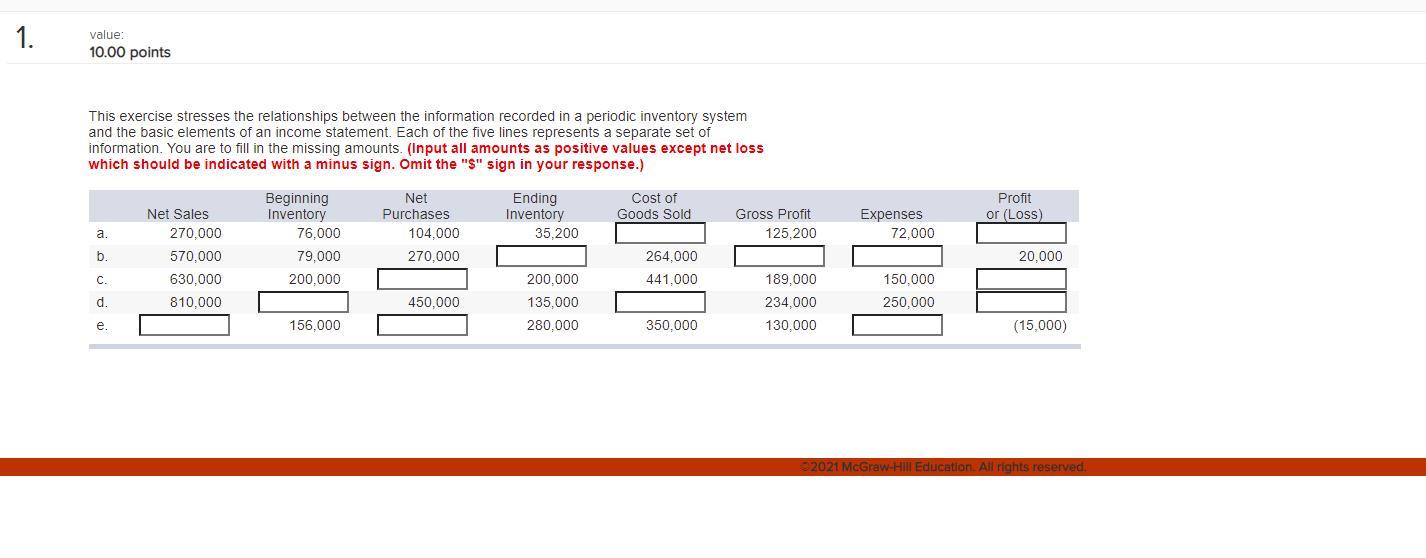

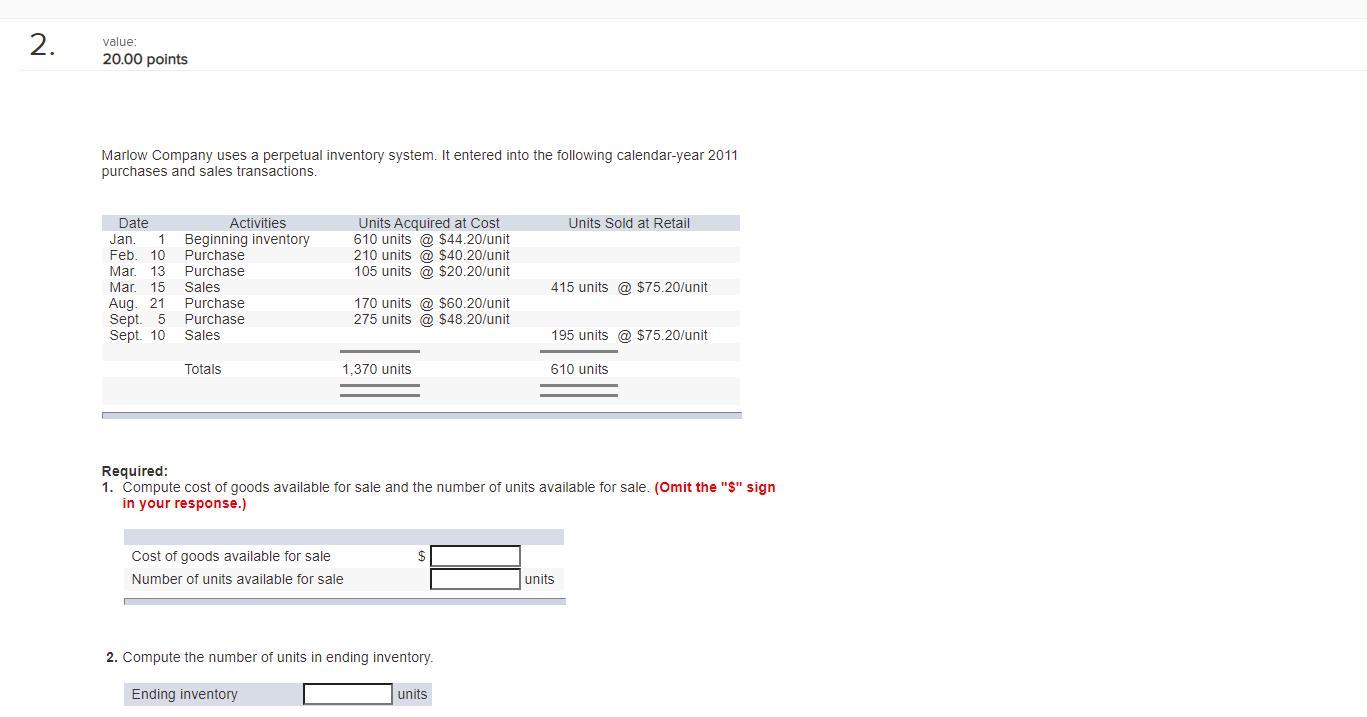

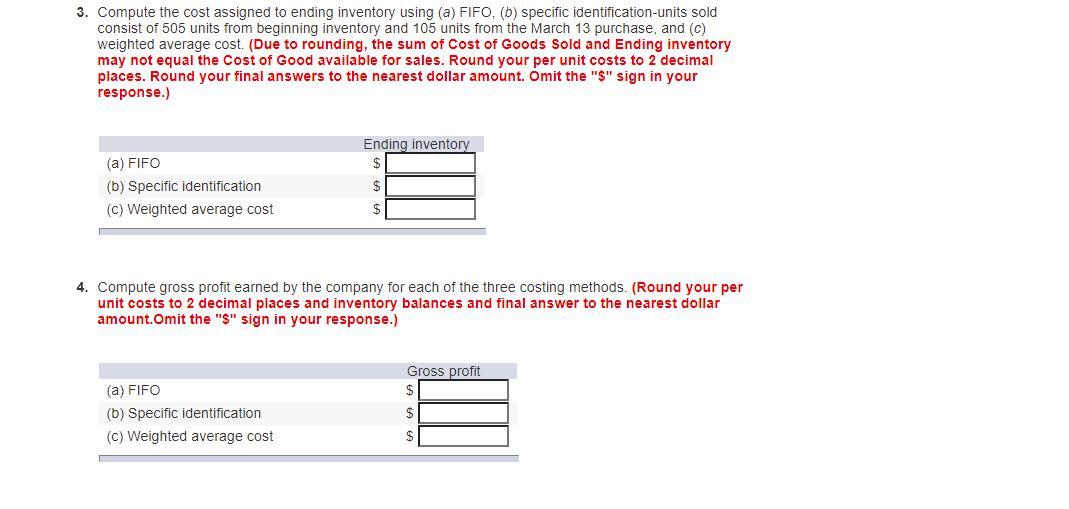

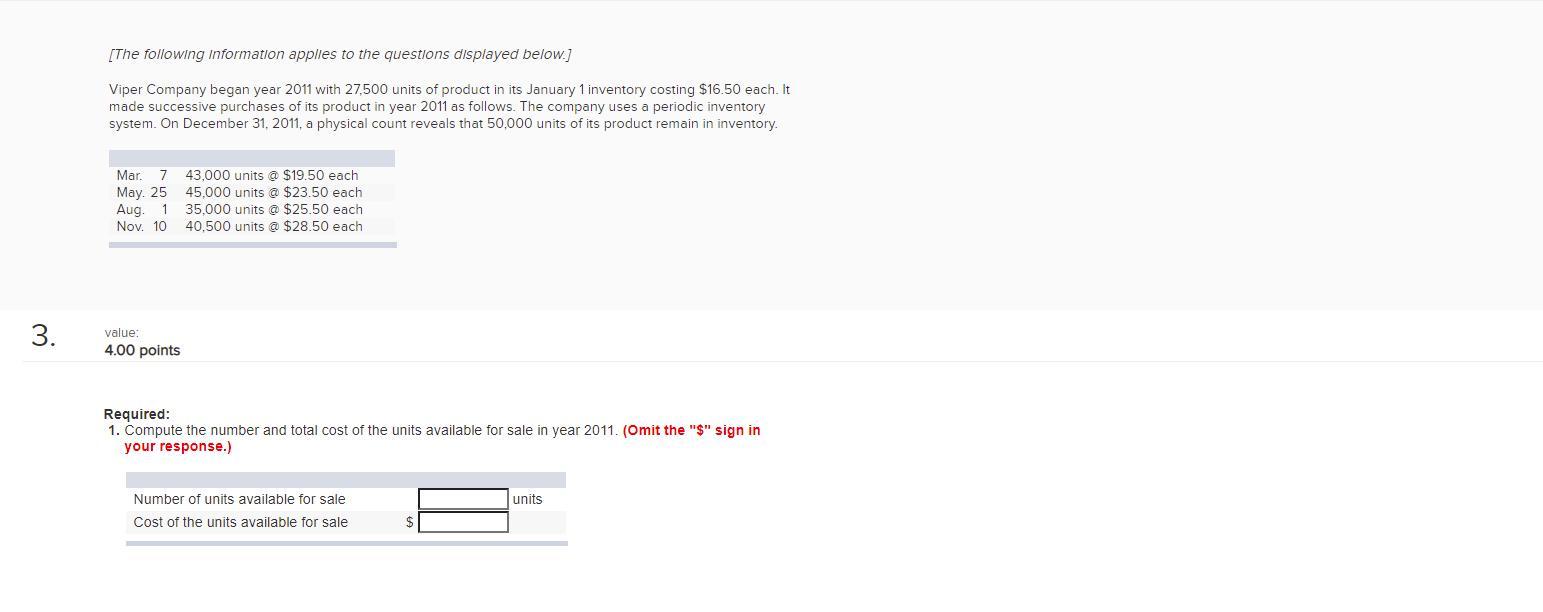

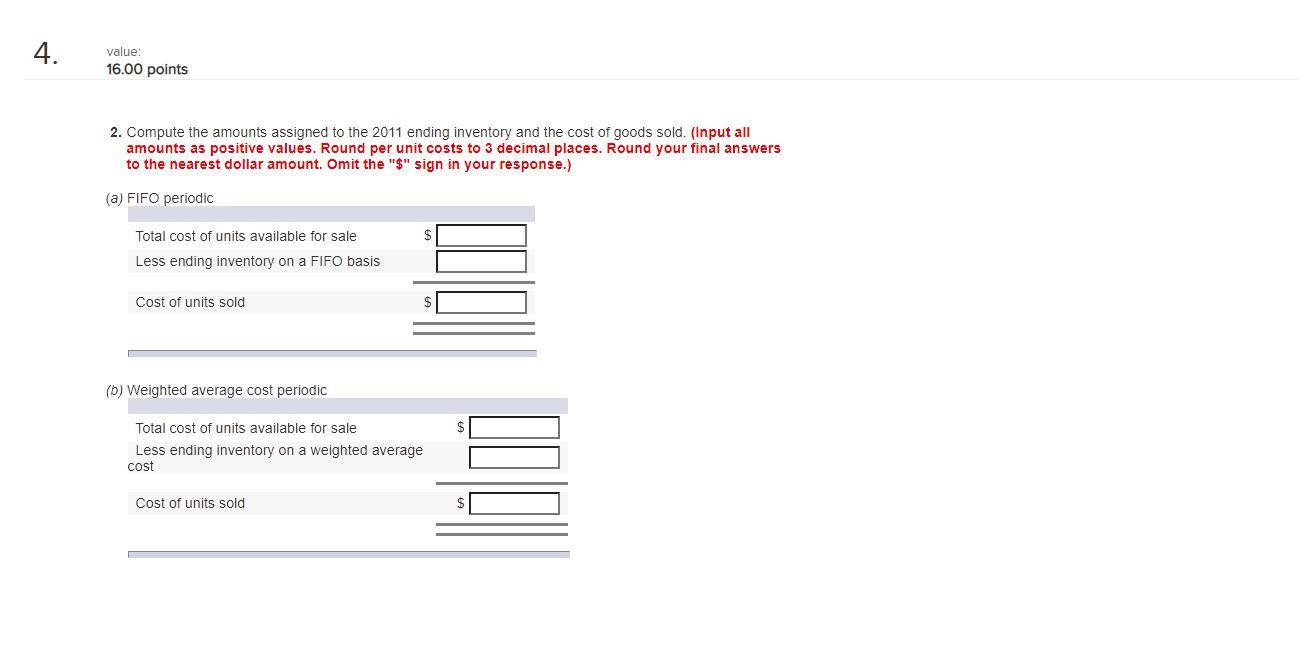

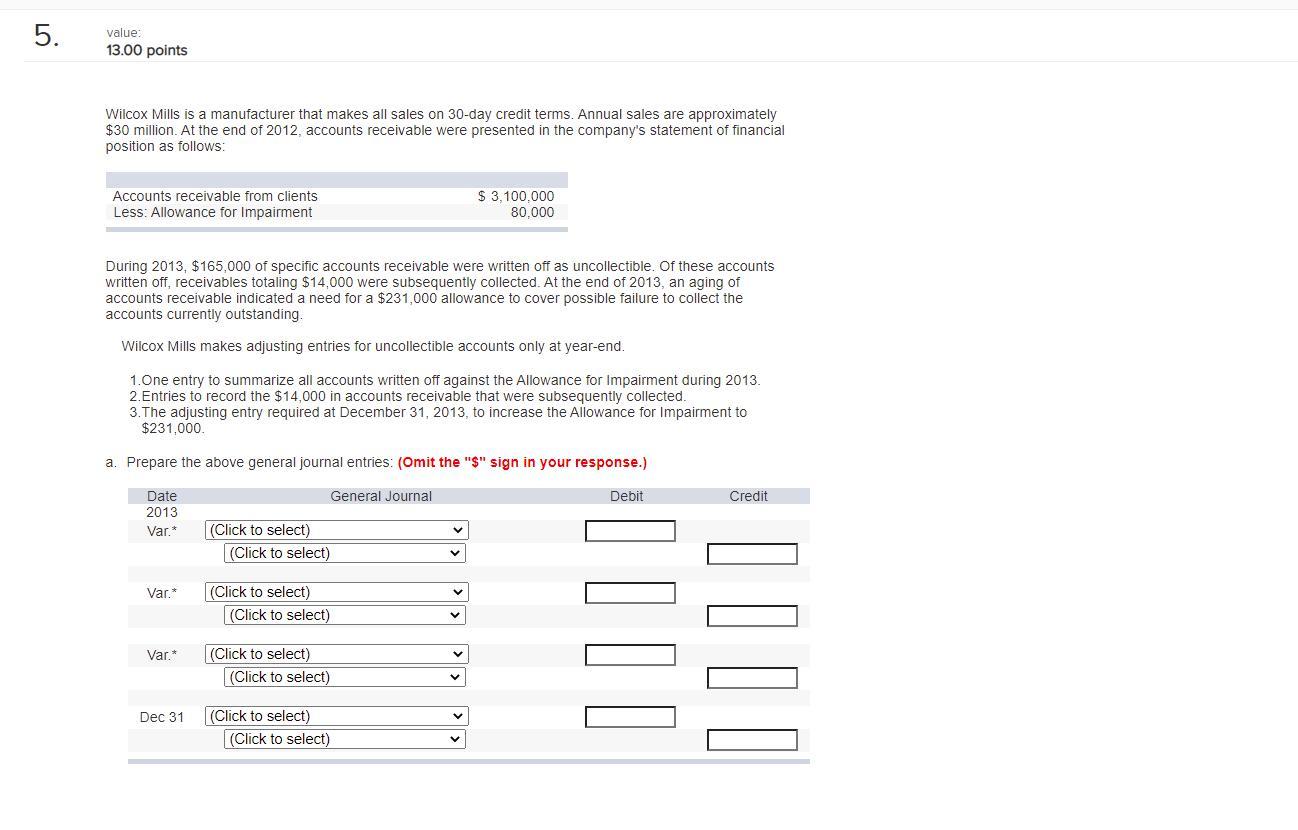

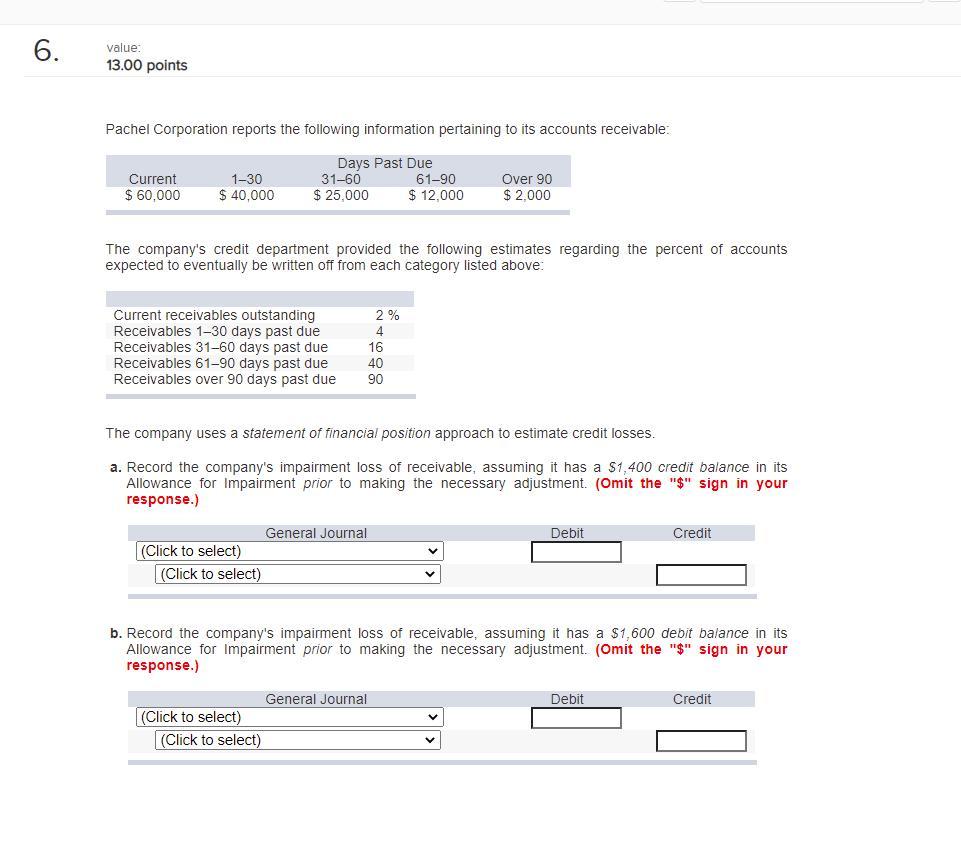

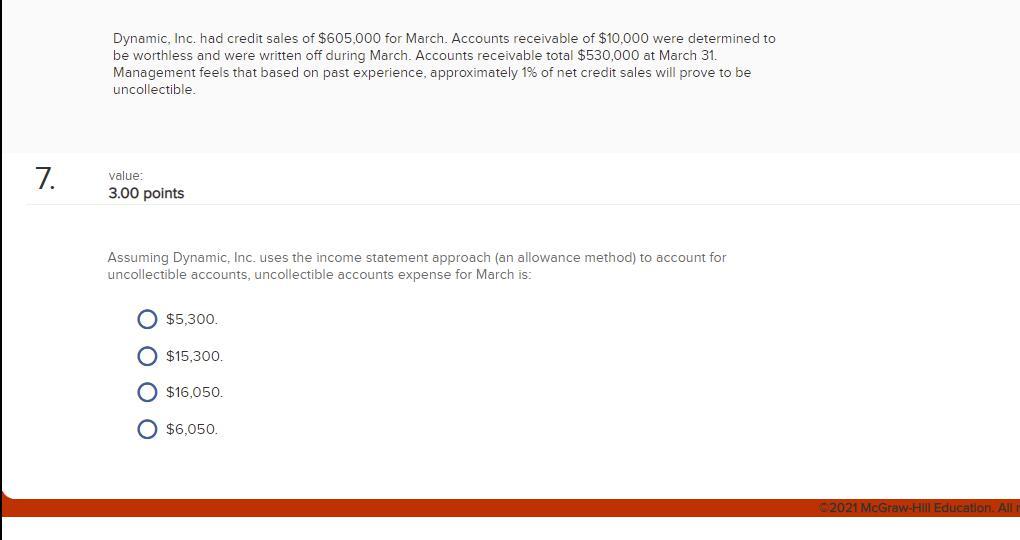

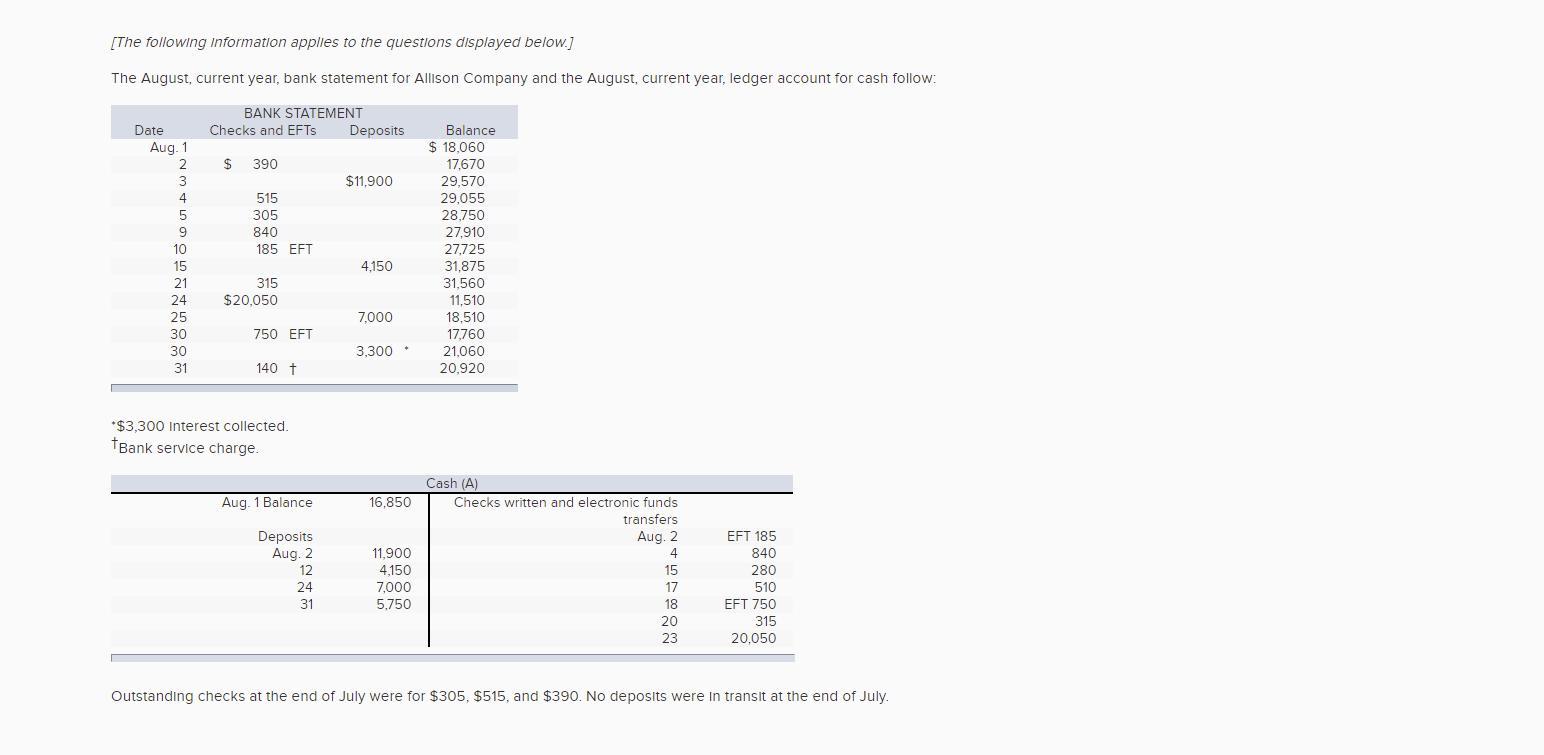

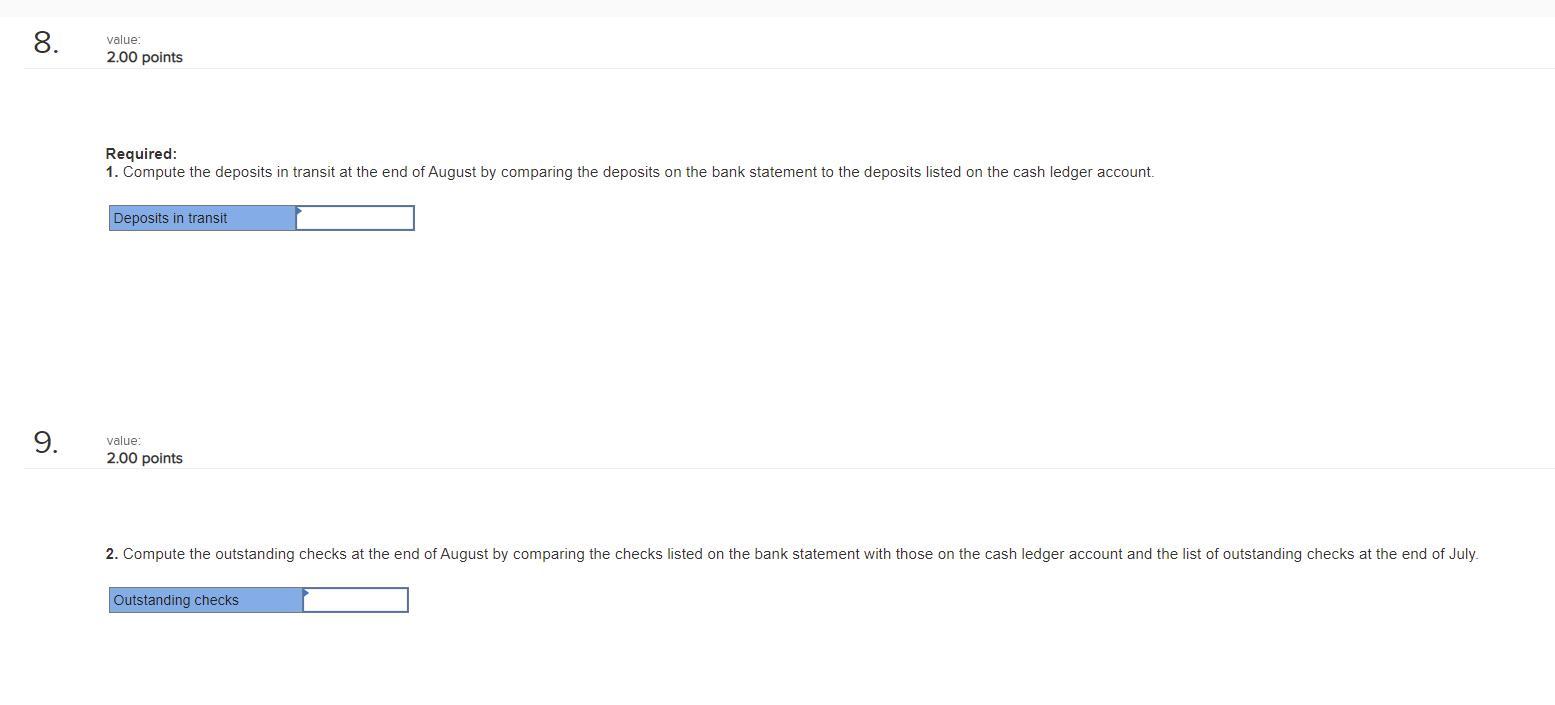

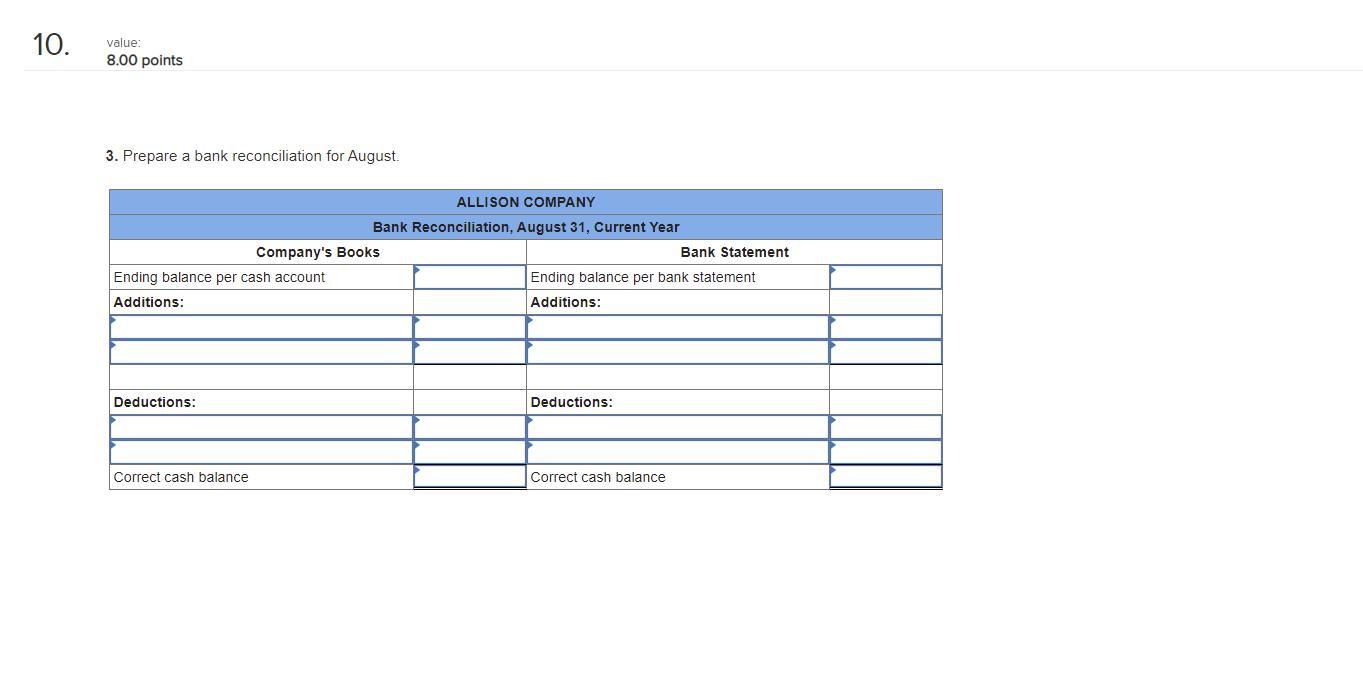

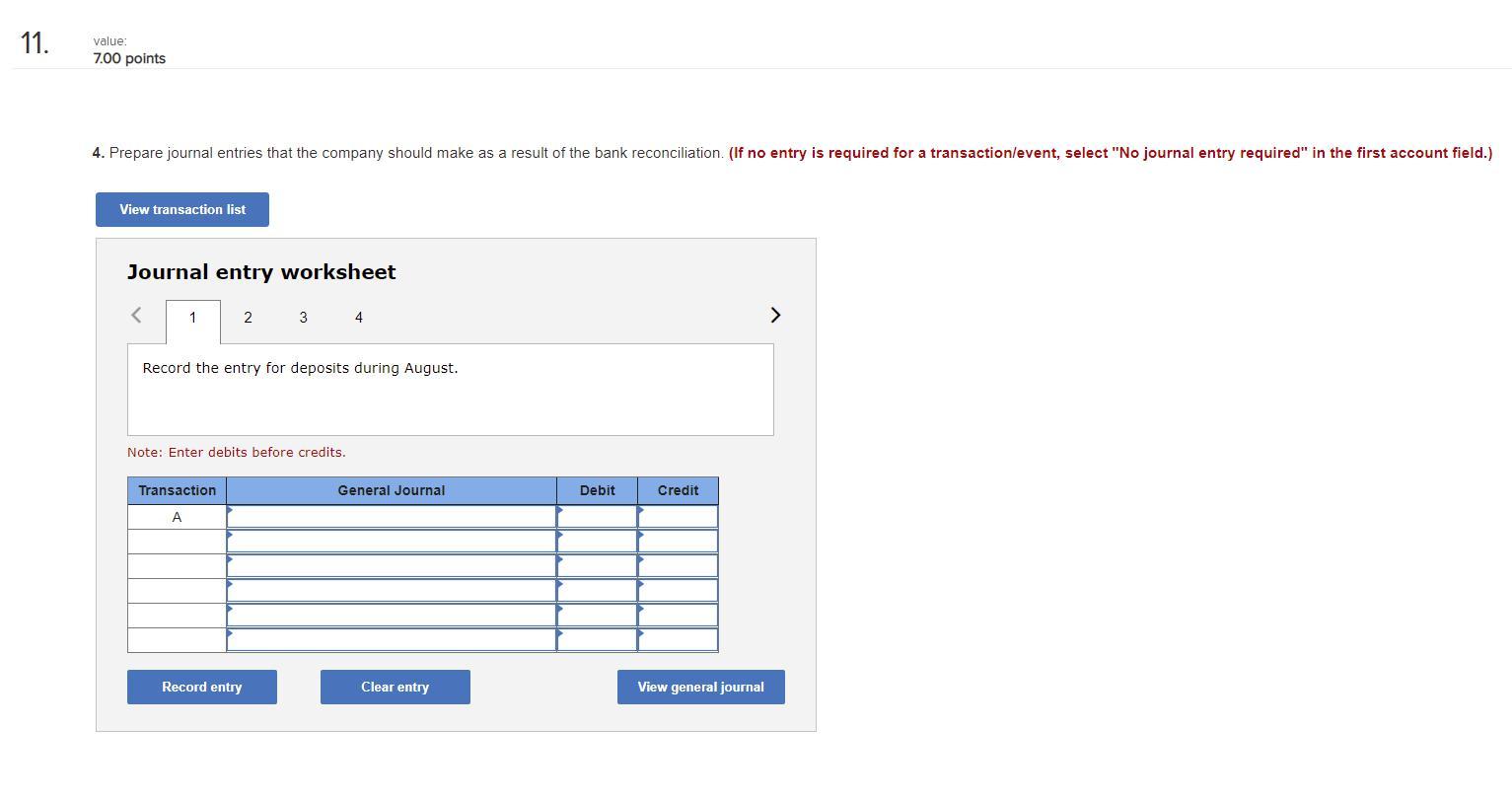

1. value 10.00 points This exercise stresses the relationships between the information recorded in a periodic inventory system and the basic elements of an income statement. Each of the five lines represents a separate set of information. You are to fill in the missing amounts. (Input all amounts as positive values except net loss which should be indicated with a minus sign. Omit the "S" sign in your response.) Cost of Goods Sold Ending Inventory 35.200 Profit or (Loss) Beginning Inventory 76,000 79.000 Net Purchases 104,000 270,000 Gross Profit 125,200 Net Sales 270,000 570,000 630.000 810,000 Expenses 72,000 b. 20,000 264,000 441.000 C. 200.000 d. 200.000 135,000 280,000 150,000 250,000 450.000 189,000 234,000 130,000 e. 156.000 350,000 (15,000) 2021 McGraw-Hill Education. All rights reserved. 2. value: 20.00 points Marlow Company uses a perpetual inventory system. It entered into the following calendar-year 2011 purchases and sales transactions. Units Sold at Retail Date Jan. 1 Feb. 10 Mar. 13 Mar 15 Aug. 21 Sept. 5 Sept. 10 Activities Beginning inventory Purchase Purchase Sales Purchase Purchase Sales Units Acquired at Cost 610 units @ $44.20/unit 210 units @ $40.20/unit 105 units @ $20.20/unit 415 units @ $75.20/unit 170 units @ $60.20/unit 275 units @ $48.20/unit 195 units @ $75.20/unit Totals 1,370 units 610 units Required: 1. Compute cost of goods available for sale and the number of units available for sale. (Omit the "S" sign in your response.) $ Cost of goods available for sale Number of units available for sale units 2. Compute the number of units in ending inventory. Ending inventory units 3. Compute the cost assigned to ending inventory using (a) FIFO, () specific identification-units sold consist of 505 units from beginning inventory and 105 units from the March 13 purchase, and (c) weighted average cost. (Due to rounding, the sum of Cost of Goods Sold and Ending inventory may not equal the Cost of Good available for sales. Round your per unit costs to 2 decimal places. Round your final answers to the nearest dollar amount. Omit the "S" sign in your response.) Ending inventory $ (a) FIFO (b) Specific identification (c) Weighted average cost $ 4. Compute gross profit earned by the company for each of the three costing methods. (Round your per unit costs to 2 decimal places and inventory balances and final answer to the nearest dollar amount.Omit the "S" sign in your response.) Gross profit (a) FIFO (b) Specific identification (c) Weighted average cost $ $ [The following Information applies to the questions displayed below. Viper Company began year 2011 with 27,500 units of product in its January 1 inventory costing $16.50 each. It made successive purchases of its product in year 2011 as follows. The company uses a periodic inventory system. On December 31, 2011, a physical count reveals that 50,000 units of its product remain in inventory. Mar. 7 43,000 units @ $19.50 each May 25 45,000 units @ $23.50 each Aug. 1 35,000 units @ $25.50 each Nov. 10 40,500 units @ $28.50 each 3. value: 4.00 points Required: 1. Compute the number and total cost of the units available for sale in year 2011. (Omit the "$" sign in your response.) units Number of units available for sale Cost of the units available for sale 4. value: 16.00 points 2. Compute the amounts assigned to the 2011 ending inventory and the cost of goods sold. (Input all amounts as positive values. Round per unit costs to 3 decimal places. Round your final answers to the nearest dollar amount. Omit the "$" sign in your response.) (a) FIFO periodic Total cost of units available for sale Less ending inventory on a FIFO basis Cost of units sold $ (b) Weighted average cost periodic Total cost of units available for sale Less ending inventory on a weighted average cost lini Cost of units sold 5. value: 13.00 points Wilcox Mills is a manufacturer that makes all sales on 30-day credit terms. Annual sales are approximately $30 million. At the end of 2012, accounts receivable were presented in the company's statement of financial position as follows: Accounts receivable from clients Less: Allowance for Impairment $ 3,100,000 80,000 During 2013, $165,000 of specific accounts receivable were written off as uncollectible. Of these accounts written off, receivables totaling $14,000 were subsequently collected. At the end of 2013, an aging of accounts receivable indicated a need for a $231,000 allowance to cover possible failure to collect the accounts currently outstanding Wilcox Mills makes adjusting entries for uncollectible accounts only at year-end. 1. One entry to summarize all accounts written off against the Allowance for Impairment during 2013 2.Entries to record the $14,000 in accounts receivable that were subsequently collected. 3. The adjusting entry required at December 31, 2013, to increase the Allowance for Impairment to $231,000 a. Prepare the abo general journal entr (Omit the "$" sign in your response.) General Journal Debit Credit Date 2013 Var* (Click to select) (Click to select) V Var.* v (Click to select) (Click to select) Var.* (Click to select) (Click to select) II Dec 31 (Click to select) (Click to select) 6. value: 13.00 points Pachel Corporation reports the following information pertaining to its accounts receivable: Current $ 60,000 1-30 $ 40,000 Days Past Due 31-60 61-90 $ 25,000 $ 12,000 Over 90 $ 2.000 The company's credit department provided the following estimates regarding the percent of accounts expected to eventually be written off from each category listed above: Current receivables outstanding Receivables 1-30 days past due Receivables 31-60 days past due Receivables 61-90 days past due Receivables over 90 days past due 2 % 4 16 40 90 The company uses a statement of financial position approach to estimate credit losses. a. Record the company's impairment loss of receivable, assuming it has a $1,400 credit balance in its Allowance for Impairment prior to making the necessary adjustment. (Omit the "$" sign in your response.) Debit Credit General Journal (Click to select) (Click to select) b. Record the company's impairment loss of receivable, assuming it has a $1,600 debit balance in its Allowance for Impairment prior to making the necessary adjustment. (Omit the "$" sign in your response.) Debit Credit General Journal (Click to select) (Click to select) Dynamic, Inc. had credit sales of $605,000 for March. Accounts receivable of $10,000 were determined to be worthless and were written off during March. Accounts receivable total $530,000 at March 31. Management feels that based on past experience, approximately 1% of net credit sales will prove to be uncollectible. 7. value: 3.00 points Assuming Dynamic, Inc. uses the income statement approach (an allowance method) to account for uncollectible accounts, uncollectible accounts expense for March is: $5,300 O $15.300. O $16,050 O $6.050. 2021 McGraw-HI Educ [The following Information applies to the questions displayed below.] The August, current year, bank statement for Allison Company and the August, current year, ledger account for cash follow: BANK STATEMENT Checks and EFTS Deposits $ 390 Balance $ 18,060 17,670 29,570 29,055 28.750 $11.900 Date Aug. 1 2 3 4 5 9 10 15 21 24 25 30 30 31 515 305 840 185 EFT 27,910 4,150 315 $20.050 7.000 27.725 31.875 31,560 11,510 18,510 17,760 21.060 20.920 750 EFT 3,300 - 1407 *$3,300 Interest collected Bank service charge. Aug. 1 Balance 16,850 Deposits Aug. 2 12 24 31 11,900 4,150 7,000 5.750 Cash (A) Checks written and electronic funds transfers Aug. 2 4 15 17 18 20 23 EFT 185 840 280 510 EFT 750 315 20,050 Outstanding checks at the end of July were for $305, $515, and $390. No deposits were in transit at the end of July. 8. value: 2.00 points Required: 1. Compute the deposits in transit at the end of August by comparing the deposits on the bank statement to the deposits listed on the cash ledger account. Deposits in transit 9. value: 2.00 points 2. Compute the outstanding checks at the end of August by comparing the checks listed on the bank statement with those on the cash ledger account and the list of outstanding checks at the end of July. Outstanding checks 10. value: 8.00 points 3. Prepare a bank reconciliation for August ALLISON COMPANY Bank Reconciliation, August 31, Current Year Company's Books Bank Statement Ending balance per cash account Ending balance per bank statement Additions: Additions: Deductions: Deductions: Correct cash balance Correct cash balance 11. value 7.00 points 4. Prepare journal entries that the company should make as a result of the bank reconciliation (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the entry for deposits during August. Note: Enter debits before credits. Transaction General Journal Debit Credit A Record entry Clear entry View general journal 12. value 2.00 points 5. What total amount of cash should be reported on the August 31, Current Year, balance sheet? Total amount of cash