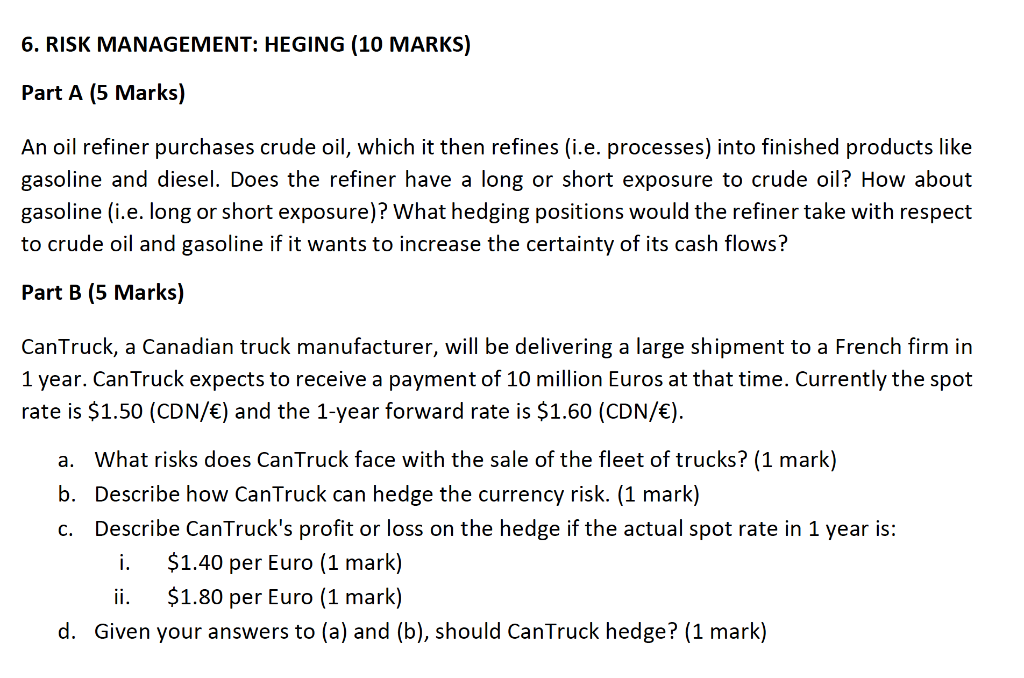

1. VARIOUS TOPICS (10 MARKS) Part A (5 marks) Benjamin Inc. currently has 10 million common shares outstanding. The shares have a beta of 1.10. Analysts predict the shares will pay a dividend of $0.25 per share next year, and that the shares will be selling at a price of $4.50 in one year's time. If the market risk premium is 6% and the risk-free rate of return is 4%, what is the current market price for Benjamin's common shares? Based on your answer, what is the expected capital gains yield this year? Part B (5 marks) Zenon Ltd.'s current capital structure consists of a $15 million face-value bond issue (face value of each bond is $1,000), two million preferred shares, and three million common shares outstanding. The bond issue carries a coupon rate of 10% with interest paid quarterly, and it matures in six years. The 6.4% preferred shares (assume dividends are paid once per year) have a par value of $25 per share, and the required rate of return on these shares is 7% (per annum). Required: a. Calculate the current market value of one bond if it is priced to provide a yield to maturity of 16% (stated annually with quarterly compounding). (3 marks) b. Calculate the current price per share of the preferred shares. (2 marks) 6. RISK MANAGEMENT: HEGING (10 MARKS) Part A (5 Marks) An oil refiner purchases crude oil, which it then refines (i.e. processes) into finished products like gasoline and diesel. Does the refiner have a long or short exposure to crude oil? How about gasoline (i.e. long or short exposure)? What hedging positions would the refiner take with respect to crude oil and gasoline if it wants to increase the certainty of its cash flows? Part B (5 Marks) CanTruck, a Canadian truck manufacturer, will be delivering a large shipment to a French firm in 1 year. Can Truck expects to receive a payment of 10 million Euros at that time. Currently the spot rate is $1.50 (CDN/) and the 1-year forward rate is $1.60 (CDN/). a. What risks does Can Truck face with the sale of the fleet of trucks? (1 mark) b. Describe how Can Truck can hedge the currency risk. (1 mark) C. Describe Can Truck's profit or loss on the hedge if the actual spot rate in 1 year is: i. $1.40 per Euro (1 mark) ii. $1.80 per Euro (1 mark) d. Given your answers to (a) and (b), should Can Truck hedge? (1 mark)