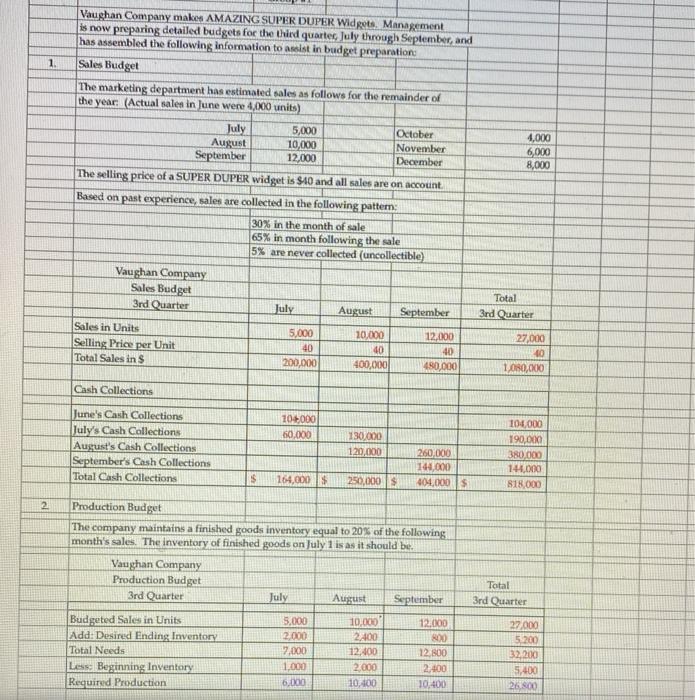

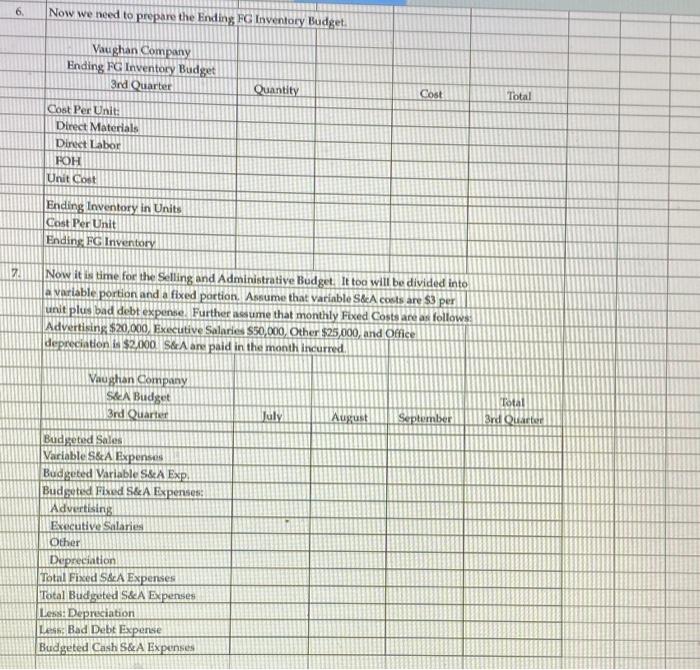

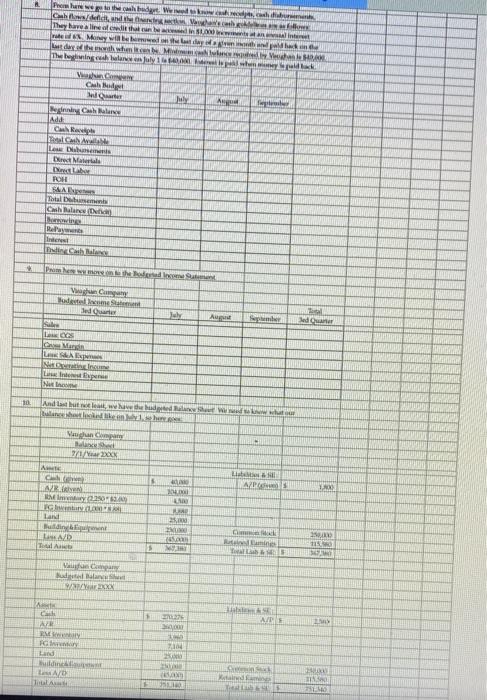

1. Vaughan Company makes AMAZING SUPER DUPER Widgets Management is now preparing detailed budgets for the third quarter July through September, and has assembled the following information to assist in budget preparation Sales Budget The marketing department has estimated sales as follows for the remainder of the year: (Actual sales in June were 4,000 units) July 5,000 October August 10,000 November September 12,000 December The selling price of a SUPER DUPER widget is $10 and all sales are on account Based on past experience, sales are collected in the following pattern: 30% in the month of sale 65% in month following the sale 5% are never collected (uncollectible) Vaughan Company Sales Budget 3rd Quarter July August September 4,000 6,000 8,000 Total 3rd Quarter Sales in Units Selling Price per Unit Total Sales in s 5.000 40 200,000 10,000 40 400,000 12.000 40 490,000 27,000 10 1.080,000 Cash Collections 704000 60,000 June's Cash Collections July's Cash Collections August's Cash Collections September's Cash Collections Total Cash Collections 130,000 120,000 260,000 144,000 404,000$ 104,000 190.000 380,000 144.000 818.000 $ 164,000 TS 250,000 2 Production Budget The company maintains a finished goods inventory equal to 20% of the following month's sales. The inventory of finished goods on July 1 is as it should be Vaughan Company Production Budget 3rd Quarter July August September Budgeted Sales in Units 5.000 10.000 12.000 Add: Desired Ending Inventory 12.000 2400 200 Total Needs 7.000 12:00 12.800 Les Beginning Inventory 1.000 2.000 2.400 Required Production 6,000 10,400 10,400 Total 3rd Quarter 27.000 5.200 32,200 5,400 26.500 6 Now we need to prepare the Ending FG Inventory Budget. Vaughan Company Ending FG Inventory Budget 3rd Quarter Quantity Cost Total Cost PerUnit: Direct Materials Direct Labor HOH Unit Cost Ending Inventory in Units Cost Per Unit Ending FG Inventory 2 Now it is time for the Selling and Administrative Budget. It too will be divided into a variable portion and a fixed portion. Assume that Variable S&A costs are $3 per unit plus bad debt expense. Further assume that monthly Fixed Costs are as follows: Advertising $20,000 Executive Salaries $50,000, Other $25,000, and Office depreciation $2,000. S&A and paid in the month incurred, Vaughan Company S&A Budget 3rd Quartet Total 3rd Quarte July August September Budgeted Sales Variable S&A Expenses Budgeted Variable S&A Exp. Budsted Fixed S&A Expenses: Advertising Executive Salaries Other Depreciation Total Fixed S&A Expenses Total Budgeted S&A Expenses Less: Depreciation Less Bad Debt Expense Budgeted Cash S&A Expenses Powe hat. Wich They have alream Want Man The Beginning away 1 pack VC ch Oly Penny Cash Man Add Low Dr Mall Detta POH Cash Balance Now Re Pays Per med VC A Sedan LE Na 10. And last but now the an Shawl Wow Vaga par M 2/1/BOOK Lab WP ARRY 2.250 Gr. La UND TA AD 2 NU G.HR line Car Madalah 2x ARE WAR 000 Land LADY TA Made 1. Vaughan Company makes AMAZING SUPER DUPER Widgets Management is now preparing detailed budgets for the third quarter July through September, and has assembled the following information to assist in budget preparation Sales Budget The marketing department has estimated sales as follows for the remainder of the year: (Actual sales in June were 4,000 units) July 5,000 October August 10,000 November September 12,000 December The selling price of a SUPER DUPER widget is $10 and all sales are on account Based on past experience, sales are collected in the following pattern: 30% in the month of sale 65% in month following the sale 5% are never collected (uncollectible) Vaughan Company Sales Budget 3rd Quarter July August September 4,000 6,000 8,000 Total 3rd Quarter Sales in Units Selling Price per Unit Total Sales in s 5.000 40 200,000 10,000 40 400,000 12.000 40 490,000 27,000 10 1.080,000 Cash Collections 704000 60,000 June's Cash Collections July's Cash Collections August's Cash Collections September's Cash Collections Total Cash Collections 130,000 120,000 260,000 144,000 404,000$ 104,000 190.000 380,000 144.000 818.000 $ 164,000 TS 250,000 2 Production Budget The company maintains a finished goods inventory equal to 20% of the following month's sales. The inventory of finished goods on July 1 is as it should be Vaughan Company Production Budget 3rd Quarter July August September Budgeted Sales in Units 5.000 10.000 12.000 Add: Desired Ending Inventory 12.000 2400 200 Total Needs 7.000 12:00 12.800 Les Beginning Inventory 1.000 2.000 2.400 Required Production 6,000 10,400 10,400 Total 3rd Quarter 27.000 5.200 32,200 5,400 26.500 6 Now we need to prepare the Ending FG Inventory Budget. Vaughan Company Ending FG Inventory Budget 3rd Quarter Quantity Cost Total Cost PerUnit: Direct Materials Direct Labor HOH Unit Cost Ending Inventory in Units Cost Per Unit Ending FG Inventory 2 Now it is time for the Selling and Administrative Budget. It too will be divided into a variable portion and a fixed portion. Assume that Variable S&A costs are $3 per unit plus bad debt expense. Further assume that monthly Fixed Costs are as follows: Advertising $20,000 Executive Salaries $50,000, Other $25,000, and Office depreciation $2,000. S&A and paid in the month incurred, Vaughan Company S&A Budget 3rd Quartet Total 3rd Quarte July August September Budgeted Sales Variable S&A Expenses Budgeted Variable S&A Exp. Budsted Fixed S&A Expenses: Advertising Executive Salaries Other Depreciation Total Fixed S&A Expenses Total Budgeted S&A Expenses Less: Depreciation Less Bad Debt Expense Budgeted Cash S&A Expenses Powe hat. Wich They have alream Want Man The Beginning away 1 pack VC ch Oly Penny Cash Man Add Low Dr Mall Detta POH Cash Balance Now Re Pays Per med VC A Sedan LE Na 10. And last but now the an Shawl Wow Vaga par M 2/1/BOOK Lab WP ARRY 2.250 Gr. La UND TA AD 2 NU G.HR line Car Madalah 2x ARE WAR 000 Land LADY TA Made