Answered step by step

Verified Expert Solution

Question

1 Approved Answer

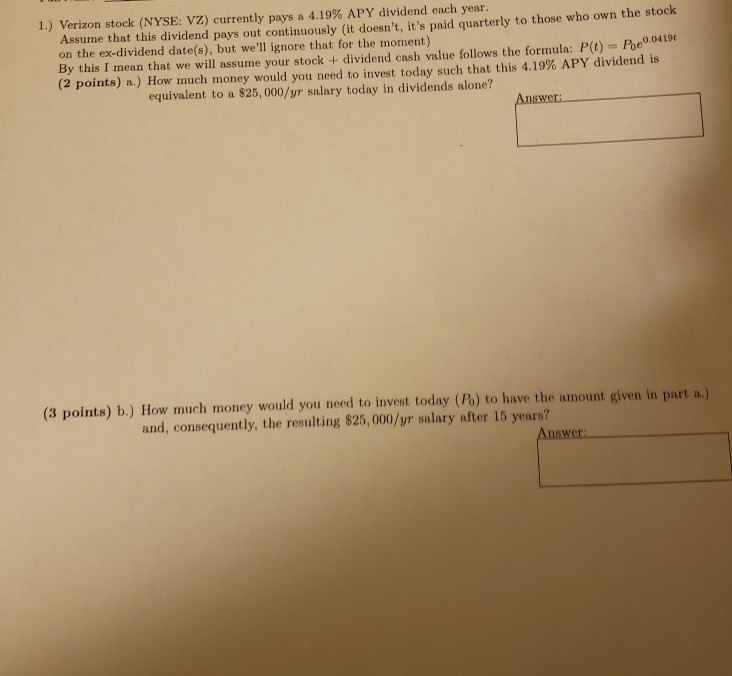

1.) Verizon stock (NYSE: VZ) currently pays a 4.19% APY dividend each year. Assume that this dividend pays out continuously (it doesn't, it's paid quarterly

1.) Verizon stock (NYSE: VZ) currently pays a 4.19% APY dividend each year. Assume that this dividend pays out continuously (it doesn't, it's paid quarterly to those who own the stock on the ex-dividend date(s), but we'll ignore that for the moment) By this I mean that we will assume your stock + dividend cash value follows the formula: PO - Poe (2 points) a) How much money would you need to invest today such that this 4.19% APY dividend is equivalent to a $25,000/yr salary today in dividends alone? Answer: (3 points) b.) How much money would you need to invest today (Po) to have the amount given in part n.) and, consequently, the resulting $25,000/yr salary after 15 years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started