Answered step by step

Verified Expert Solution

Question

1 Approved Answer

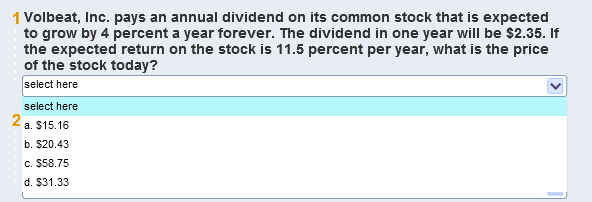

1 Volbeat, Inc. pays an annual dividend on its common stock that is expected to grow by 4 percent a year forever. The dividend

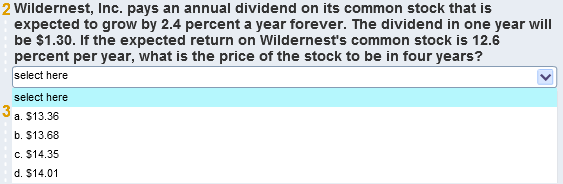

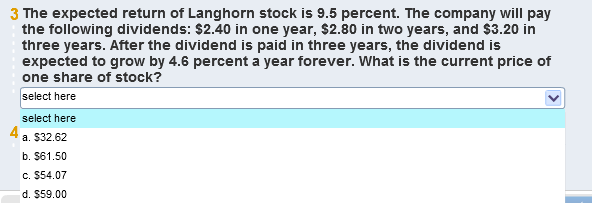

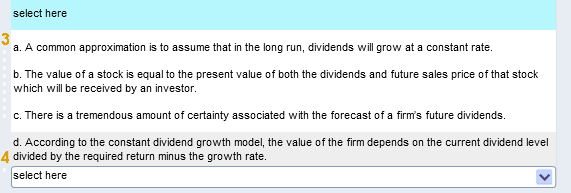

1 Volbeat, Inc. pays an annual dividend on its common stock that is expected to grow by 4 percent a year forever. The dividend in one year will be $2.35. If the expected return on the stock is 11.5 percent per year, what is the price of the stock today? select here select here 2 a. $15.16 b. $20.43 c. $58.75 d. $31.33 2 Wildernest, Inc. pays an annual dividend on its common stock that is expected to grow by 2.4 percent a year forever. The dividend in one year will be $1.30. If the expected return on Wildernest's common stock is 12.6 percent per year, what is the price of the stock to be in four years? select here select here a. $13.36 b. $13.68 c. $14.35 d. $14.01 3 The expected return of Langhorn stock is 9.5 percent. The company will pay the following dividends: $2.40 in one year, $2.80 in two years, and $3.20 in three years. After the dividend is paid in three years, the dividend is expected to grow by 4.6 percent a year forever. What is the current price of one share of stock? select here select here a. $32.62 b. $61.50 c. $54.07 d. $59.00 Which one of the following statements is false? select here select here 3 a. A common approximation is to assume that in the long run, dividends will grow at a constant rate. b. The value of a stock is equal to the present value of both the dividends and future sales price of that stock which will be received by an investor. c. There is a tremendous amount of certainty associated with the forecast of a firm's future dividends. d. According to the constant dividend growth model, the value of the firm depends on the current dividend level 4 divided by the required return minus the growth rate. select here

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started