Answered step by step

Verified Expert Solution

Question

1 Approved Answer

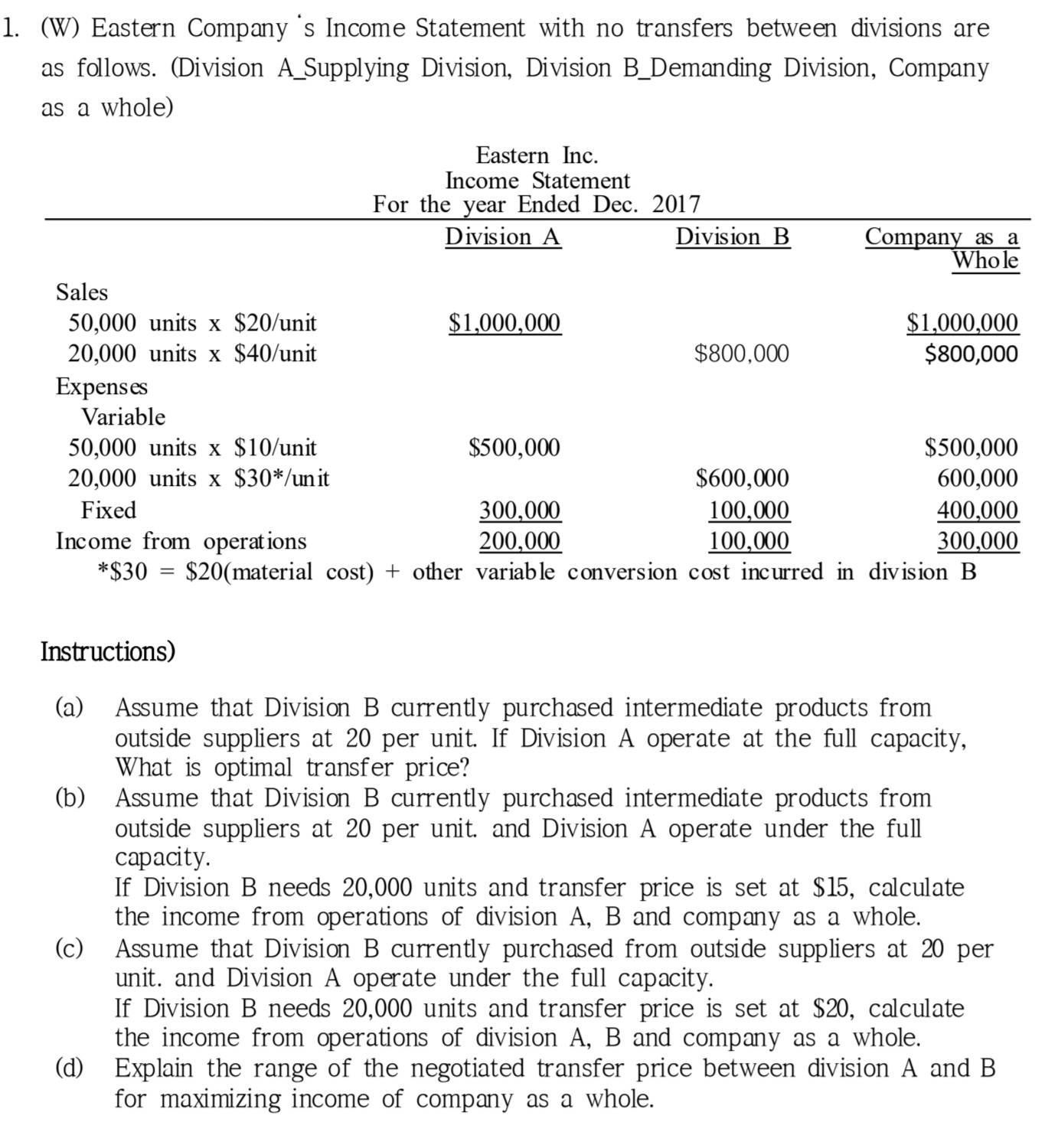

1. (W) Eastern Company 's Income Statement with no transfers between divisions are as follows. (Division A_Supplying Division, Division B_Demanding Division, Company as a

1. (W) Eastern Company 's Income Statement with no transfers between divisions are as follows. (Division A_Supplying Division, Division B_Demanding Division, Company as a whole) Sales 50,000 units x $20/unit 20,000 units x $40/unit Expenses Variable 50,000 units x $10/unit 20,000 units x $30*/unit Fixed Eastern Inc. Income Statement For the year Ended Dec. 2017 Division A $1,000,000 $500,000 (c) Division B $800,000 $500,000 600,000 300,000 400,000 Income from operations 200,000 300,000 *$30 = $20(material cost) + other variable conversion cost incurred in division B Company as a Whole $600,000 100,000 100,000 $1,000,000 $800,000 Instructions) (a) Assume that Division B currently purchased intermediate products from outside suppliers at 20 per unit. If Division A operate at the full capacity, What is optimal transfer price? (b) Assume that Division B currently purchased intermediate products from outside suppliers at 20 per unit. and Division A operate under the full capacity. If Division B needs 20,000 units and transfer price is set at $15, calculate the income from operations of division A, B and company as a whole. Assume that Division B currently purchased from outside suppliers at 20 per unit. and Division A operate under the full capacity. If Division B needs 20,000 units and transfer price is set at $20, calculate the income from operations of division A, B and company as a whole. (d) Explain the range of the negotiated transfer price between division A and B for maximizing income of company as a whole.

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a To determine the optimal transfer price when Division A operates at full capacity we need to consider the opportunity cost for Division A The opport...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started