Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. What are 2 key features and 2 key functions of accounting software programs used to manage financial operations? Key Features 1. 2. Key

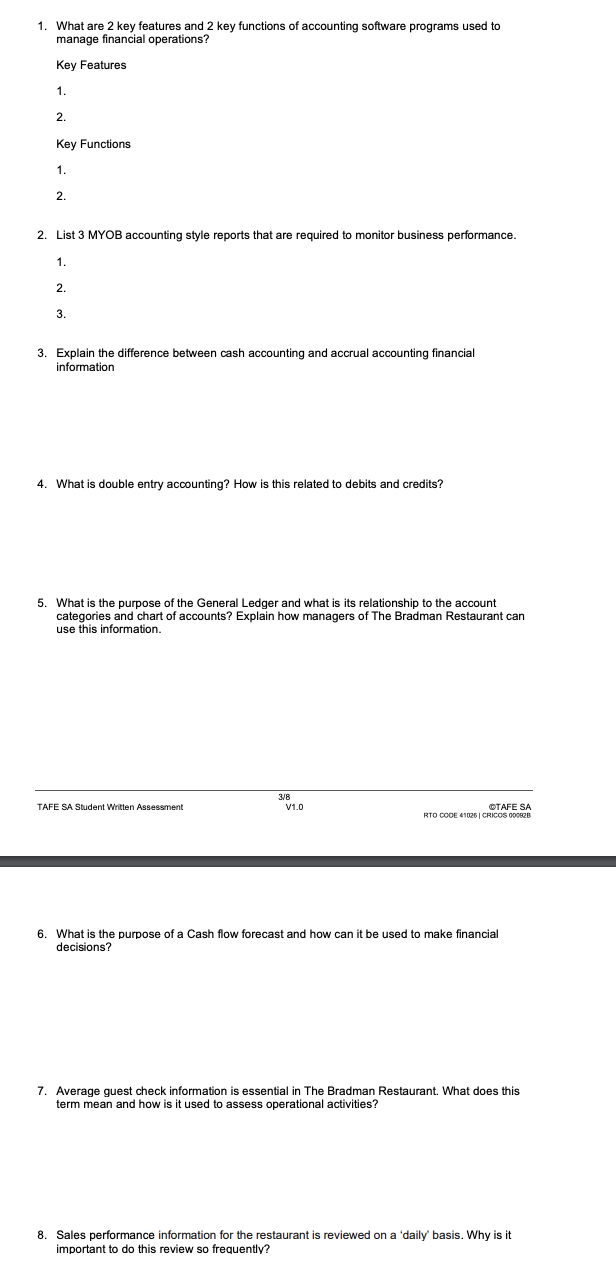

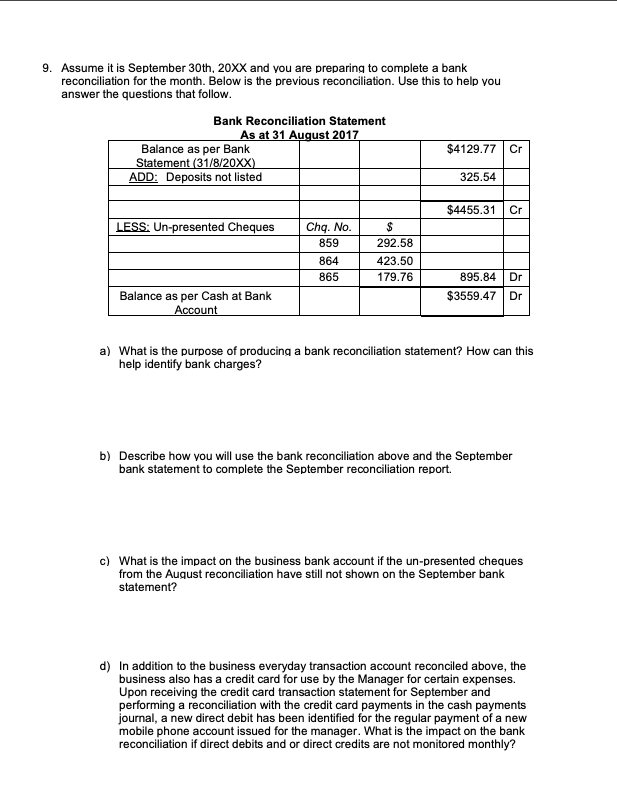

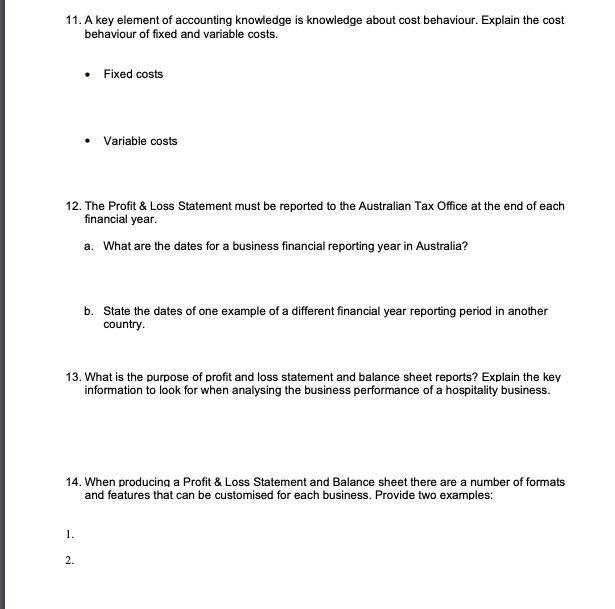

1. What are 2 key features and 2 key functions of accounting software programs used to manage financial operations? Key Features 1. 2. Key Functions 1. 2. 2. List 3 MYOB accounting style reports that are required to monitor business performance. 1. 2. 3. 3. Explain the difference between cash accounting and accrual accounting financial information 4. What is double entry accounting? How is this related to debits and credits? 5. What is the purpose of the General Ledger and what is its relationship to the account categories and chart of accounts? Explain how managers of The Bradman Restaurant can use this information. 3/8 TAFE SA Student Written Assessment V1.0 TAFE SA RTO CODE 41026 | CRICOS 00082B 6. What is the purpose of a Cash flow forecast and how can it be used to make financial decisions? 7. Average guest check information is essential in The Bradman Restaurant. What does this term mean and how is it used to assess operational activities? 8. Sales performance information for the restaurant is reviewed on a 'daily' basis. Why is it important to do this review so frequently? 9. Assume it is September 30th, 20XX and you are preparing to complete a bank reconciliation for the month. Below is the previous reconciliation. Use this to help you answer the questions that follow. Bank Reconciliation Statement As at 31 August 2017 Balance as per Bank Statement (31/8/20XX) ADD: Deposits not listed $4129.77 Cr 325.54 $4455.31 Cr LESS: Un-presented Cheques Chq. No. $ 859 292.58 864 423.50 865 179.76 895.84 Dr Balance as per Cash at Bank $3559.47 Dr Account a) What is the purpose of producing a bank reconciliation statement? How can this help identify bank charges? b) Describe how you will use the bank reconciliation above and the September bank statement to complete the September reconciliation report. c) What is the impact on the business bank account if the un-presented cheques from the August reconciliation have still not shown on the September bank statement? d) In addition to the business everyday transaction account reconciled above, the business also has a credit card for use by the Manager for certain expenses. Upon receiving the credit card transaction statement for September and performing a reconciliation with the credit card payments in the cash payments journal, a new direct debit has been identified for the regular payment of a new mobile phone account issued for the manager. What is the impact on the bank reconciliation if direct debits and or direct credits are not monitored monthly? 10. Use the Aged receivables report shown below to answer the questions that follow. Aged by days overdue Aged Receivables [Detail] ID No 01/12/2010 Date Total Due Current AZ Stationery Supplies 60+ Charles 452 1235 Net EON 00000002 02/11/2010 00000004 $215.00 $215.00 02/11/2010 $46050 $460.50 Total $675.50 $460.50 $215.00 $0.00 $0.00 Chelsea Moszet CUS0003 043/282 272 Net 30 00000005 02/10/2010 $150.00 00000006 28/10/2010 170620 $150.00 $79520 Total $535.20 $0.00 $335.20 $0.00 $0.00 Footloose Dance Studio CUS-0004 Timothy Sun 9875689 Net 21 000007 01/11/2010 00000000 11/11/2010 $230.60 $400.00 $230.00 Total $630.60 $400.00 $400.00 $23060 $0.00 $0.00 Island Way Motel CUSDIOS 04:3/045623 Net 50 00000001 01/08/2010 $128.50 Total $120.50 $0.00 $0.00 $128.50 $120.50 $0.00 Leisure Landscape Nursery CUS0006 Mr Lucas Jones 02 3878931 Net EOM 00000002 29/09/2010 $301.40 Total $301.40 $0.00 50.00 $0.00 $301.40 $301.40 Grand Total Ageing Percent 12.471.20 3223 $1,300.00 51.73 $120.50 4.83 $301.40 11.33 Reference: MYOB Australia website http://myobaustralia.custhelp.com/app/answers/detail/a id/30876/kw/9250 (Accessed: 05/12/2013) a) Which debtor has the oldest outstanding amount? b) How overdue is the payment? c) Has the business been successful in collecting amounts from their customers? Explain why/why not. 11. A key element of accounting knowledge is knowledge about cost behaviour. Explain the cost behaviour of fixed and variable costs. Fixed costs Variable costs 12. The Profit & Loss Statement must be reported to the Australian Tax Office at the end of each financial year. a. What are the dates for a business financial reporting year in Australia? b. State the dates of one example of a different financial year reporting period in another country. 13. What is the purpose of profit and loss statement and balance sheet reports? Explain the key information to look for when analysing the business performance of a hospitality business. 14. When producing a Profit & Loss Statement and Balance sheet there are a number of formats and features that can be customised for each business. Provide two examples: 1. 2.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started