Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. What are the advantages and disadvantages of principal-protected equity-linked notes from the investor's (e.g. private banking client's) point of view? 2. If a

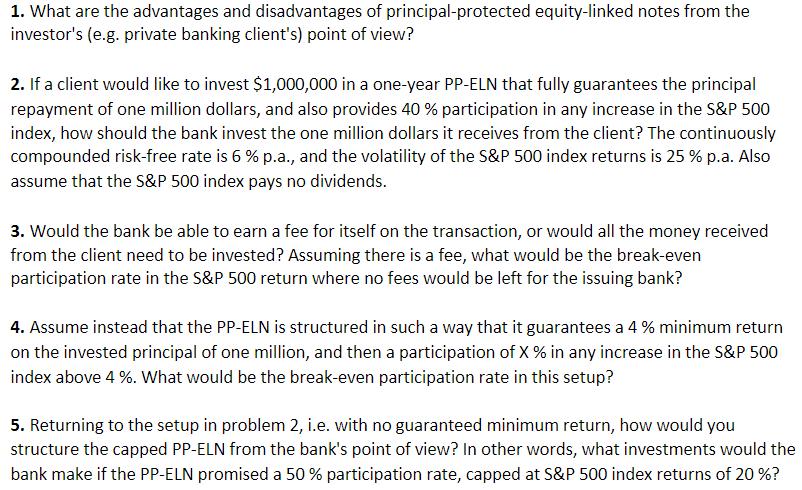

1. What are the advantages and disadvantages of principal-protected equity-linked notes from the investor's (e.g. private banking client's) point of view? 2. If a client would like to invest $1,000,000 in a one-year PP-ELN that fully guarantees the principal repayment of one million dollars, and also provides 40 % participation in any increase in the S&P 500 index, how should the bank invest the one million dollars it receives from the client? The continuously compounded risk-free rate is 6 % p.a., and the volatility of the S&P 500 index returns is 25% p.a. Also assume that the S&P 500 index pays no dividends. 3. Would the bank be able to earn a fee for itself on the transaction, or would all the money received from the client need to be invested? Assuming there is a fee, what would be the break-even participation rate in the S&P 500 return where no fees would be left for the issuing bank? 4. Assume instead that the PP-ELN is structured in such a way that it guarantees a 4% minimum return on the invested principal of one million, and then a participation of X % in any increase in the S&P 500 index above 4%. What would be the break-even participation rate in this setup? 5. Returning to the setup in problem 2, i.e. with no guaranteed minimum return, how would you structure the capped PP-ELN from the bank's point of view? In other words, what investments would the bank make if the PP-ELN promised a 50% participation rate, capped at S&P 500 index returns of 20 %?

Step by Step Solution

★★★★★

3.29 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

1 Advantages and disadvantages of PrincipalProtected EquityLinked Notes PPELNs for investors Advantages Principal protection PPELNs guarantee the return of the initial investment amount at maturity pr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started