Answered step by step

Verified Expert Solution

Question

1 Approved Answer

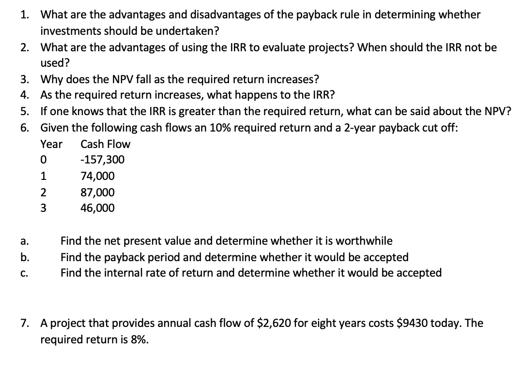

1. What are the advantages and disadvantages of the payback rule in determining whether investments should be undertaken? 2. What are the advantages of

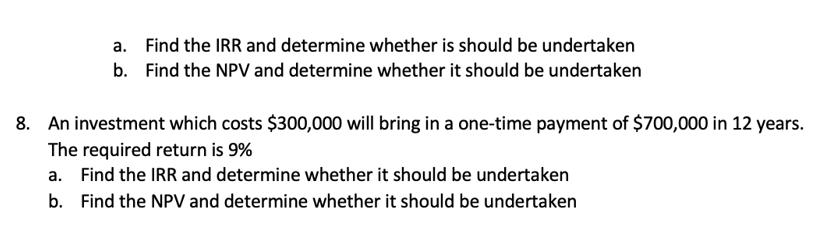

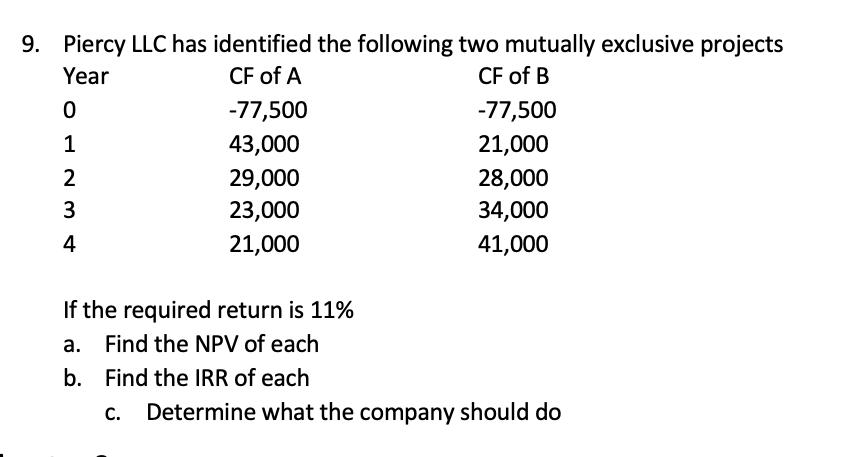

1. What are the advantages and disadvantages of the payback rule in determining whether investments should be undertaken? 2. What are the advantages of using the IRR to evaluate projects? When should the IRR not be used? 3. Why does the NPV fall as the required return increases? 4. As the required return increases, what happens to the IRR? 5. 6. a. b. C. If one knows that the IRR is greater than the required return, what can be said about the NPV? Given the following cash flows an 10% required return and a 2-year payback cut off: Year Cash Flow 0 1 2 3 -157,300 74,000 87,000 46,000 Find the net present value and determine whether it is worthwhile Find the payback period and determine whether it would be accepted Find the internal rate of return and determine whether it would be accepted 7. A project that provides annual cash flow of $2,620 for eight years costs $9430 today. The required return is 8%. a. Find the IRR and determine whether is should be undertaken b. Find the NPV and determine whether it should be undertaken 8. An investment which costs $300,000 will bring in a one-time payment of $700,000 in 12 years. The required return is 9% a. Find the IRR and determine whether it should be undertaken b. Find the NPV and determine whether it should be undertaken 9. Piercy LLC has identified the following two mutually exclusive projects Year CF of A CF of B 0 1 234 -77,500 43,000 29,000 23,000 21,000 If the required return is 11% a. Find the NPV of each b. -77,500 21,000 28,000 34,000 41,000 Find the IRR of each Determine what the company should do

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Advantages and Disadvantages of the Payback Rule Advantages The payback rule is a simple and easytounderstand method for evaluating investments It provides a quick estimate of the time it will take to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started