Answered step by step

Verified Expert Solution

Question

1 Approved Answer

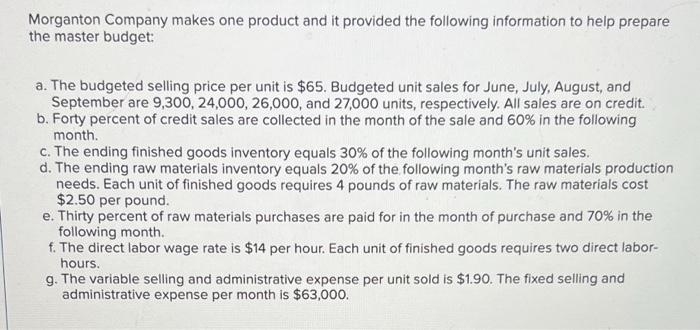

1. What are the budgeted sales for July? 2. what are the expected cash collections for July? 3. what is the accounts receivable balance at

1. What are the budgeted sales for July?

2. what are the expected cash collections for July?

3. what is the accounts receivable balance at the end of July?

4. according to the production budget how many units should be produced in July?

5. if 105,200 pounds of raw materials are needed to meet production in August, how many pounds of raw materials should be purchased in July?

6. if 105,200 pounds of raw materials are needed to make production in August what is the estimated cost of raw material purchases for July?

7. in July what are the total estimated cash disbursements for raw material purchases? Assume the cost of raw material purchases in June is 158,880 and 105,200 pounds of raw materials are needed to meet production in August

8. if 105,200 pounds of raw materials are needed to meet production in August what is the estimated accounts payable balance at the end of July?

9. if 105,200 pounds of raw materials are needed to make production in August what is the estimated raw materials inventory balance at the end of July?

10. what is the total estimated direct labor cost for July?

11. if we assume that there is no fixed manufacturing overhead and the variable manufacturing overhead is nine dollars per direct labor hour what is the estimated unit product cost?

12. if we assume that there is no fixed manufacturing overhead and the variable manufacturing overhead is nine dollars per direct labor hour what is the estimated finished goods inventory balance at the in July?

13. if we assume that there is no fixed manufacturing overhead and the variable manufacturing overhead is nine dollars per direct labor hour what is the estimated cost of good sold and gross margin for July?

14. what is the estimated total selling and administrative expense for July?

15. if we assume that there is no fixed manufacturing overhead and the variable manufacturing overhead is nine dollars per direct labor hour what is the estimated net operating income for July?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started