Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. What are the general implications for banks providing more loans and investing less in government securities, other things being the same? a. Increase in

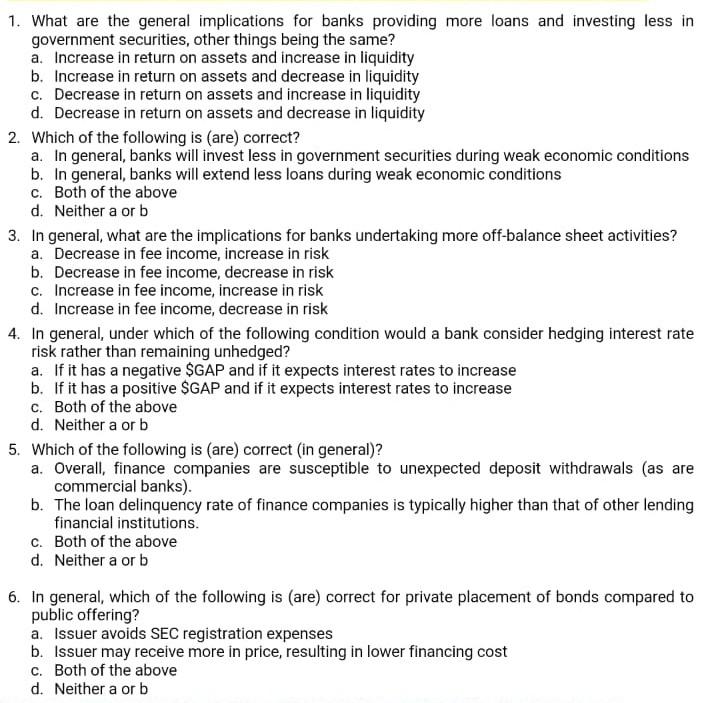

1. What are the general implications for banks providing more loans and investing less in government securities, other things being the same? a. Increase in return on assets and increase in liquidity b. Increase in return on assets and decrease in liquidity c. Decrease in return on assets and increase in liquidity d. Decrease in return on assets and decrease in liquidity 2. Which of the following is (are) correct? a. In general, banks will invest less in government securities during weak economic conditions b. In general, banks will extend less loans during weak economic conditions c. Both of the above d. Neither a orb 3. In general, what are the implications for banks undertaking more off-balance sheet activities? a. Decrease in fee income, increase in risk b. Decrease in fee income, decrease in risk c. Increase in fee income, increase in risk d. Increase in fee income, decrease in risk 4. In general, under which of the following condition would a bank consider hedging interest rate risk rather than remaining unhedged? a. If it has a negative SGAP and if it expects interest rates to increase b. If it has a positive SGAP and if it expects interest rates to increase C. Both of the above d. Neither a orb 5. Which of the following is (are) correct (in general)? a. Overall, finance companies are susceptible to unexpected deposit withdrawals (as are commercial banks). b. The loan delinquency rate of finance companies is typically higher than that of other lending financial institutions. C. Both of the above d. Neither a orb 6. In general, which of the following is (are) correct for private placement of bonds compared to public offering? a. Issuer avoids SEC registration expenses b. Issuer may receive more in price, resulting in lower financing cost c. Both of the above d. Neither a orb

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started