Question

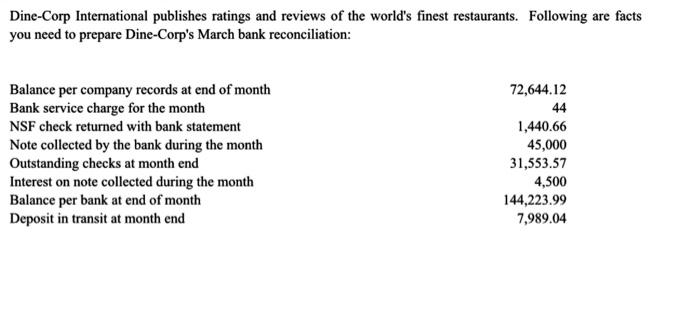

1. What is the Adjusted End Cash balance for the Bank? $112670.42 $152,213.03 $120,659.46 None of the above 2. What total amount should be added

1.What is the Adjusted End Cash balance for the Bank?

$112670.42

$152,213.03

$120,659.46

None of the above

2. What total amount should be added to the companys book records?

4500.00

49500.00

45,000.00

7,989.04

3. What total amount should be deducted from the companys book records?

Both 1440.66 and 44.00

1440.66

7989.04

44.00

4. What needs to be journalized as adjusting entry for this bank reconciliation?

a) No adjusting Entries are needed.

b) Mostly the book side needs adjustments.

c) Anything that has been adjusted in the company record side of the bank reconciliation

d) Anything that has been adjusted in the bank side of the bank reconciliation.

5. Which one of these is a correct adjusting journal entry for the bank reconciliation?

a) Cash 4500

Interest income 4500

b) Interest Income 4500

Cash 4500

c) Cash 4500

Interest expense 4500

d)none of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started