Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. What is the calculation for basic EPS AND what are the specific ASC codifications (ASC XXX-XX-XX-X....not XXX or XXX-XX-XX. Must be complete code to

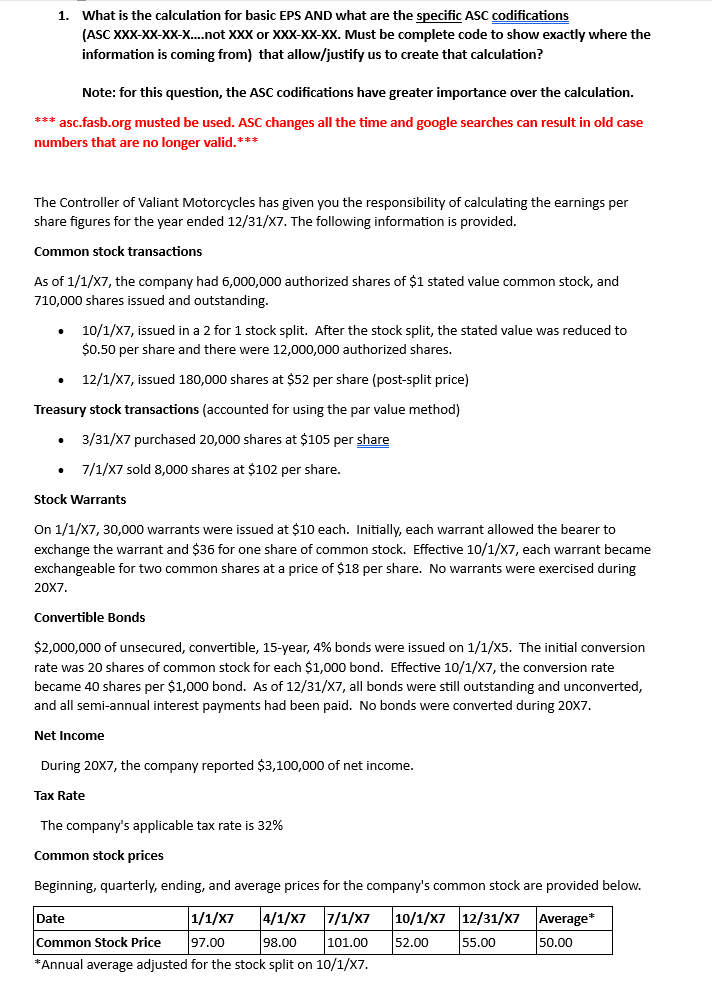

1. What is the calculation for basic EPS AND what are the specific ASC codifications (ASC XXX-XX-XX-X....not XXX or XXX-XX-XX. Must be complete code to show exactly where the information is coming from) that allow/justify us to create that calculation? Note: for this question, the ASC codifications have greater importance over the calculation. asc.fasb.org musted be used. ASC changes all the time and google searches can result in old case numbers that are no longer valid.*** The Controller of Valiant Motorcycles has given you the responsibility of calculating the earnings per share figures for the year ended 12/31/X7. The following information is provided. Common stock transactions As of 1/1/X7, the company had 6,000,000 authorized shares of $1 stated value common stock, and 710,000 shares issued and outstanding. - 10/1/X7, issued in a 2 for 1 stock split. After the stock split, the stated value was reduced to $0.50 per share and there were 12,000,000 authorized shares. - 12/1/X7, issued 180,000 shares at $52 per share (post-split price) Treasury stock transactions (accounted for using the par value method) - 3/31/X7 purchased 20,000 shares at $105 per share - 7/1/7 sold 8,000 shares at $102 per share. Stock Warrants On 1/1/X7,30,000 warrants were issued at $10 each. Initially, each warrant allowed the bearer to exchange the warrant and $36 for one share of common stock. Effective 10/1/X7, each warrant became exchangeable for two common shares at a price of $18 per share. No warrants were exercised during 207. Convertible Bonds $2,000,000 of unsecured, convertible, 15 -year, 4% bonds were issued on 1/1/X5. The initial conversion rate was 20 shares of common stock for each $1,000 bond. Effective 10/1/X7, the conversion rate became 40 shares per $1,000 bond. As of 12/31/X7, all bonds were still outstanding and unconverted, and all semi-annual interest payments had been paid. No bonds were converted during 207. Net Income During 207, the company reported $3,100,000 of net income. Tax Rate The company's applicable tax rate is 32% Common stock prices Beginning, quarterly, ending, and average prices for the company's common stock are provided below. *Annual average adjusted for the stock split on 10/1/X7

1. What is the calculation for basic EPS AND what are the specific ASC codifications (ASC XXX-XX-XX-X....not XXX or XXX-XX-XX. Must be complete code to show exactly where the information is coming from) that allow/justify us to create that calculation? Note: for this question, the ASC codifications have greater importance over the calculation. asc.fasb.org musted be used. ASC changes all the time and google searches can result in old case numbers that are no longer valid.*** The Controller of Valiant Motorcycles has given you the responsibility of calculating the earnings per share figures for the year ended 12/31/X7. The following information is provided. Common stock transactions As of 1/1/X7, the company had 6,000,000 authorized shares of $1 stated value common stock, and 710,000 shares issued and outstanding. - 10/1/X7, issued in a 2 for 1 stock split. After the stock split, the stated value was reduced to $0.50 per share and there were 12,000,000 authorized shares. - 12/1/X7, issued 180,000 shares at $52 per share (post-split price) Treasury stock transactions (accounted for using the par value method) - 3/31/X7 purchased 20,000 shares at $105 per share - 7/1/7 sold 8,000 shares at $102 per share. Stock Warrants On 1/1/X7,30,000 warrants were issued at $10 each. Initially, each warrant allowed the bearer to exchange the warrant and $36 for one share of common stock. Effective 10/1/X7, each warrant became exchangeable for two common shares at a price of $18 per share. No warrants were exercised during 207. Convertible Bonds $2,000,000 of unsecured, convertible, 15 -year, 4% bonds were issued on 1/1/X5. The initial conversion rate was 20 shares of common stock for each $1,000 bond. Effective 10/1/X7, the conversion rate became 40 shares per $1,000 bond. As of 12/31/X7, all bonds were still outstanding and unconverted, and all semi-annual interest payments had been paid. No bonds were converted during 207. Net Income During 207, the company reported $3,100,000 of net income. Tax Rate The company's applicable tax rate is 32% Common stock prices Beginning, quarterly, ending, and average prices for the company's common stock are provided below. *Annual average adjusted for the stock split on 10/1/X7 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started