Answered step by step

Verified Expert Solution

Question

1 Approved Answer

BHP wishes to raise new share capital in the stock market. Which of the following financial institutions should it approach? Select one: a. ANZ

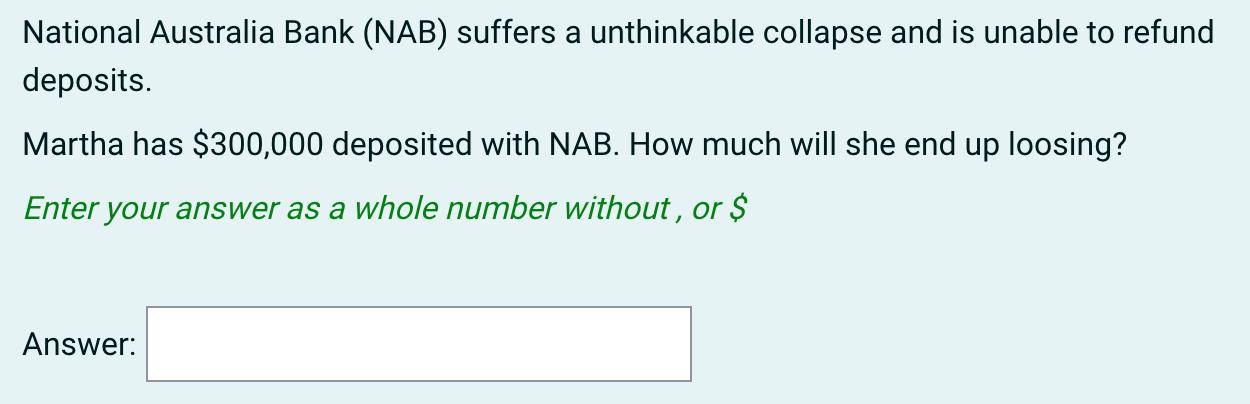

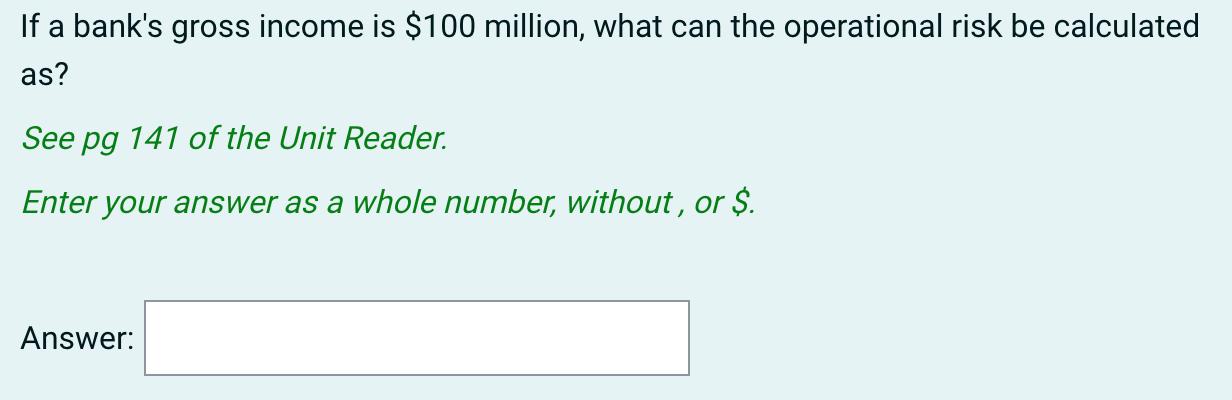

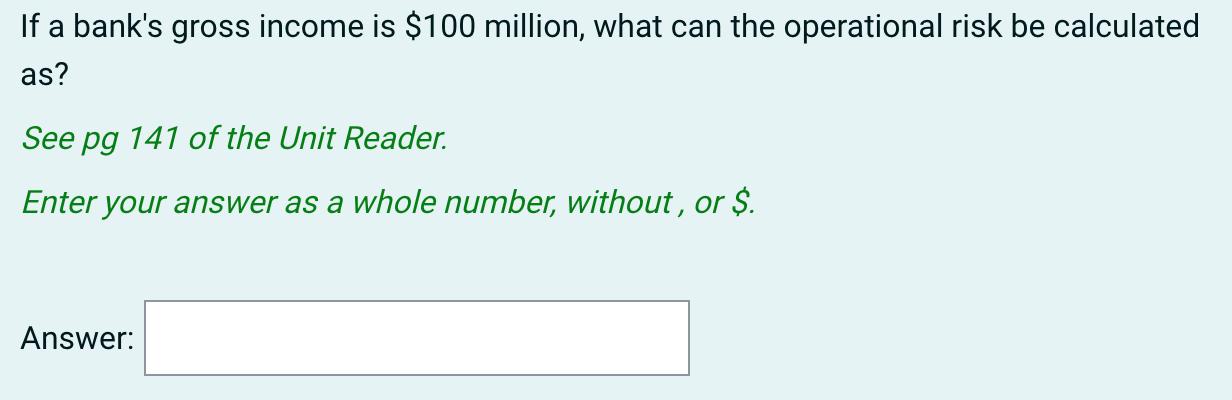

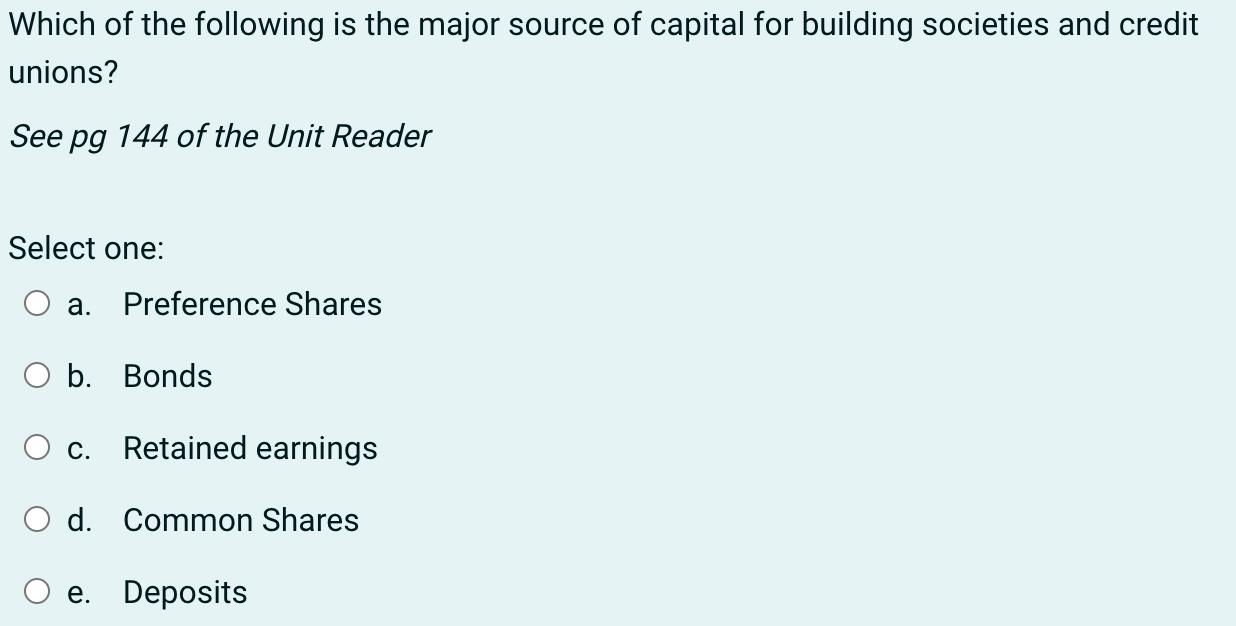

BHP wishes to raise new share capital in the stock market. Which of the following financial institutions should it approach? Select one: a. ANZ O b. Macquarie Bank C. NAB O d. CBA e. Westpac National Australia Bank (NAB) suffers a unthinkable collapse and is unable to refund deposits. Martha has $300,000 deposited with NAB. How much will she end up loosing? Enter your answer as a whole number without, or $ Answer: If a bank's gross income is $100 million, what can the operational risk be calculated as? See pg 141 of the Unit Reader. Enter your answer as a whole number, without, or $. Answer: If a bank's gross income is $100 million, what can the operational risk be calculated as? See pg 141 of the Unit Reader. Enter your answer as a whole number, without, or $. Answer: Which of the following is the major source of capital for building societies and credit unions? See pg 144 of the Unit Reader Select one: a. Preference Shares O b. Bonds C. Retained earnings d. Common Shares e. Deposits

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

c NAB Explanation The National Australia Bank ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started