Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) What is the estimated purchase price of the subject property? 2) What is the estimated sale price at the end of the 5-year holding

1) What is the estimated purchase price of the subject property?

1) What is the estimated purchase price of the subject property?

2) What is the estimated sale price at the end of the 5-year holding period?

3) What is my effective Tax Rate?

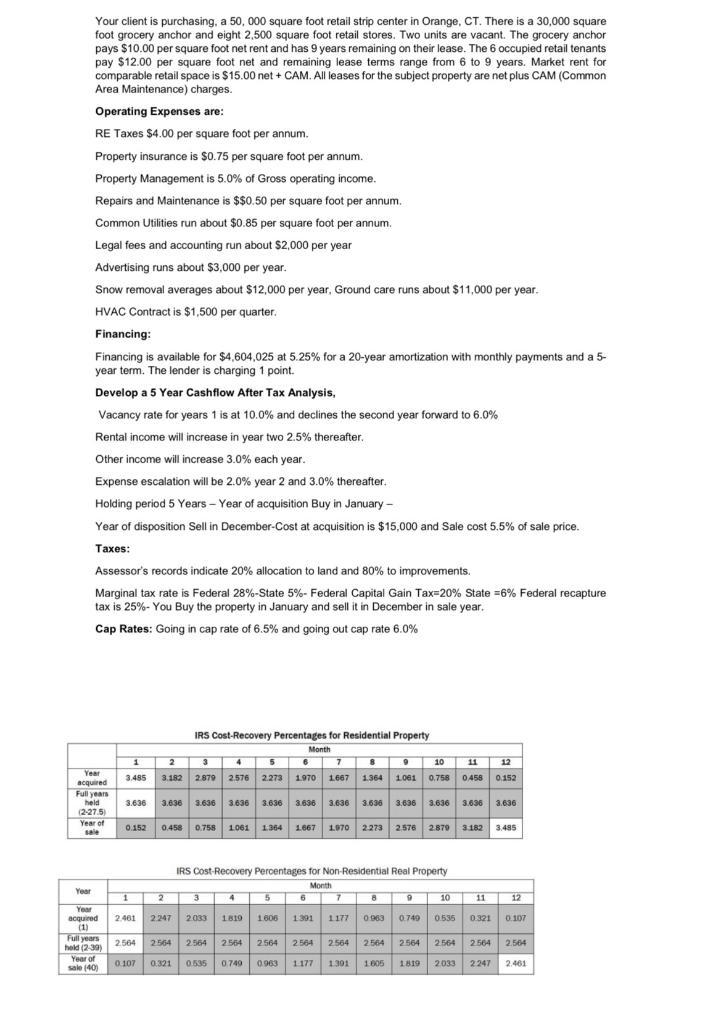

Your client is purchasing, a 50, 000 square foot retail strip center in Orange, CT. There is a 30,000 square foot grocery anchor and eight 2,500 square foot retail stores. Two units are vacant. The grocery anchor pays $10.00 per square foot net rent and has 9 years remaining on their lease. The 6 occupied retail tenants pay $12.00 per square foot net and remaining lease terms range from 6 to 9 years. Market rent for comparable retail space is $15.00 net + CAM. All leases for the subject property are net plus CAM (Common Area Maintenance) charges. Operating Expenses are: RE Taxes $4.00 per square foot per annum. Property insurance is $0.75 per square foot per annum. Property Management is 5.0% of Gross operating income. Repairs and Maintenance is $$0.50 per square foot per annum. Common Utilities run about $0.85 per square foot per annum. Legal fees and accounting run about $2,000 per year Advertising runs about $3,000 per year. Snow removal averages about $12,000 per year, Ground care runs about $11,000 per year. HVAC Contract is $1,500 per quarter. Year Financing: Financing is available for $4,604,025 at 5.25% for a 20-year amortization with monthly payments and a 5- year term. The lender is charging 1 point. Develop a 5 Year Cashflow After Tax Analysis, Vacancy rate for years 1 is at 10.0% and declines the second year forward to 6.0% Rental income will increase in year two 2.5% thereafter. Other income will increase 3.0% each year. Expense escalation will be 2.0% year 2 and 3.0% thereafter. Holding period 5 Years-Year of acquisition Buy in January - Year of disposition Sell in December-Cost at acquisition is $15,000 and Sale cost 5.5% of sale price. Taxes: Assessor's records indicate 20% allocation to land and 80% to improvements. Marginal tax rate is Federal 28%-State 5% - Federal Capital Gain Tax=20% State = 6% Federal recapture tax is 25% - You Buy the property in January and sell it in December in sale year. Cap Rates: Going in cap rate of 6.5% and going out cap rate 6.0% Year acquired Full years held (2-27.5) Year of sa 1 2 7 3.485 3.182 2.879 2.576 2.273 1970 1.667 3.636 Year of sale (40) 0.152 9 10 11 12 1.061 0.758 0.458 0.152 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 1 2 Year acquired 2.461 2.247 (1) IRS Cost-Recovery Percentages for Residential Property Month Full years 2.564 2564 hold (2-39) 0.458 0.758 1061 1.364 1.667 1970 2273 2576 2.879 3.182 3.495 0.107 0.321 IRS Cost-Recovery Percentages for Non-Residential Real Property Month 3 2.033 2.564 0.535 4 8 1.364 1819 5 7 1.606 1391 1177 6 8 9 10 0.963 0.749 0.535 0.321 0.107 2.564 2.564 2.564 2564 2.564 0,749 0.963 1.177 1.301 1.605 11 12 2.564 2.564 2.564 2.564 1819 2.033 2247 2.461

Step by Step Solution

★★★★★

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1To estimate the purchase price of the subject property we need to calculate the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started