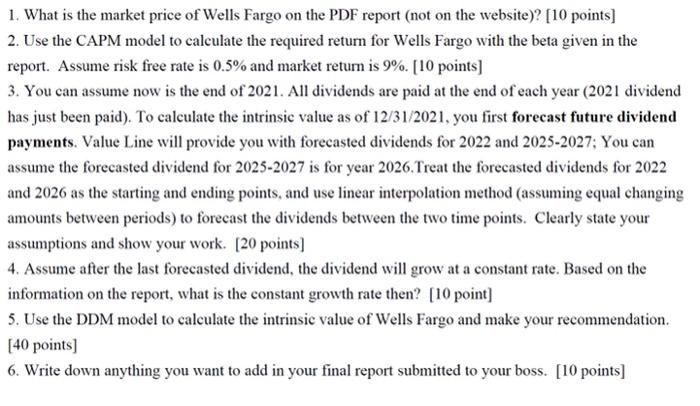

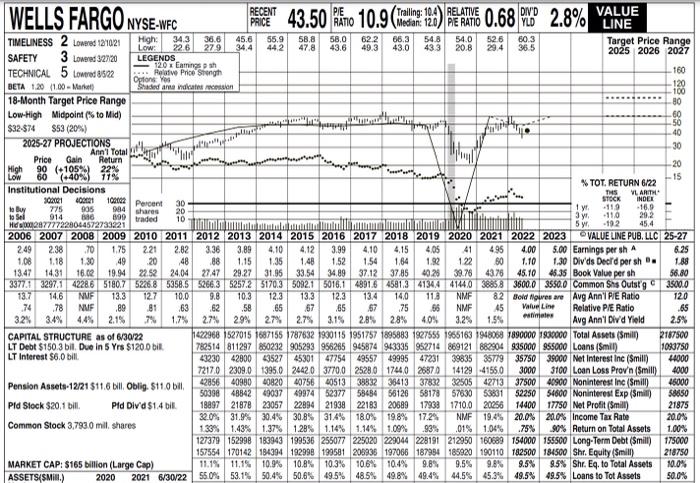

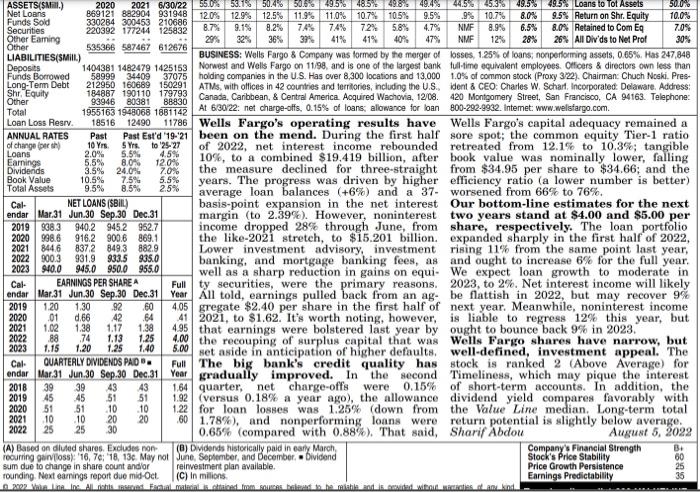

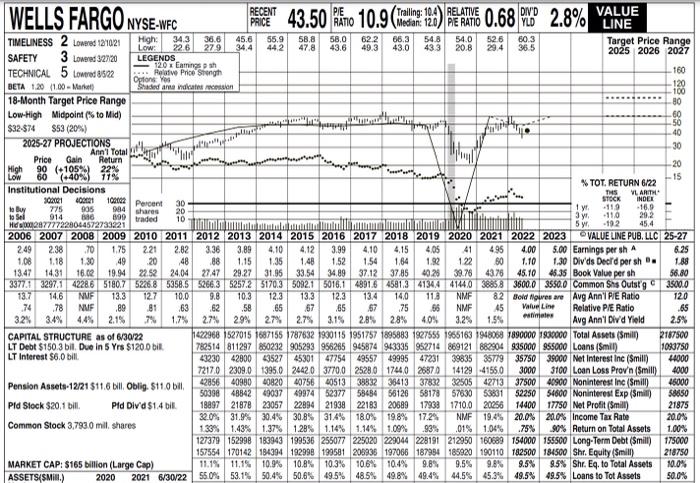

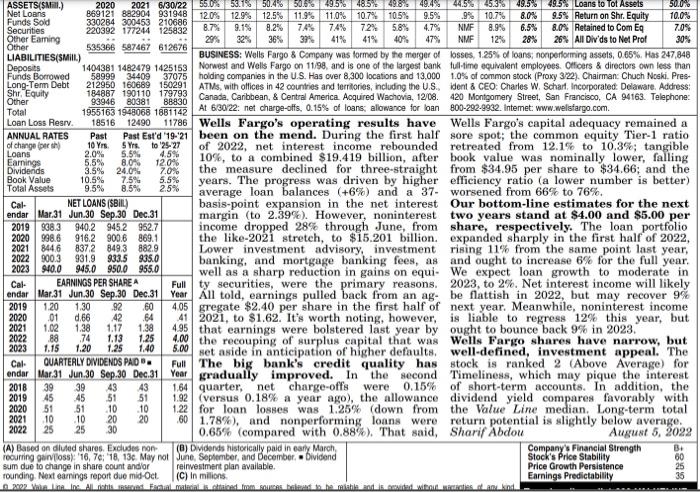

1. What is the market price of Wells Fargo on the PDF report (not on the website)? [10 points] 2. Use the CAPM model to calculate the required return for Wells Fargo with the beta given in the report. Assume risk free rate is 0.5% and market return is 9%. [ 10 points] 3. You can assume now is the end of 2021 . All dividends are paid at the end of each year (2021 dividend has just been paid). To calculate the intrinsic value as of 12/31/2021, you first forecast future dividend payments. Value Line will provide you with forecasted dividends for 2022 and 2025-2027; You can assume the forecasted dividend for 20252027 is for year 2026. Treat the forecasted dividends for 2022 and 2026 as the starting and ending points, and use linear interpolation method (assuming equal changing amounts between periods) to forecast the dividends between the two time points. Clearly state your assumptions and show your work. [20 points] 4. Assume after the last forecasted dividend, the dividend will grow at a constant rate. Based on the information on the report, what is the constant growth rate then? [ 10 point] 5. Use the DDM model to calculate the intrinsic value of Wells Fargo and make your recommendation. [40 points] 6. Write down anything you want to add in your final report submitted to your boss. [10 points] BUSINESS: Wells Fargo \& Company was formed by the merger of losses, 1.25\% of loans; nonperforming assets, 0.65\%. Has 247,848 Norwest and Wells Farge on 11,98, and is one of the largest bank fullime equivalent employoes. Olficers \& direciors own less than holding companies in the U.S. Has cver 8,300 locations and 13,0001.0% of common stock (Proxy 3/22). Chairman: Chuch Nuski. PresATMAs, with ollices in 42 oountries and territories, including the U.S., ident \& CEO: Charles W. Schart, Incopporated. Delawate. Address: Canada, Carbbean, 8 Central America. Aoquired Wachovia, 1208. 420 Montgomery Street, San Francisoo, CA 94163 . Telaphone: At 6.30/22: net charga-olfs, 0.15% of loans; allowance for loan 800-292-9932. Intemet: www.welsfargo.com