Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. What is the maximum price that Monmouth can afford to pay? Are there any other opportunities to improve Robertson's performance beyond what is directly

1. What is the maximum price that Monmouth can afford to pay? Are there any other opportunities to improve Robertson's performance beyond what is directly stated in the case?

2. You should assume throughout your case analysis that NDP owns 11,000 shares of Robertson, while Monmouth owns 29,000 shares of Robertson. You can also assume that Robertson has been following a financing policy of maintaining a fixed debt ratio, and Monmouth (and all other purchasers) intend to maintain this policy if they acquire Robertson.

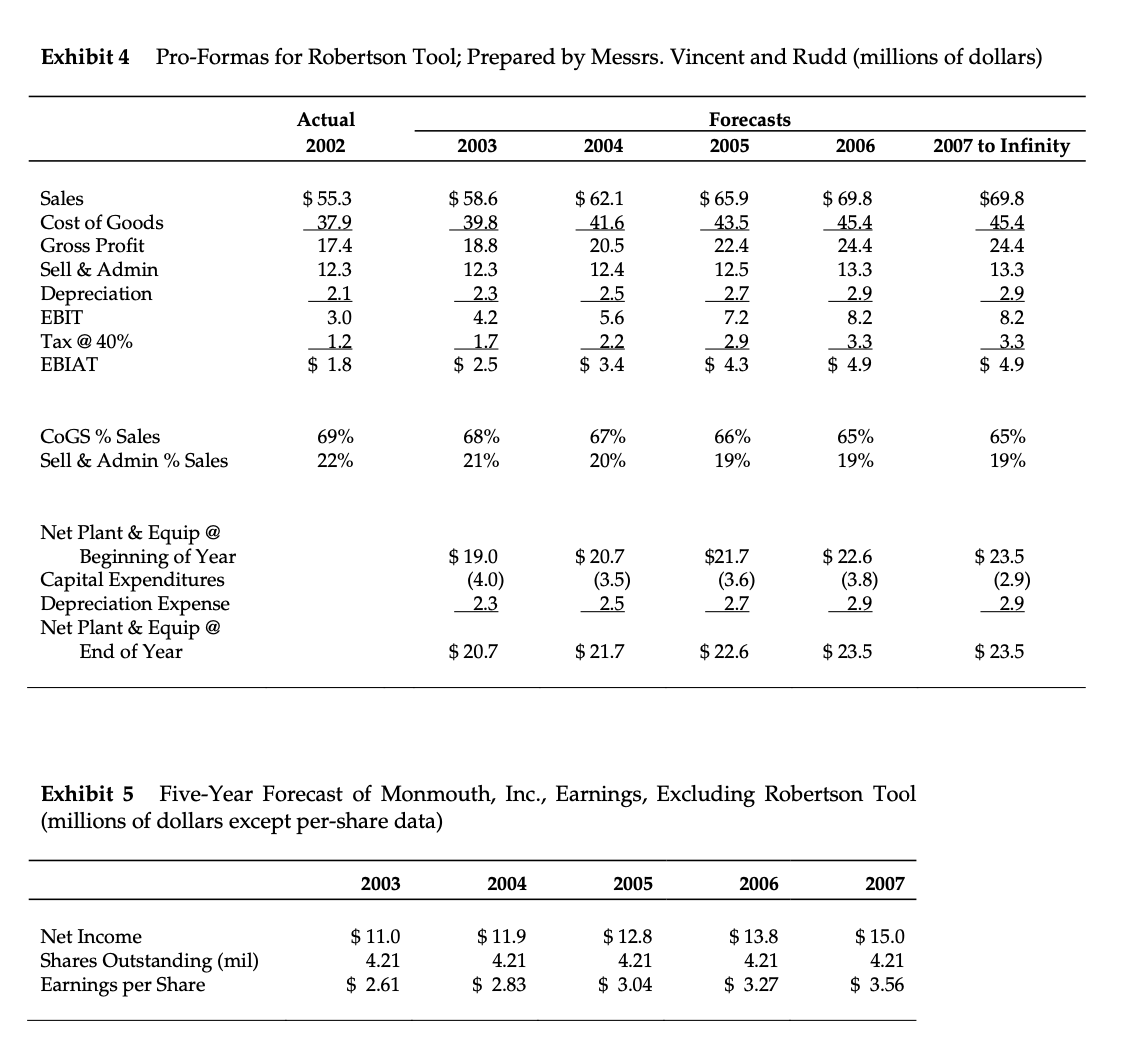

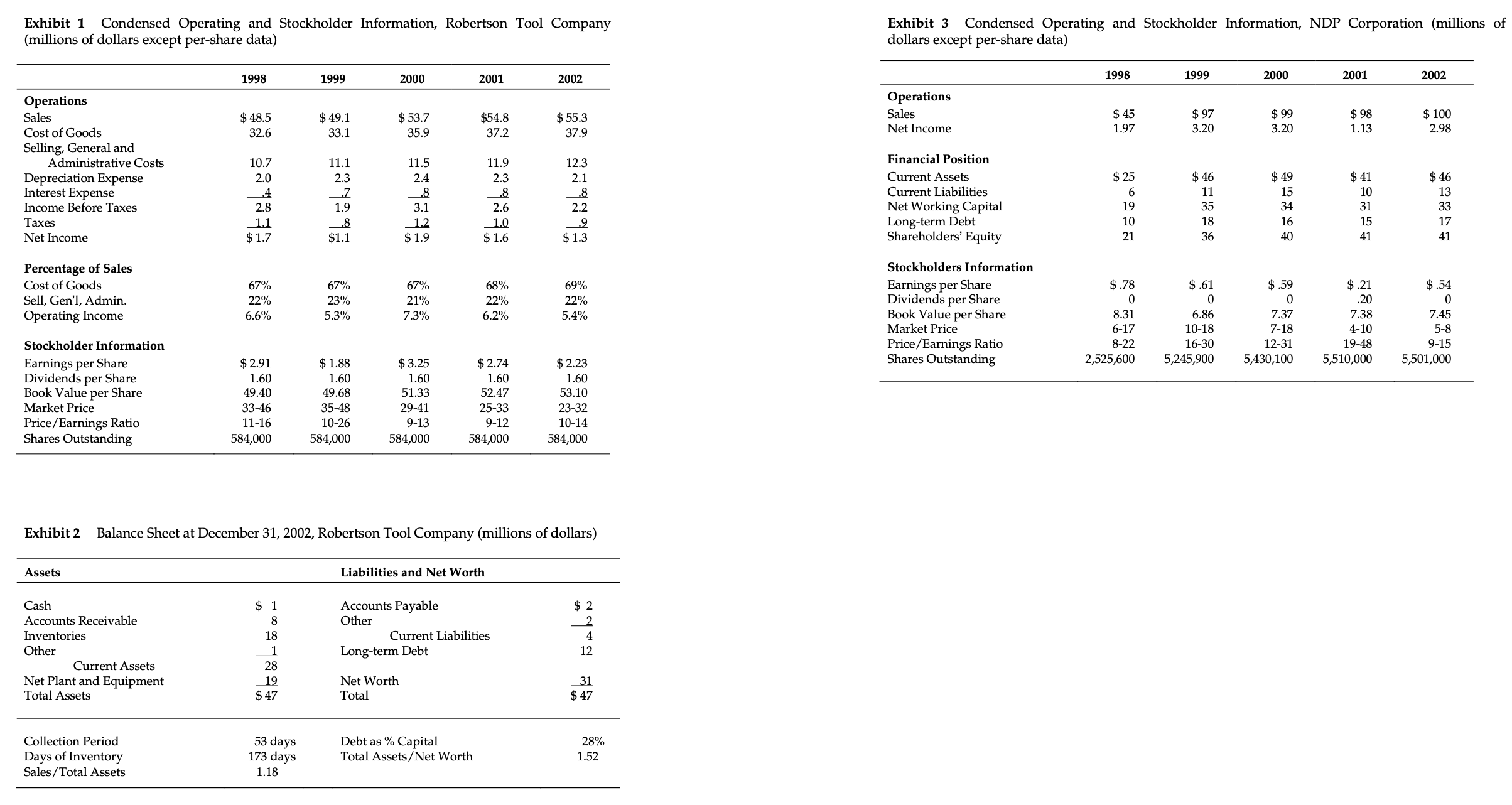

Exhibit 4 Pro-Formas for Robertson Tool; Prepared by Messrs. Vincent and Rudd (millions of dollars) Sales Cost of Goods Gross Profit Sell & Admin Depreciation EBIT Tax @ 40% EBIAT COGS % Sales Sell & Admin % Sales Net Plant & Equip @ Beginning of Year Capital Expenditures Depreciation Expense Net Plant & Equip @ End of Year Actual 2002 Net Income Shares Outstanding (mil) Earnings per Share $ 55.3 37.9 17.4 12.3 2.1 3.0 1.2 $ 1.8 69% 22% 2003 2003 $11.0 4.21 $ 2.61 $ 58.6 39.8 18.8 12.3 2.3 4.2 1.7 $2.5 68% 21% $ 19.0 (4.0) 2.3 $ 20.7 2004 2004 $11.9 4.21 $2.83 $ 62.1 41.6 20.5 12.4 2.5 5.6 2.2 $3.4 67% 20% $ 20.7 (3.5) 2.5 $21.7 2005 Forecasts 2005 $ 12.8 4.21 $3.04 $65.9 43.5 22.4 12.5 2.7 7.2 2.9 $4.3 66% 19% $21.7 (3.6) 2.7 $22.6 Exhibit 5 Five-Year Forecast of Monmouth, Inc., Earnings, Excluding Robertson Tool (millions of dollars except per-share data) 2006 2006 $ 13.8 4.21 $ 3.27 $ 69.8 45.4 24.4 13.3 2.9 8.2 3.3 $4.9 65% 19% $22.6 (3.8) 2.9 $23.5 2007 $15.0 4.21 $ 3.56 2007 to Infinity $69.8 45.4 24.4 13.3 2.9 8.2 3.3 $4.9 65% 19% $23.5 (2.9) 2.9 $23.5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the information provided 1 What is the maximum price that Monmouth can afford to pay for Robertson To determine the maximum price Monmouth ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started