Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. What is the NPV of a project that costs $100,000 and returns $50,000 annually for 3 years if the opportunity cost of capital is

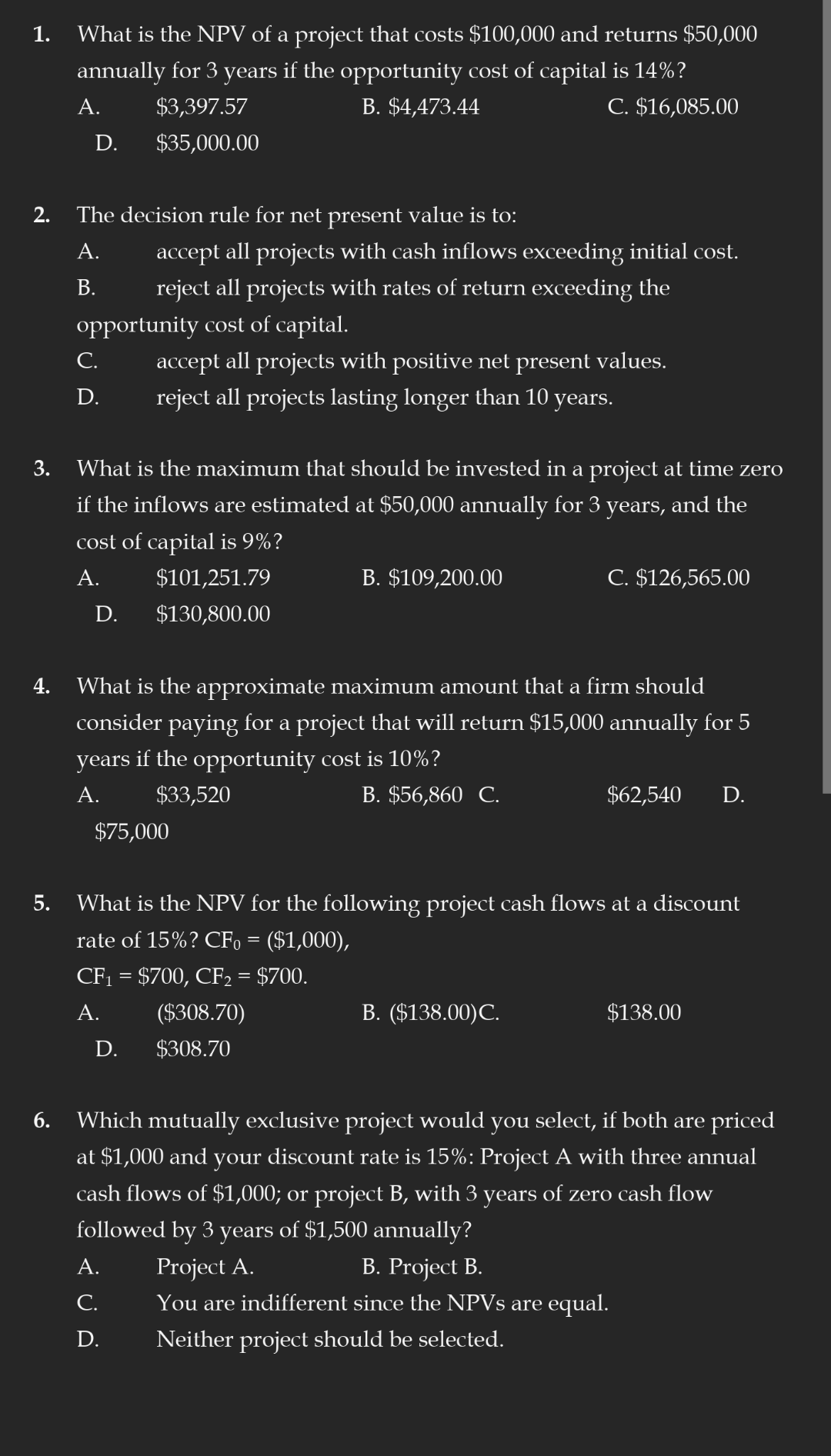

1. What is the NPV of a project that costs $100,000 and returns $50,000 annually for 3 years if the opportunity cost of capital is 14% ? A. $3,397.57 B. $4,473.44 C. $16,085.00 D. $35,000.00 2. The decision rule for net present value is to: A. accept all projects with cash inflows exceeding initial cost. B. reject all projects with rates of return exceeding the opportunity cost of capital. C. accept all projects with positive net present values. D. reject all projects lasting longer than 10 years. 3. What is the maximum that should be invested in a project at time zero if the inflows are estimated at $50,000 annually for 3 years, and the cost of capital is 9%? A. $101,251.79 B. $109,200.00 C. $126,565.00 D. $130,800.00 4. What is the approximate maximum amount that a firm should consider paying for a project that will return $15,000 annually for 5 years if the opportunity cost is 10% ? A. $33,520 B. $56,860 C. $62,540 D. $75,000 5. What is the NPV for the following project cash flows at a discount rate of 15%?CF0=($1,000), CF1=$700,CF2=$700. A. ($308.70) B. ($138.00) C. $138.00 D. $308.70 6. Which mutually exclusive project would you select, if both are priced at $1,000 and your discount rate is 15% : Project A with three annual cash flows of $1,000; or project B, with 3 years of zero cash flow followed by 3 years of $1,500 annually? A. Project A. B. Project B. C. You are indifferent since the NPVs are equal. D. Neither project should be selected

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started