Question

1. What is the RMA Industry's ROE? (Answer in terms of %, so 1.23% would just be 1.23). 2. For FYE 2022, what was Steelcase's

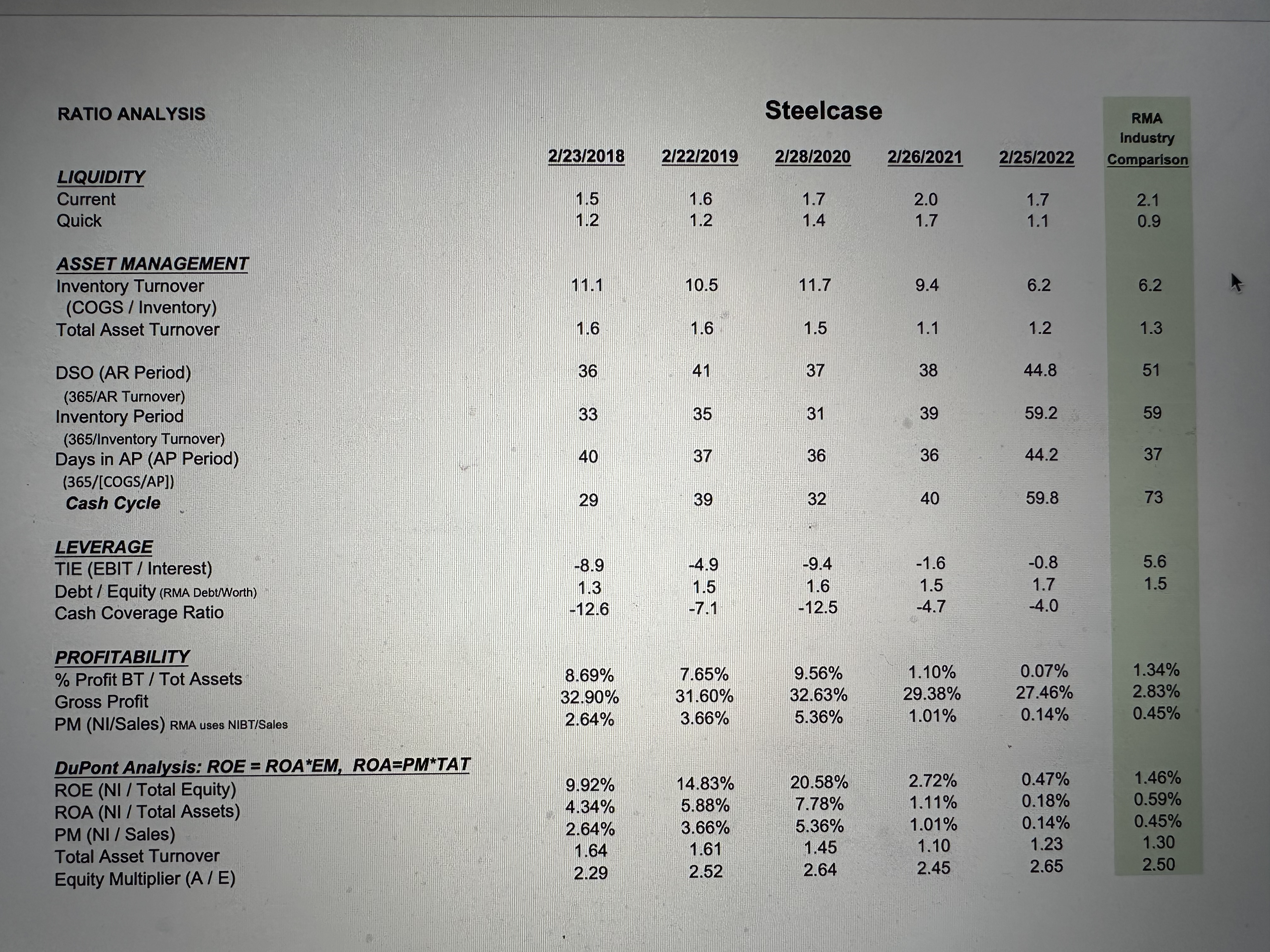

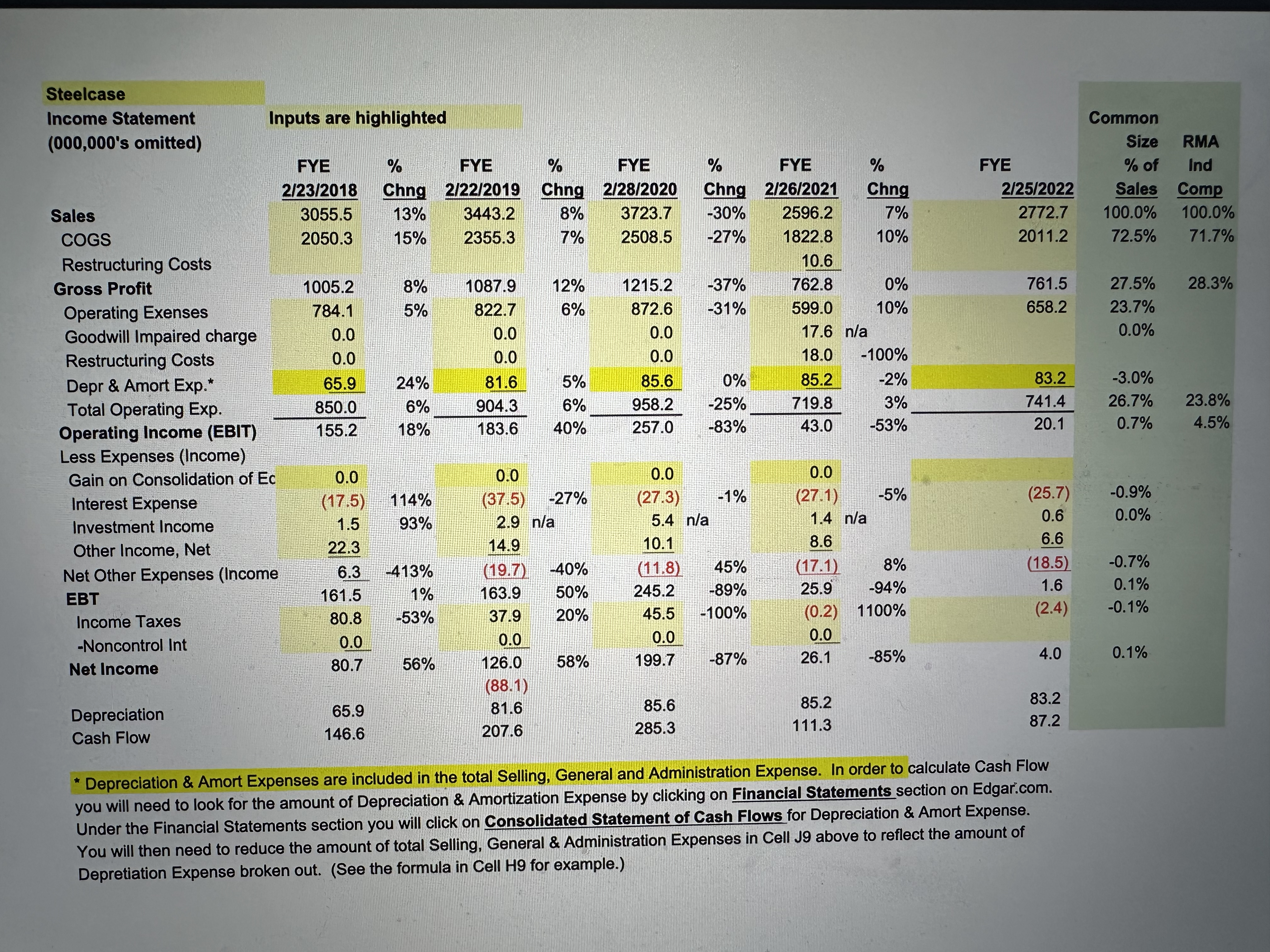

1. What is the RMA Industry's ROE? (Answer in terms of %, so 1.23% would just be 1.23).

2. For FYE 2022, what was Steelcase's ROA? (Answer in terms of %, so 1.23% would just be 1.23).

3. For FYE 2022, what was Steelcase's ROE? (Answer in terms of %, so 1.23% would just be 1.23).

4. What is the RMA Industry's Equity Multiplier?

5. What is the RMA Industry's ROA? (Answer in terms of %, so 1.23% would just be 1.23).

6. What is the operating cycle for Steelcase (in days?)

7. What is the cash cycle for Steelcase (in days?)

8. What is the inventory period for the industry (in days?)

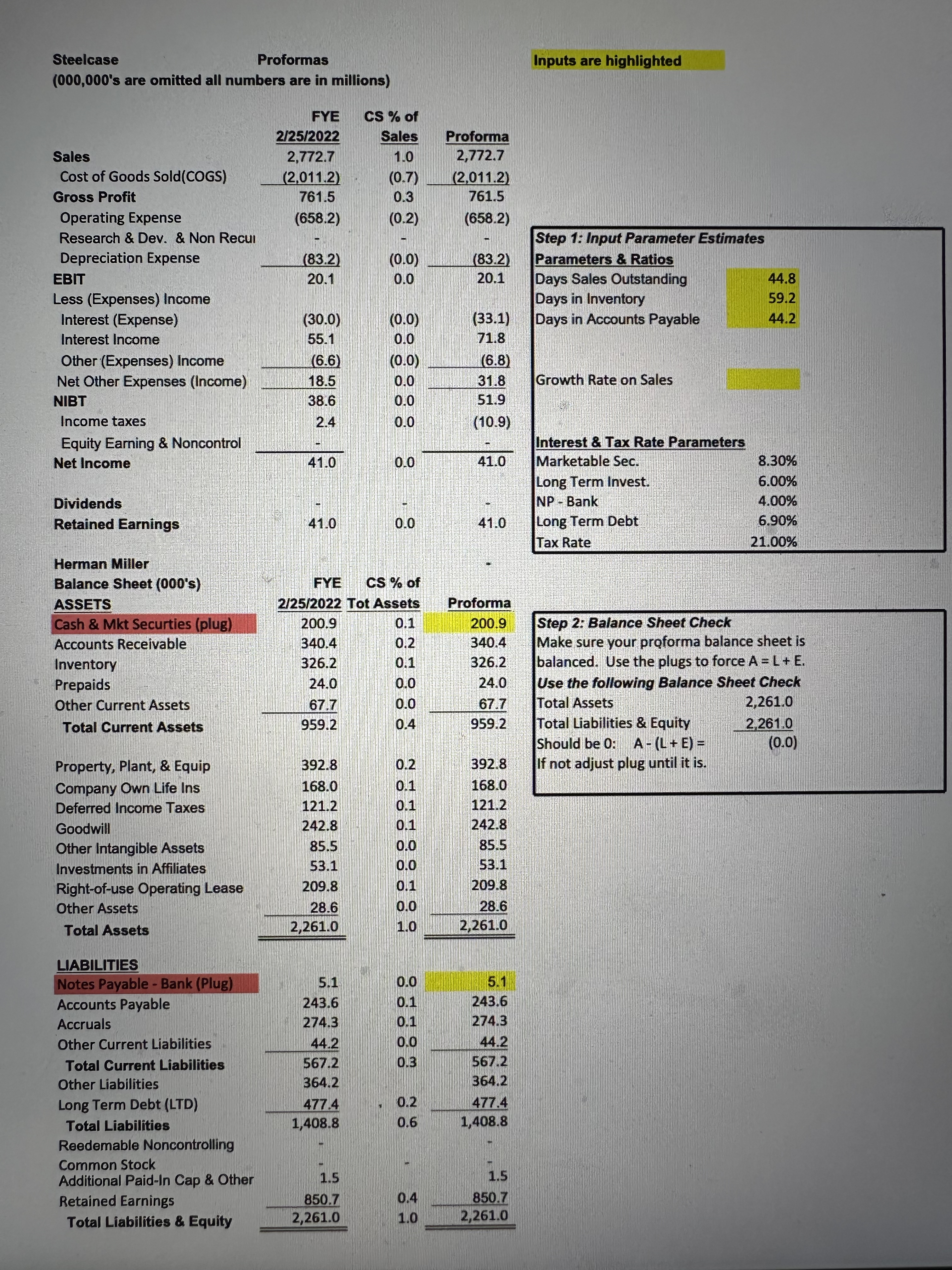

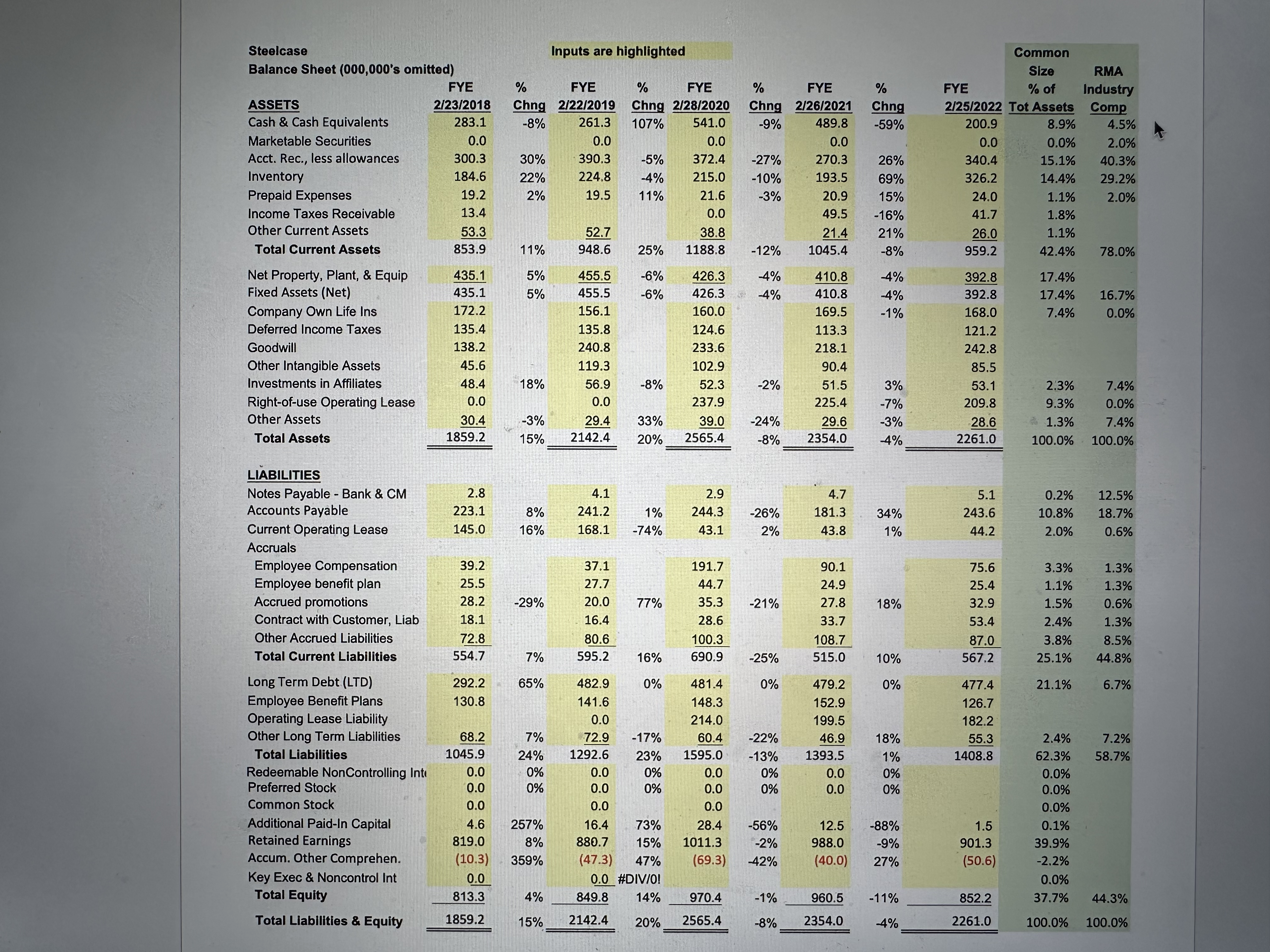

Steelcase Proformas (000,000's are omitted all numbers are in millions) Inputs are highlighted FYE CS % of 2/25/2022 Sales Proforma Sales 2,772.7 1.0 2,772.7 Cost of Goods Sold(COGS) (2,011.2) (0.7) (2,011.2) Gross Profit 761.5 0.3 761.5 Operating Expense (658.2) (0.2) (658.2) Research & Dev. & Non Recui Step 1: Input Parameter Estimates Depreciation Expense (83.2) (0.0) (83.2) Parameters & Ratios EBIT 20.1 0.0 20.1 Days Sales Outstanding 44.8 Less (Expenses) Income Days in Inventory 59.2 Interest (Expense) (30.0) (0.0) (33.1) Days in Accounts Payable 44.2 Interest Income 55.1 0.0 71.8 Other (Expenses) Income (6.6) (0.0) (6.8) Net Other Expenses (Income) 18.5 0.0 31.8 Growth Rate on Sales NIBT 38.6 0.0 51.9 Income taxes 2.4 0.0 (10.9) Equity Earning & Noncontrol Interest & Tax Rate Parameters Net Income 41.0 0.0 41.0 Marketable Sec. 8.30% Long Term Invest. 6.00% Dividends Retained Earnings Herman Miller NP - Bank 4.00% 41.0 0.0 41.0 Long Term Debt Tax Rate 6.90% 21.00% Balance Sheet (000's) ASSETS FYE CS % of 2/25/2022 Tot Assets Proforma Cash & Mkt Securties (plug) 200.9 0.1 200.9 Accounts Receivable 340.4 0.2 340.4 Inventory 326.2 0.1 326.2 Prepaids 24.0 0.0 24.0 Other Current Assets 67.7 0.0 67.7 Step 2: Balance Sheet Check Make sure your proforma balance sheet is balanced. Use the plugs to force A = L + E. Use the following Balance Sheet Check Total Assets 2,261.0 Total Current Assets 959.2 0.4 959.2 Total Liabilities & Equity 2,261.0 Should be 0: A-(L+E) = (0.0) Property, Plant, & Equip 392.8 0.2 392.8 If not adjust plug until it is. Company Own Life Ins 168.0 0.1 168.0 Deferred Income Taxes 121.2 0.1 121.2 Goodwill 242.8 0.1 242.8 Other Intangible Assets 85.5 0.0 85.5 Investments in Affiliates 53.1 0.0 53.1 Right-of-use Operating Lease 209.8 0.1 209.8 Other Assets 28.6 0.0 28.6 Total Assets 2,261.0 1.0 2,261.0 LIABILITIES Notes Payable - Bank (Plug) 5.1 0.0 5.1 Accounts Payable 243.6 0.1 243.6 Accruals 274.3 0.1 274.3 Other Current Liabilities 44.2 0.0 44.2 Total Current Liabilities 567.2 0.3 567.2 Other Liabilities 364.2 364.2 Long Term Debt (LTD) 477.4 0.2 477.4 Total Liabilities 1,408.8 0.6 1,408.8 Reedemable Noncontrolling Common Stock Additional Paid-In Cap & Other 1.5 1.5 Retained Earnings 850.7 0.4 850.7 Total Liabilities & Equity 2,261.0 1.0 2,261.0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started