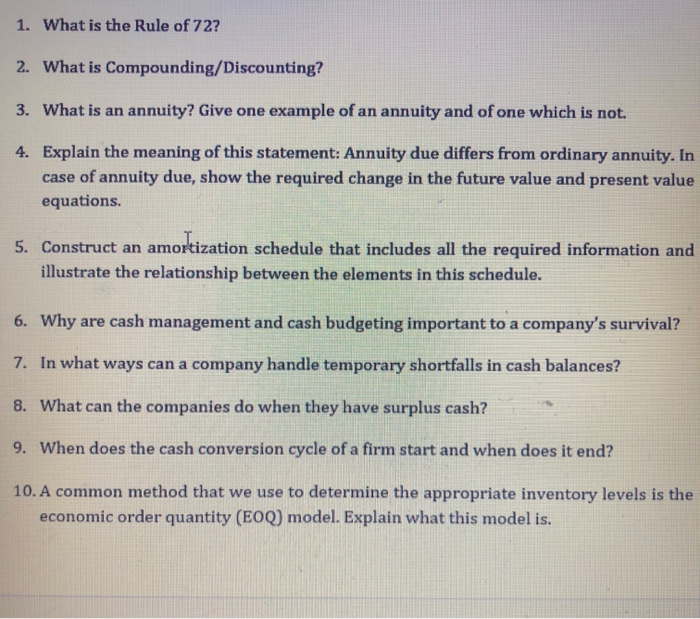

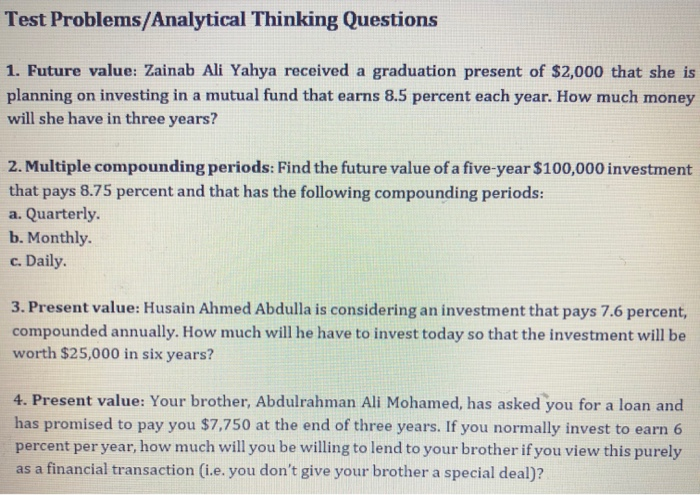

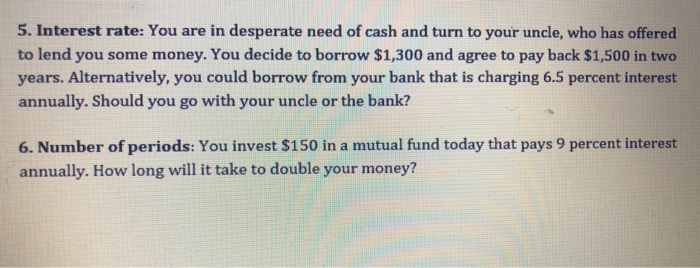

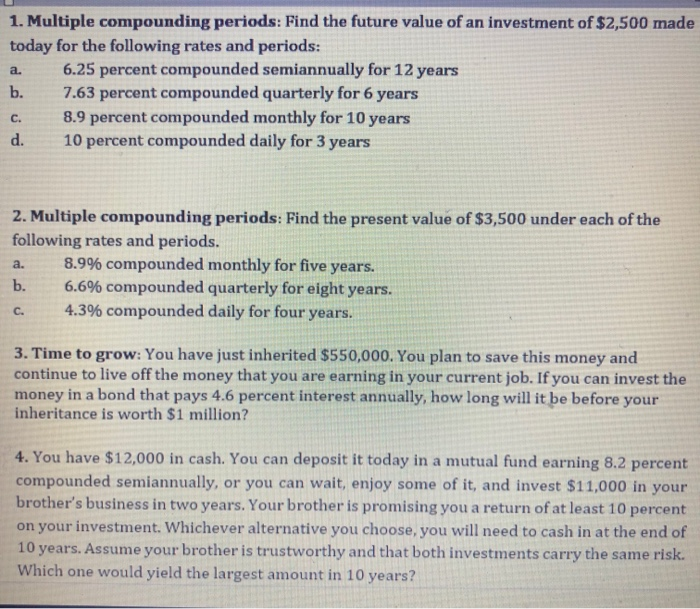

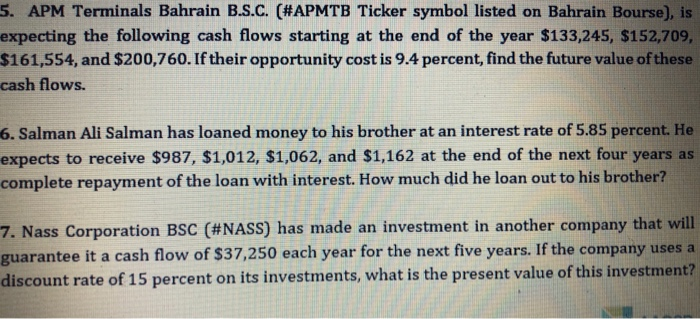

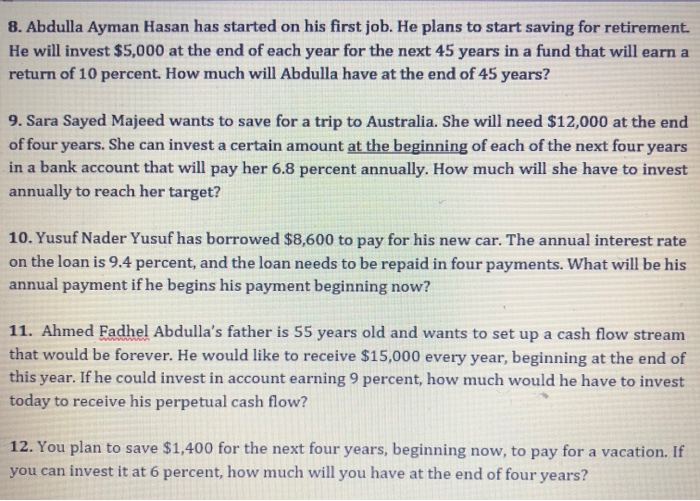

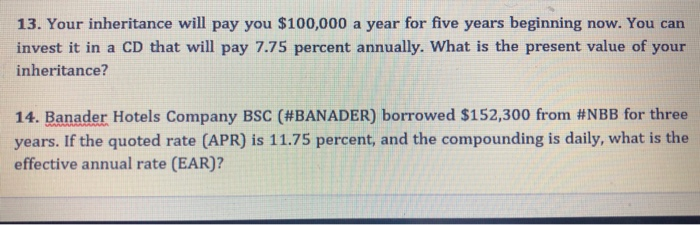

1. What is the Rule of 72? 2. What is Compounding/Discounting? 3. What is an annuity? Give one example of an annuity and of one which is not. 4. Explain the meaning of this statement: Annuity due differs from ordinary annuity. In case of annuity due, show the required change in the future value and present value equations. 5. Construct an amortization schedule that includes all the required information and illustrate the relationship between the elements in this schedule. 6. Why are cash management and cash budgeting important to a company's survival? 7. In what ways can a company handle temporary shortfalls in cash balances? 8. What can the companies do when they have surplus cash? 9. When does the cash conversion cycle of a firm start and when does it end? 10. A common method that we use to determine the appropriate inventory levels is the economic order quantity (E0Q) model. Explain what this model is. Test Problems/Analytical Thinking Questions 1. Future value: Zainab Ali Yahya received a graduation present of $2,000 that she is planning on investing in a mutual fund that earns 8.5 percent each year. How much money will she have in three years? 2. Multiple compounding periods: Find the future value of a five-year $100,000 investment that pays 8.75 percent and that has the following compounding periods: a. Quarterly. b. Monthly. c. Daily. 3. Present value: Husain Ahmed Abdulla is considering an investment that pays 7.6 percent, compounded annually. How much will he have to invest today so that the investment will be worth $25,000 in six years? 4. Present value: Your brother, Abdulrahman Ali Mohamed, has asked you for a loan and has promised to pay you $7,750 at the end of three years. If you normally invest to earn 6 percent per year, how much will you be willing to lend to your brother if you view this purely as a financial transaction (i.e. you don't give your brother a special deal)? 5. Interest rate: You are in desperate need of cash and turn to your uncle, who has offered to lend you some money. You decide to borrow $1,300 and agree to pay back $1,500 in two years. Alternatively, you could borrow from your bank that is charging 6.5 percent interest annually. Should you go with your uncle or the bank? 6. Number of periods: You invest $150 in a mutual fund today that pays 9 percent interest annually. How long will it take to double your money? a. 1. Multiple compounding periods: Find the future value of an investment of $2,500 made today for the following rates and periods: 6.25 percent compounded semiannually for 12 years b. 7.63 percent compounded quarterly for 6 years 8.9 percent compounded monthly for 10 years d. 10 percent compounded daily for 3 years C. 2. Multiple compounding periods: Find the present value of $3,500 under each of the following rates and periods. 8.9% compounded monthly for five years. b. 6.6% compounded quarterly for eight years. 4.3% compounded daily for four years. a. C. 3. Time to grow: You have just inherited $550,000. You plan to save this money and continue to live off the money that you are earning in your current job. If you can invest the money in a bond that pays 4.6 percent interest annually, how long will it be before your inheritance is worth $1 million? 4. You have $12,000 in cash. You can deposit it today in a mutual fund earning 8.2 percent compounded semiannually, or you can wait, enjoy some of it, and invest $11,000 in your brother's business in two years. Your brother is promising you a return of at least 10 percent on your investment. Whichever alternative you choose, you will need to cash in at the end of 10 years. Assume your brother is trustworthy and that both investments carry the same risk. Which one would yield the largest amount in 10 years? 5. APM Terminals Bahrain B.S.C. (#APMTB Ticker symbol listed on Bahrain Bourse), is expecting the following cash flows starting at the end of the year $133,245, $152,709, $161,554, and $200,760. If their opportunity cost is 9.4 percent, find the future value of these cash flows. 6. Salman Ali Salman has loaned money to his brother at an interest rate of 5.85 percent. He expects to receive $987, $1,012, $1,062, and $1,162 at the end of the next four years as complete repayment of the loan with interest. How much did he loan out to his brother? 7. Nass Corporation BSC (#NASS) has made an investment in another company that will guarantee it a cash flow of $37,250 each year for the next five years. If the company uses a discount rate of 15 percent on its investments, what is the present value of this investment? 8. Abdulla Ayman Hasan has started on his first job. He plans to start saving for retirement. He will invest $5,000 at the end of each year for the next 45 years in a fund that will earn a return of 10 percent. How much will Abdulla have at the end of 45 years? 9. Sara Sayed Majeed wants to save for a trip to Australia. She will need $12,000 at the end of four years. She can invest a certain amount at the beginning of each of the next four years in a bank account that will pay her 6.8 percent annually. How much will she have to invest annually to reach her target? 10. Yusuf Nader Yusuf has borrowed $8,600 to pay for his new car. The annual interest rate on the loan is 9.4 percent, and the loan needs to be repaid in four payments. What will be his annual payment if he begins his payment beginning now? 11. Ahmed Fadhel Abdulla's father is 55 years old and wants to set up a cash flow stream that would be forever. He would like to receive $15,000 every year, beginning at the end of this year. If he could invest in account earning 9 percent, how much would he have to invest today to receive his perpetual cash flow? 12. You plan to save $1,400 for the next four years, beginning now, to pay for a vacation. If you can invest it at 6 percent, how much will you have at the end of four years? 13. Your inheritance will pay you $100,000 a year for five years beginning now. You can invest it in a CD that will pay 7.75 percent annually. What is the present value of your inheritance? 14. Banader Hotels Company BSC (#BANADER) borrowed $152,300 from #NBB for three years. If the quoted rate (APR) is 11.75 percent, and the compounding is daily, what is the effective annual rate (EAR)? 1. What is the Rule of 72? 2. What is Compounding/Discounting? 3. What is an annuity? Give one example of an annuity and of one which is not. 4. Explain the meaning of this statement: Annuity due differs from ordinary annuity. In case of annuity due, show the required change in the future value and present value equations. 5. Construct an amortization schedule that includes all the required information and illustrate the relationship between the elements in this schedule. 6. Why are cash management and cash budgeting important to a company's survival? 7. In what ways can a company handle temporary shortfalls in cash balances? 8. What can the companies do when they have surplus cash? 9. When does the cash conversion cycle of a firm start and when does it end? 10. A common method that we use to determine the appropriate inventory levels is the economic order quantity (E0Q) model. Explain what this model is. Test Problems/Analytical Thinking Questions 1. Future value: Zainab Ali Yahya received a graduation present of $2,000 that she is planning on investing in a mutual fund that earns 8.5 percent each year. How much money will she have in three years? 2. Multiple compounding periods: Find the future value of a five-year $100,000 investment that pays 8.75 percent and that has the following compounding periods: a. Quarterly. b. Monthly. c. Daily. 3. Present value: Husain Ahmed Abdulla is considering an investment that pays 7.6 percent, compounded annually. How much will he have to invest today so that the investment will be worth $25,000 in six years? 4. Present value: Your brother, Abdulrahman Ali Mohamed, has asked you for a loan and has promised to pay you $7,750 at the end of three years. If you normally invest to earn 6 percent per year, how much will you be willing to lend to your brother if you view this purely as a financial transaction (i.e. you don't give your brother a special deal)? 5. Interest rate: You are in desperate need of cash and turn to your uncle, who has offered to lend you some money. You decide to borrow $1,300 and agree to pay back $1,500 in two years. Alternatively, you could borrow from your bank that is charging 6.5 percent interest annually. Should you go with your uncle or the bank? 6. Number of periods: You invest $150 in a mutual fund today that pays 9 percent interest annually. How long will it take to double your money? a. 1. Multiple compounding periods: Find the future value of an investment of $2,500 made today for the following rates and periods: 6.25 percent compounded semiannually for 12 years b. 7.63 percent compounded quarterly for 6 years 8.9 percent compounded monthly for 10 years d. 10 percent compounded daily for 3 years C. 2. Multiple compounding periods: Find the present value of $3,500 under each of the following rates and periods. 8.9% compounded monthly for five years. b. 6.6% compounded quarterly for eight years. 4.3% compounded daily for four years. a. C. 3. Time to grow: You have just inherited $550,000. You plan to save this money and continue to live off the money that you are earning in your current job. If you can invest the money in a bond that pays 4.6 percent interest annually, how long will it be before your inheritance is worth $1 million? 4. You have $12,000 in cash. You can deposit it today in a mutual fund earning 8.2 percent compounded semiannually, or you can wait, enjoy some of it, and invest $11,000 in your brother's business in two years. Your brother is promising you a return of at least 10 percent on your investment. Whichever alternative you choose, you will need to cash in at the end of 10 years. Assume your brother is trustworthy and that both investments carry the same risk. Which one would yield the largest amount in 10 years? 5. APM Terminals Bahrain B.S.C. (#APMTB Ticker symbol listed on Bahrain Bourse), is expecting the following cash flows starting at the end of the year $133,245, $152,709, $161,554, and $200,760. If their opportunity cost is 9.4 percent, find the future value of these cash flows. 6. Salman Ali Salman has loaned money to his brother at an interest rate of 5.85 percent. He expects to receive $987, $1,012, $1,062, and $1,162 at the end of the next four years as complete repayment of the loan with interest. How much did he loan out to his brother? 7. Nass Corporation BSC (#NASS) has made an investment in another company that will guarantee it a cash flow of $37,250 each year for the next five years. If the company uses a discount rate of 15 percent on its investments, what is the present value of this investment? 8. Abdulla Ayman Hasan has started on his first job. He plans to start saving for retirement. He will invest $5,000 at the end of each year for the next 45 years in a fund that will earn a return of 10 percent. How much will Abdulla have at the end of 45 years? 9. Sara Sayed Majeed wants to save for a trip to Australia. She will need $12,000 at the end of four years. She can invest a certain amount at the beginning of each of the next four years in a bank account that will pay her 6.8 percent annually. How much will she have to invest annually to reach her target? 10. Yusuf Nader Yusuf has borrowed $8,600 to pay for his new car. The annual interest rate on the loan is 9.4 percent, and the loan needs to be repaid in four payments. What will be his annual payment if he begins his payment beginning now? 11. Ahmed Fadhel Abdulla's father is 55 years old and wants to set up a cash flow stream that would be forever. He would like to receive $15,000 every year, beginning at the end of this year. If he could invest in account earning 9 percent, how much would he have to invest today to receive his perpetual cash flow? 12. You plan to save $1,400 for the next four years, beginning now, to pay for a vacation. If you can invest it at 6 percent, how much will you have at the end of four years? 13. Your inheritance will pay you $100,000 a year for five years beginning now. You can invest it in a CD that will pay 7.75 percent annually. What is the present value of your inheritance? 14. Banader Hotels Company BSC (#BANADER) borrowed $152,300 from #NBB for three years. If the quoted rate (APR) is 11.75 percent, and the compounding is daily, what is the effective annual rate (EAR)