Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. What is the total contributed capital as of December 31, 2019? 2. What is the total current liabilities to be reported in the 2019

1. What is the total contributed capital as of December 31, 2019?

2. What is the total current liabilities to be reported in the 2019 statement of financial position?

3. How much from the 12% notes payable shall be presented as current liability?

4. How much from the 10% notes payable shall be presents as noncurrent liability?

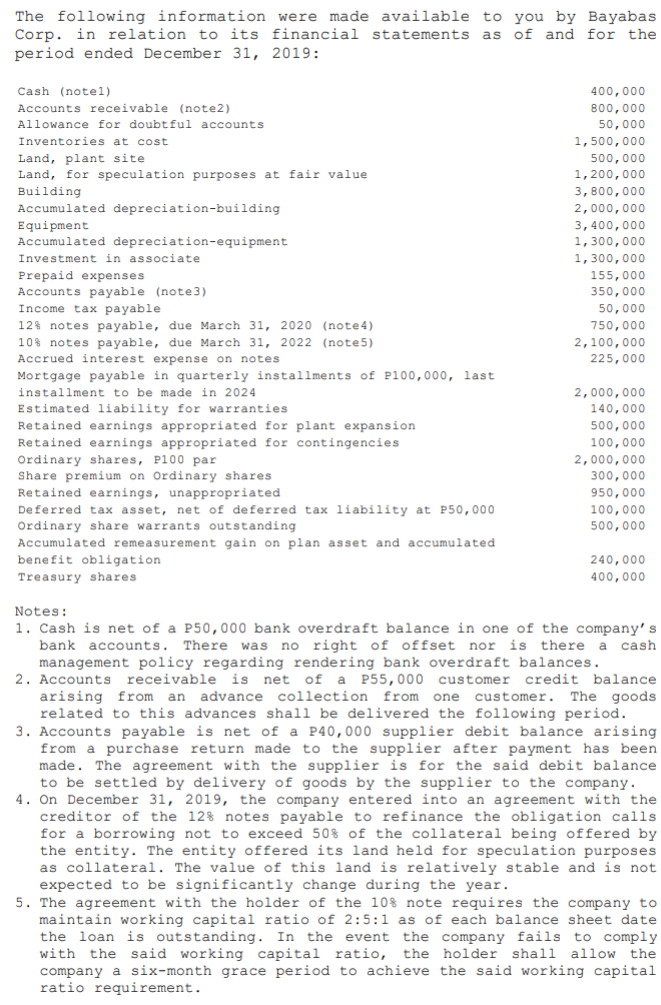

The following information were made available to you by Bayabas Corp. in relation to its financial statements as of and for the period ended December 31, 2019: Cash (notel) Accounts receivable (note2) Allowance for doubtful accounts Inventories at cost Land, plant site Land, for speculation purposes at fair value Building Accumulated depreciation-building Equipment Accumulated depreciation-equipment Investment in associate Prepaid expenses Accounts payable (note 3) Income tax payable 12% notes payable, due March 31, 2020 (note4) 10% notes payable, due March 31, 2022 (note5) Accrued interest expense on notes Mortgage payable in quarterly installments of P100,000, last installment to be made in 2024 Estimated liability for warranties Retained earnings appropriated for plant expansion Retained earnings appropriated for contingencies Ordinary shares, P100 par Share premium on Ordinary shares Retained earnings, unappropriated Deferred tax asset, net of deferred tax liability at P50,000 Ordinary share warrants outstanding Accumulated remeasurement gain on plan asset and accumulated benefit obligation Treasury shares. 400,000 800,000 50,000 1,500,000 500,000 1,200,000 3,800,000 2,000,000 3,400,000 1,300,000 1,300,000 155,000 350,000 50,000 750,000 2,100,000 225,000 2,000,000 140,000 500,000 100,000 2,000,000 300,000 950,000 100,000 500,000 240,000 400,000 Notes: 1. Cash is net of a P50,000 bank overdraft balance in one of the company's bank accounts. There was no right of offset nor is there a cash management policy regarding rendering bank overdraft balances. 2. Accounts receivable is net of a P55,000 customer credit balance. arising from an advance collection from one customer. The goods related to this advances shall be delivered the following period. 3. Accounts payable is net of a P40,000 supplier debit balance arising from a purchase return made to the supplier after payment has been made. The agreement with the supplier is for the said debit balance. to be settled by delivery of goods by the supplier to the company. 4. On December 31, 2019, the company entered into an agreement with the creditor of the 12% notes payable to refinance the obligation calls. for a borrowing not to exceed 50% of the collateral being offered by the entity. The entity offered its land held for speculation purposes as collateral. The value of this land is relatively stable and is not expected to be significantly change during the year. 5. The agreement with the holder of the 10% note requires the company to maintain working capital ratio of 2:5:1 as of each balance sheet date the loan is outstanding. In the event the company fails to comply with the said working capital ratio, the holder shall allow the company a six-month grace period to achieve the said working capital ratio requirement. The following information were made available to you by Bayabas Corp. in relation to its financial statements as of and for the period ended December 31, 2019: Cash (notel) Accounts receivable (note2) Allowance for doubtful accounts Inventories at cost Land, plant site Land, for speculation purposes at fair value Building Accumulated depreciation-building Equipment Accumulated depreciation-equipment Investment in associate Prepaid expenses Accounts payable (note 3) Income tax payable 12% notes payable, due March 31, 2020 (note4) 10% notes payable, due March 31, 2022 (note5) Accrued interest expense on notes Mortgage payable in quarterly installments of P100,000, last installment to be made in 2024 Estimated liability for warranties Retained earnings appropriated for plant expansion Retained earnings appropriated for contingencies Ordinary shares, P100 par Share premium on Ordinary shares Retained earnings, unappropriated Deferred tax asset, net of deferred tax liability at P50,000 Ordinary share warrants outstanding Accumulated remeasurement gain on plan asset and accumulated benefit obligation Treasury shares. 400,000 800,000 50,000 1,500,000 500,000 1,200,000 3,800,000 2,000,000 3,400,000 1,300,000 1,300,000 155,000 350,000 50,000 750,000 2,100,000 225,000 2,000,000 140,000 500,000 100,000 2,000,000 300,000 950,000 100,000 500,000 240,000 400,000 Notes: 1. Cash is net of a P50,000 bank overdraft balance in one of the company's bank accounts. There was no right of offset nor is there a cash management policy regarding rendering bank overdraft balances. 2. Accounts receivable is net of a P55,000 customer credit balance. arising from an advance collection from one customer. The goods related to this advances shall be delivered the following period. 3. Accounts payable is net of a P40,000 supplier debit balance arising from a purchase return made to the supplier after payment has been made. The agreement with the supplier is for the said debit balance. to be settled by delivery of goods by the supplier to the company. 4. On December 31, 2019, the company entered into an agreement with the creditor of the 12% notes payable to refinance the obligation calls. for a borrowing not to exceed 50% of the collateral being offered by the entity. The entity offered its land held for speculation purposes as collateral. The value of this land is relatively stable and is not expected to be significantly change during the year. 5. The agreement with the holder of the 10% note requires the company to maintain working capital ratio of 2:5:1 as of each balance sheet date the loan is outstanding. In the event the company fails to comply with the said working capital ratio, the holder shall allow the company a six-month grace period to achieve the said working capital ratio requirementStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started