Answered step by step

Verified Expert Solution

Question

1 Approved Answer

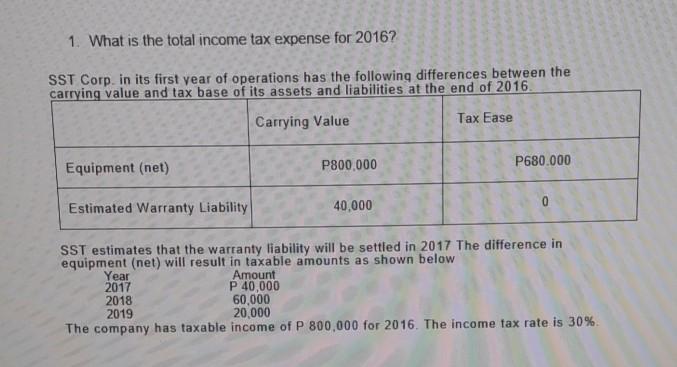

1. What is the total income tax expense for 2016? SST Corp. in its first year of operations has the following differences between the carrying

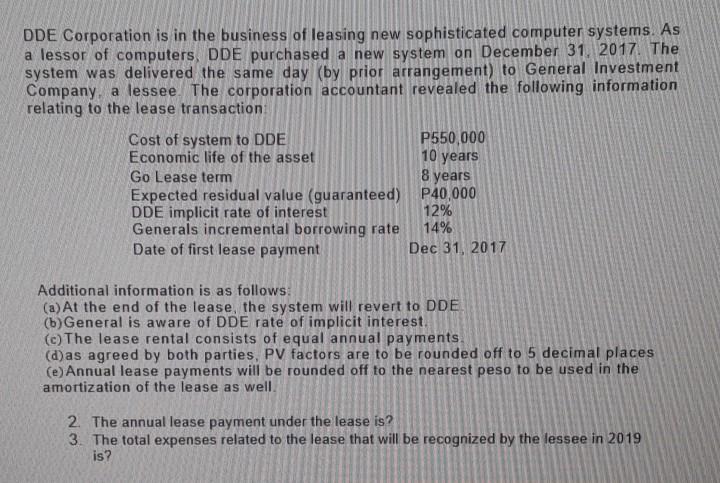

1. What is the total income tax expense for 2016? SST Corp. in its first year of operations has the following differences between the carrying value and tax base of its assets and liabilities at the end of 2016 Carrying Value Tax Ease P800,000 P680.000 Equipment (net) 40.000 0 Estimated Warranty Liability SST estimates that the warranty liability will be settled in 2017 The difference in equipment (net) will result in taxable amounts as shown below Year Amount 2017 P 40,000 2018 60,000 2019 20.000 The company has taxable income of P 800,000 for 2016. The income tax rate is 30% DDE Corporation is in the business of leasing new sophisticated computer systems. As a lessor of computers, DDE purchased a new system on December 31, 2017 The system was delivered the same day (by prior arrangement) to General Investment Company, a lessee. The corporation accountant revealed the following information relating to the lease transaction Cost of system to DDE P550,000 Economic life of the asset 10 years Go Lease term 8 years Expected residual value (guaranteed) P40,000 DDE implicit rate of interest 12% Generals incremental borrowing rate 14% Date of first lease payment Dec 31, 2017 Additional information is as follows: (a) At the end of the lease, the system will revert to DDE (b) General is aware of DDE rate of implicit interest (c) The lease rental consists of equal annual payments (d) as agreed by both parties, PV factors are to be rounded off to 5 decimal places (e) Annual lease payments will be rounded off to the nearest peso to be used in the amortization of the lease as well. 2. The annual lease payment under the lease is? 3. The total expenses related to the lease that will be recognized by the lessee in 2019 is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started