Question

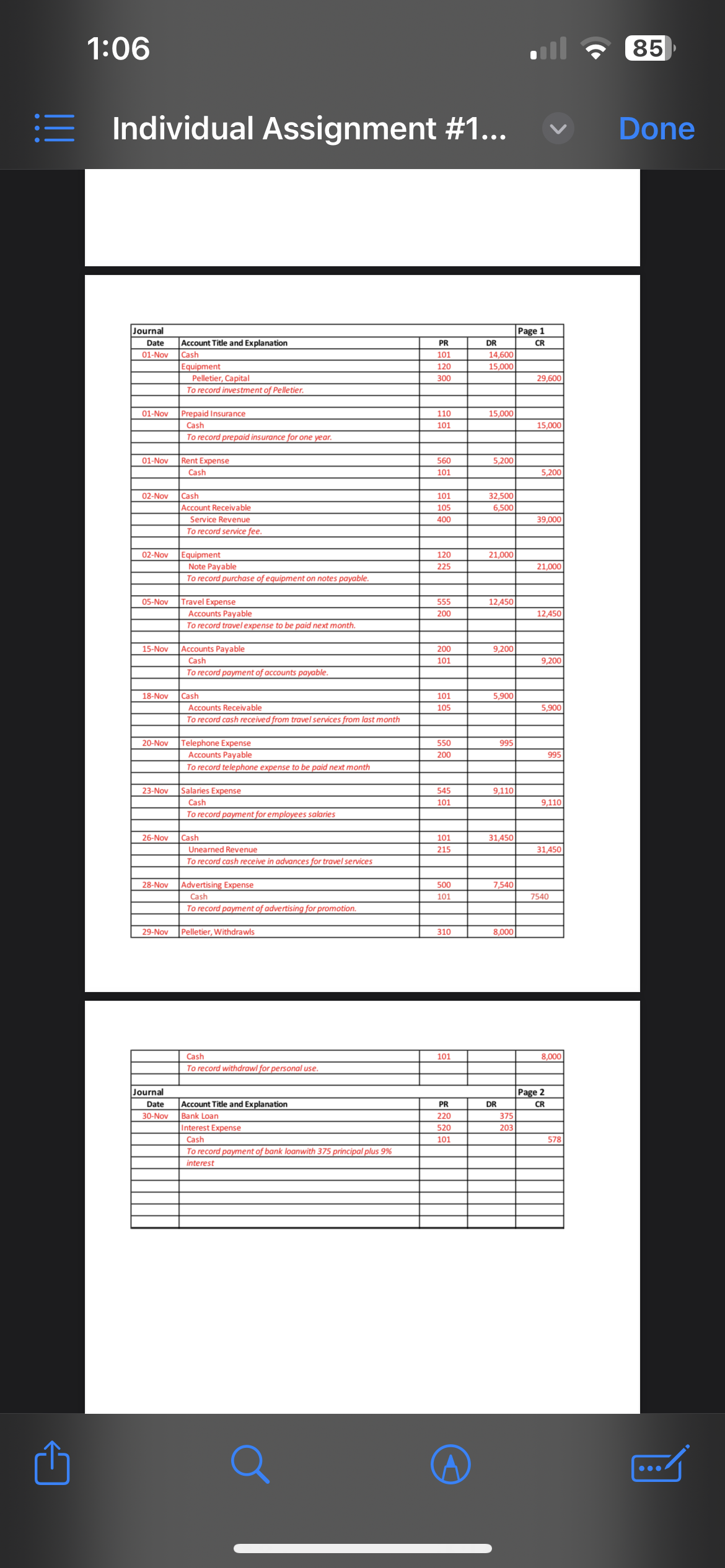

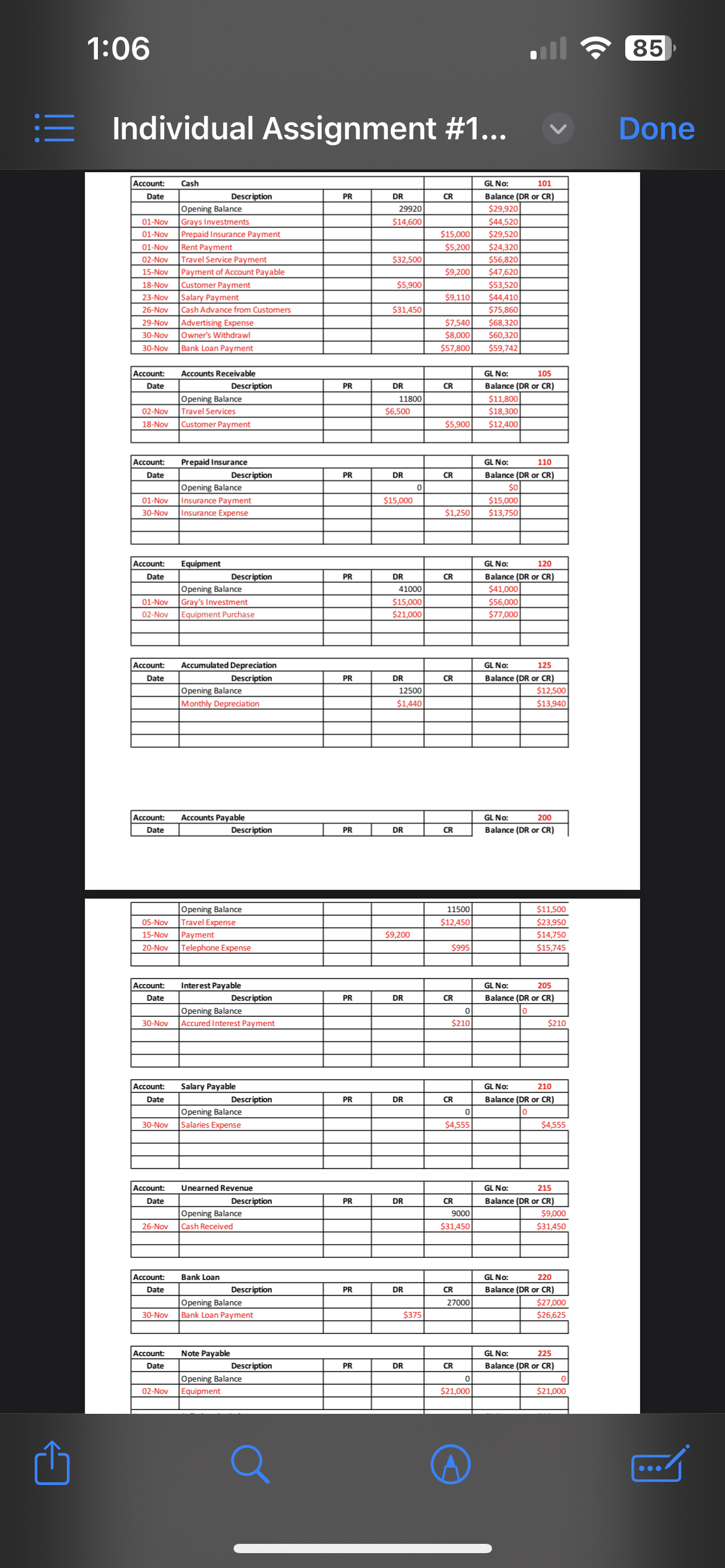

1. what should be debited for the Nov 15th transaction? 2. How much would the undadjusted trial balance be out by if the debit entry

1. what should be debited for the Nov 15th transaction?

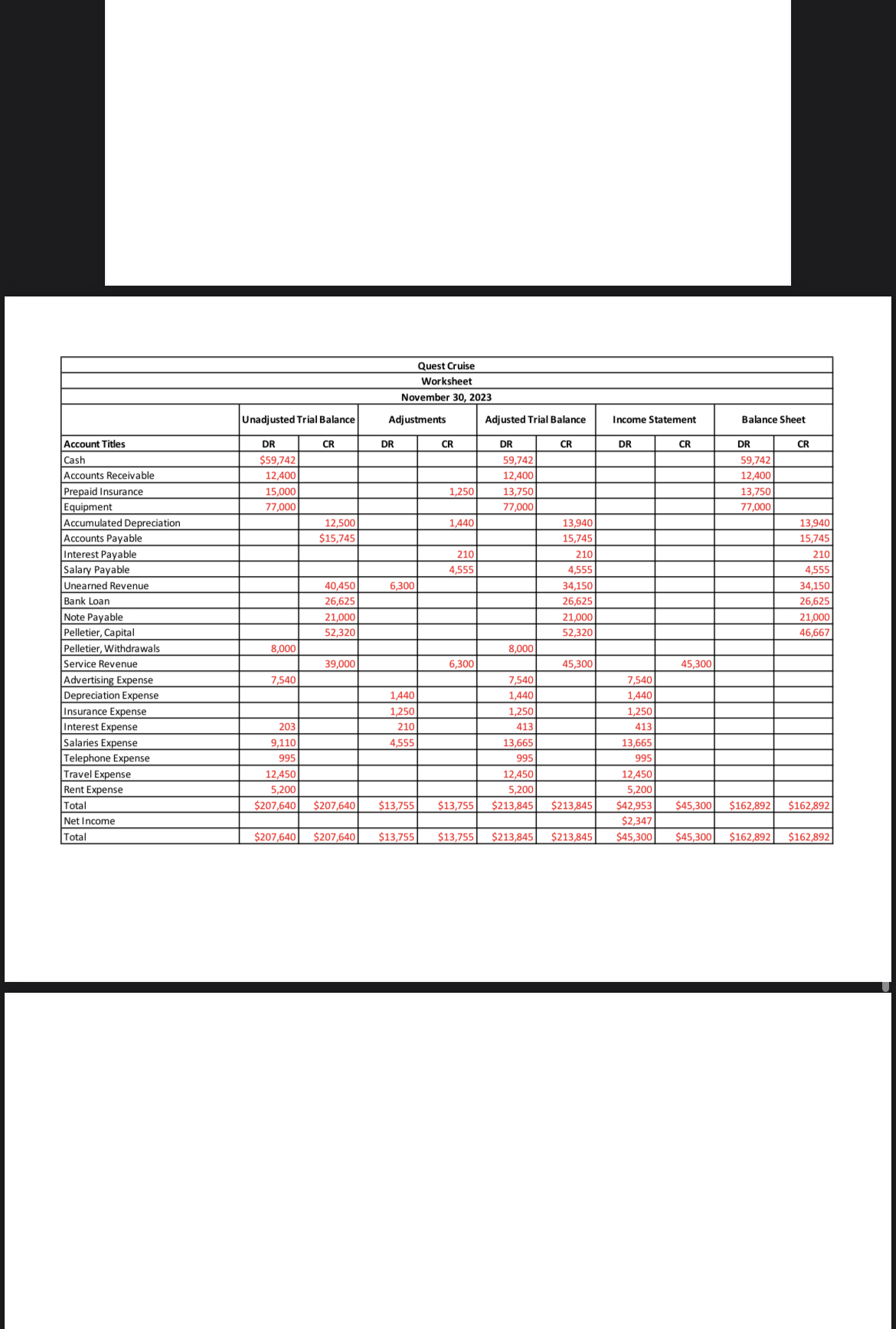

2. How much would the undadjusted trial balance be out by if the debit entry from the Nov. 2 entry was posted in error as $12,000?

3. What type of account, Asset, Liability, Owner's Equity, Revenue or Expense, is involved when an expense is paid but not yet incurred?

4. Quest Cruise received cash on Nov. 26 for travel services taking place in December. What account was credited for this transaction?

5. As of Nov 5th, after transactions were posted on that day, what would be the balance of Accounts Payable? Be sure to indicate whether balance is a debit(DR) or credit(CR)

6. For the bank loan, as of Nov. 1, how many months will it take to pay off this balance?

7. Quest Cruise paid the bank loan on Nov. 30, indicate which accounts will be debited and credited in the journal entry to record the payment?

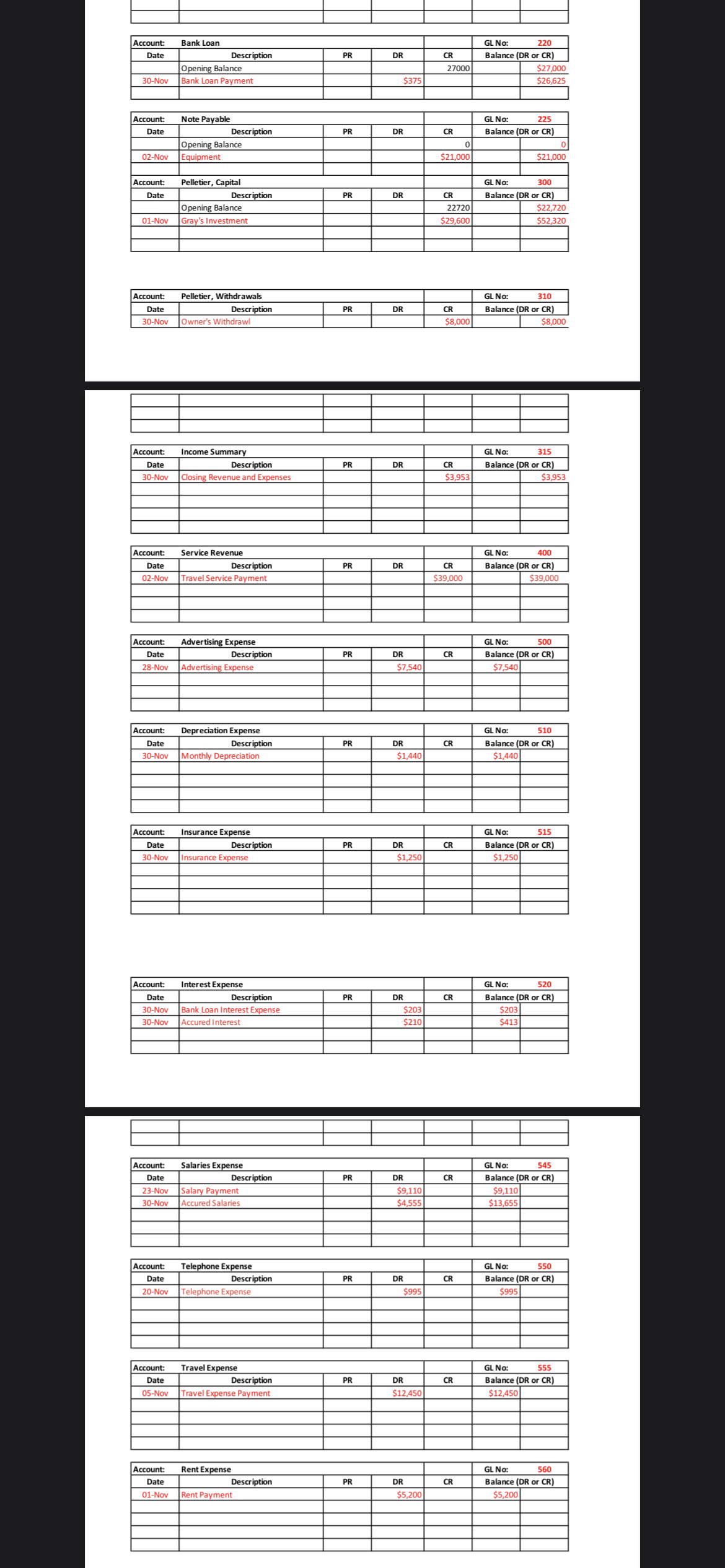

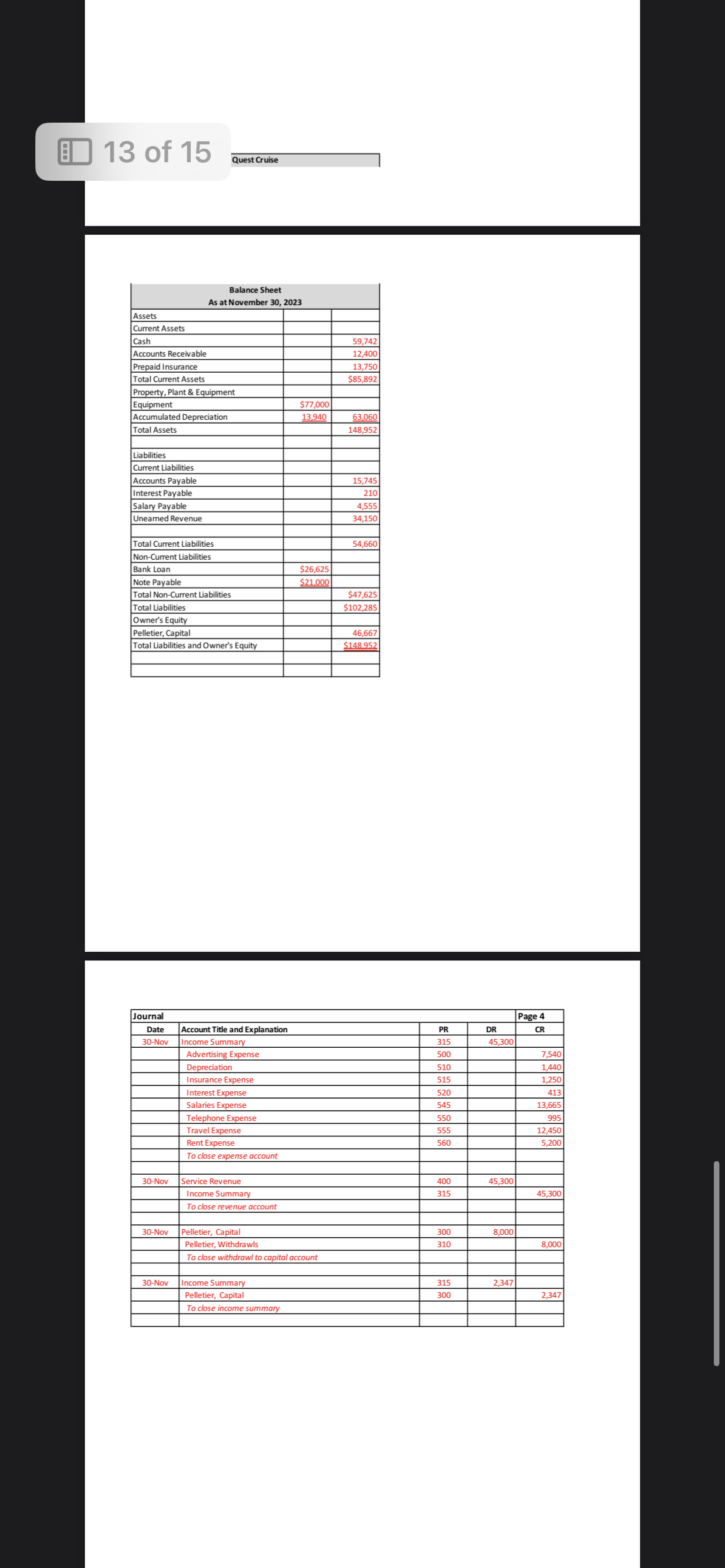

8. What is the ending balance of Pellitier, Capital on November 30, before the closing entries have been posted? State whether balance is a DR or CR.

9. When doing the closing entries for Quest Cruise, what account is used to close the Service Revenue Account?

10. In the cosing entries, what is the total of the debit entry amount to close the expense accounts?

11. What financial statement is prepared to summarize the changes that occurred to Bullet, Capital account from the beginning to the end of November?

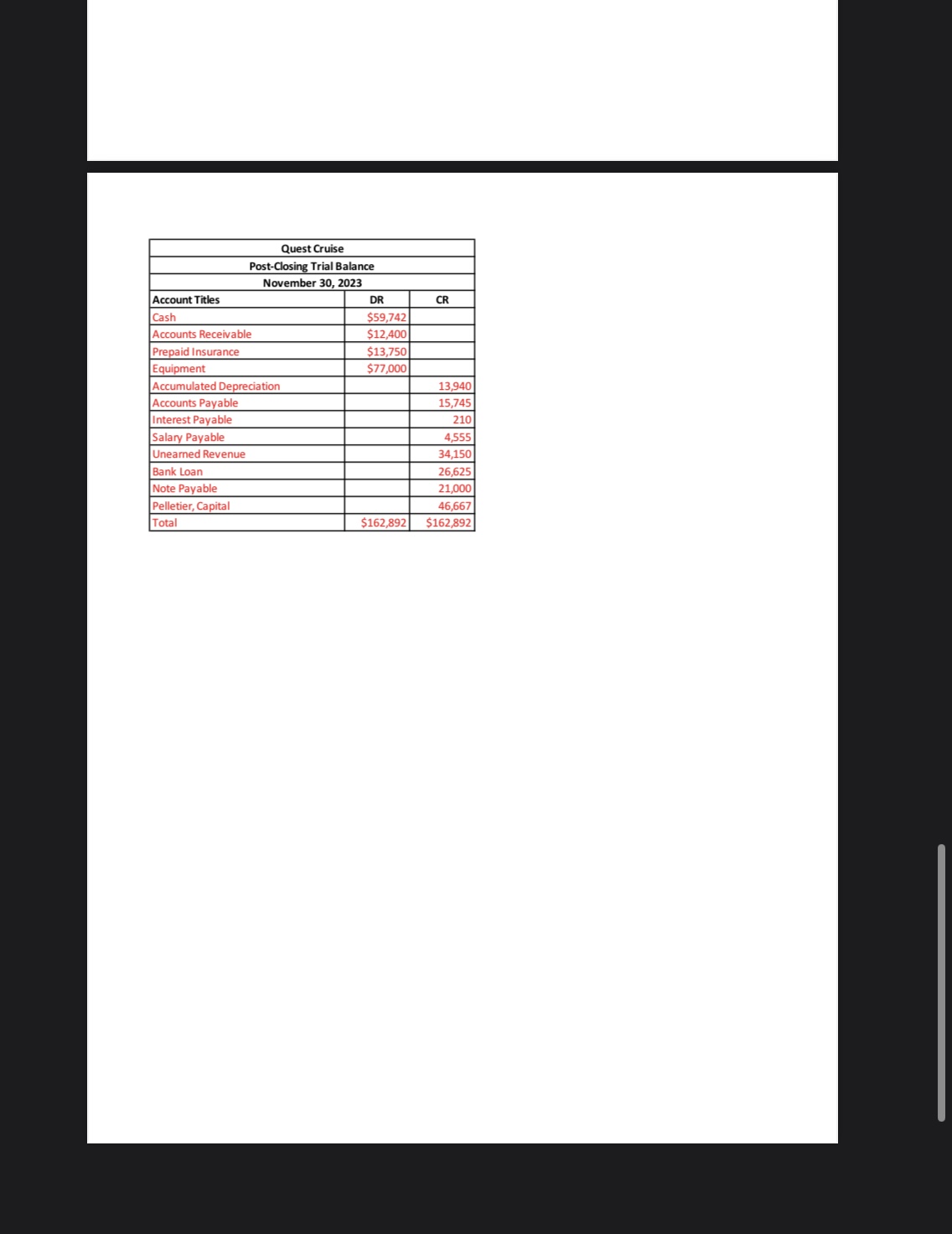

12. By how much would Net Income be understated if no adjustment is made to Unearned Revenue on November 30?

13. How much of the bank loan is being reported as non-current on Nov. 30, 2023? State whether amount is a DR or CR.

14. Based on the list of accounts given, what account is debited for the Nov. 29 transaction?

15. After the adjusting transactions are completed, how many more months of insurance will the prepaid insurance account now cover?

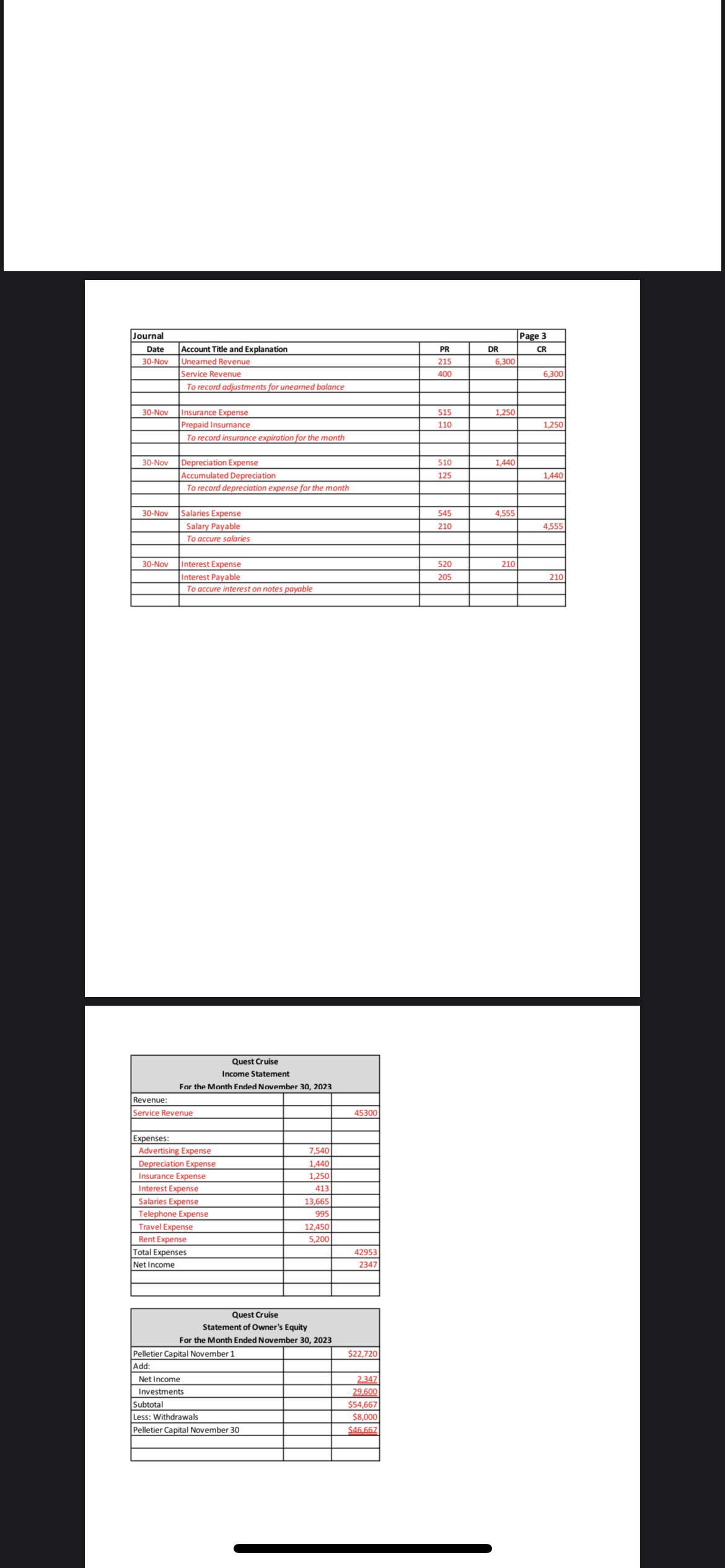

16. What was the total dollar amount of the adjustments recorded at the end of the month?

17. What would be the ending balance of the Accounts Receivable Account if the Nov. 18th entry had been recorded as a debit instead of a credit?

18. How many transactions were posted to the Cash account during the month? Note: Do not include the opening balance as a transaction

19. What would the balance of the Cash account be on Nov. 30 if the Nov. 18 transaction was not posted?

20. How much was recorded as accrued salaries at the end of November?

1:06 := Individual Assignment #1... Journal Account Title and Explanation Date 01-Nov Cash Equipment Page 1 PR DR CR 101 14.600 120 15,000 300 29,600 Pelletier, Capital To record investment of Pelletier. 01-Nov Prepaid Insurance 110 15,000 Cash 101 15,000 To record prepaid insurance for one year. 01-Nov Rent Expense 560 5,200 Cash 101 5,200 02-Nov Cash Account Receivable Service Revenue 101 32,500 105 6,500 400 39,000 To record service fee. 02-Nov Equipment 120 21,000 Note Payable 225 21,000 To record purchase of equipment on notes payable. 05-Nov Travel Expense 555 12,450 Accounts Payable 200 12,450 To record travel expense to be paid next month. 15-Nov Accounts Payable 200 9,200 Cash 101 9,200 To record payment of accounts payable. 18-Nov Cash 101 5,900 Accounts Receivable 105 5,900 To record cash received from travel services from last month 20-Nov Telephone Expense 550 995 Accounts Payable 200 995 To record telephone expense to be paid next month 23-Nov Salaries Expense Cash 545 9,110 101 9,110 To record payment for employees salaries 26-Nov Cash 101 31,450 Unearned Revenue 215 31,450 To record cash receive in advances for travel services 28-Nov Advertising Expense 500 7,540 Cash 101 7540 To record payment of advertising for promotion. 29-Nov Pelletier, Withdrawls 310 8,000 Cash 101 8,000 To record withdrawl for personal use. Journal Page 2 Date 30-Nov Account Title and Explanation PR DR CR Bank Loan 220 375 Interest Expense 520 203 Cash 101 578 To record payment of bank loanwith 375 principal plus 9% interest 1 A 85 Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started