Question

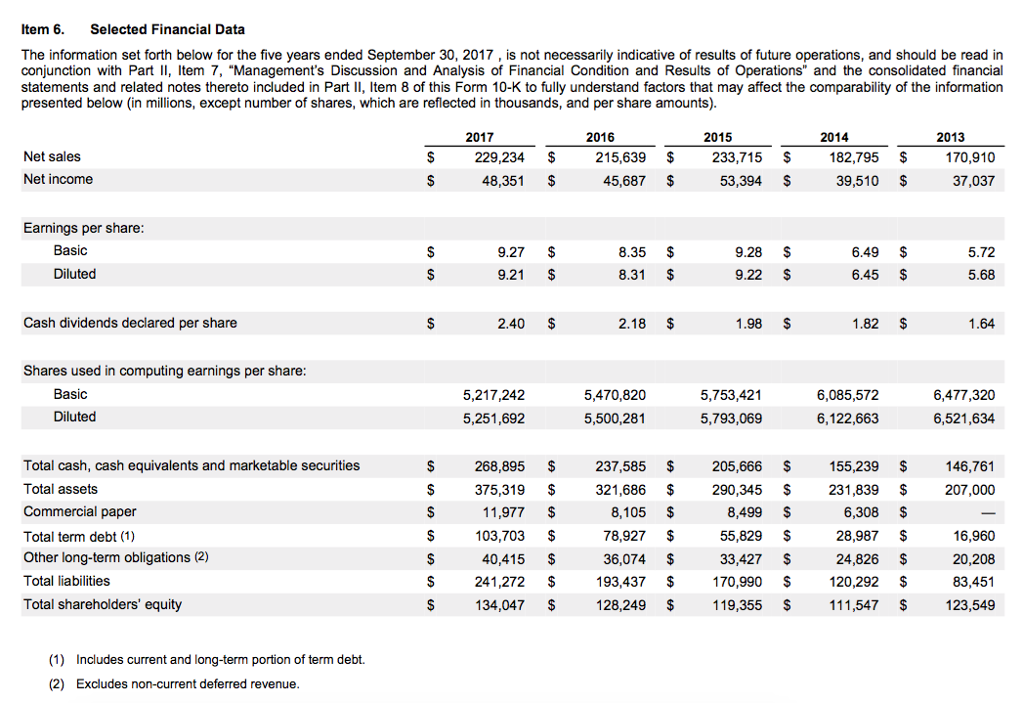

1. What title does Apple give to its income statements? 2. Perform a vertical analysis on Apples income statement for fiscal years 2017 and 2016.

1. What title does Apple give to its income statements? 2. Perform a vertical analysis on Apples income statement for fiscal years 2017 and 2016. That is, using Net Sales as the base, convert each amount shown on the 2017 and 2016 income statements to a percentage of net sales. You should carry your analysis down to the line item labeled Net income. (You do not need to perform the analysis for fiscal year 2015.)

3.Why would an investor want to perform a vertical analysis each year on a companys income statement?

4. Perform a horizontal analysis on the income statements to measure the changes (in terms of dollars and percentages) for each line item from fiscal year 2016 to fiscal year 2017. (You do not need to measure the changes from 2015 to 2016.)

5. Why would an investor want to perform horizontal analysis each year on a companys income statement?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started