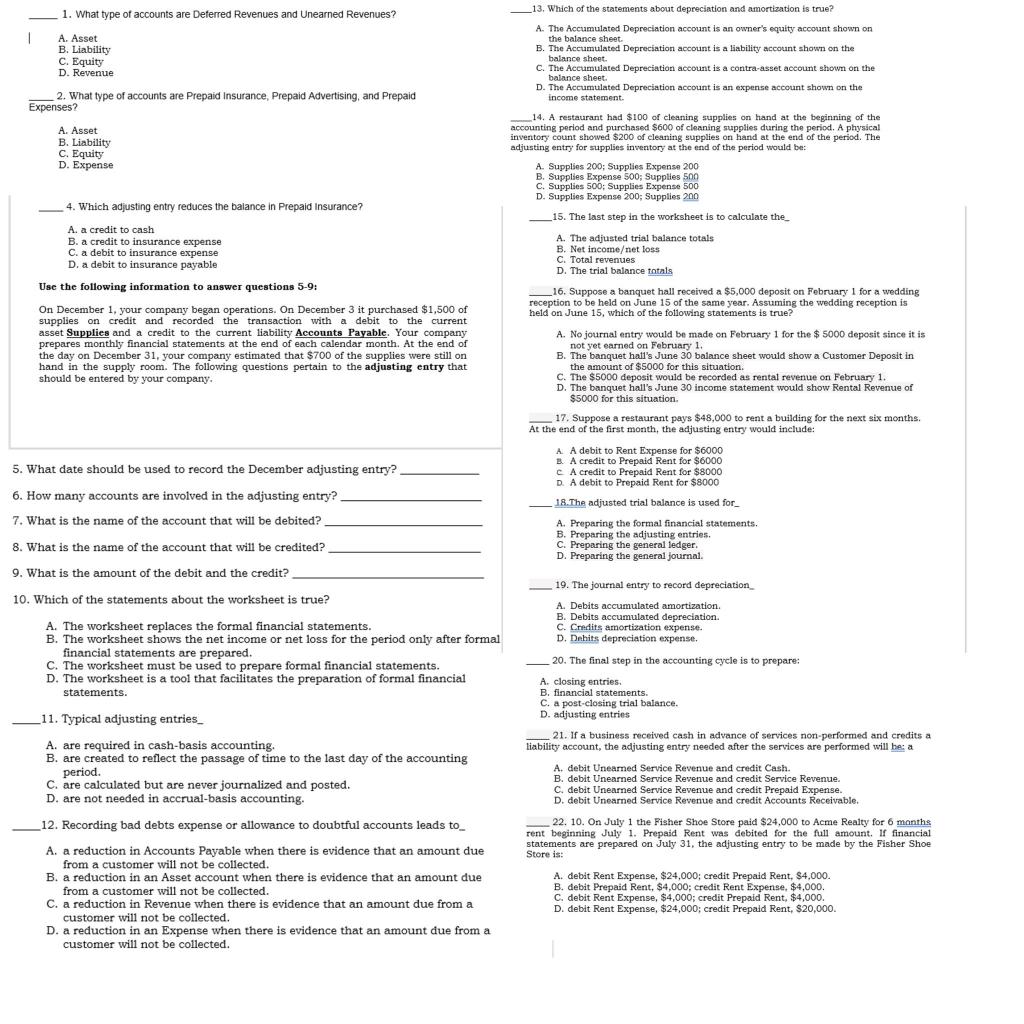

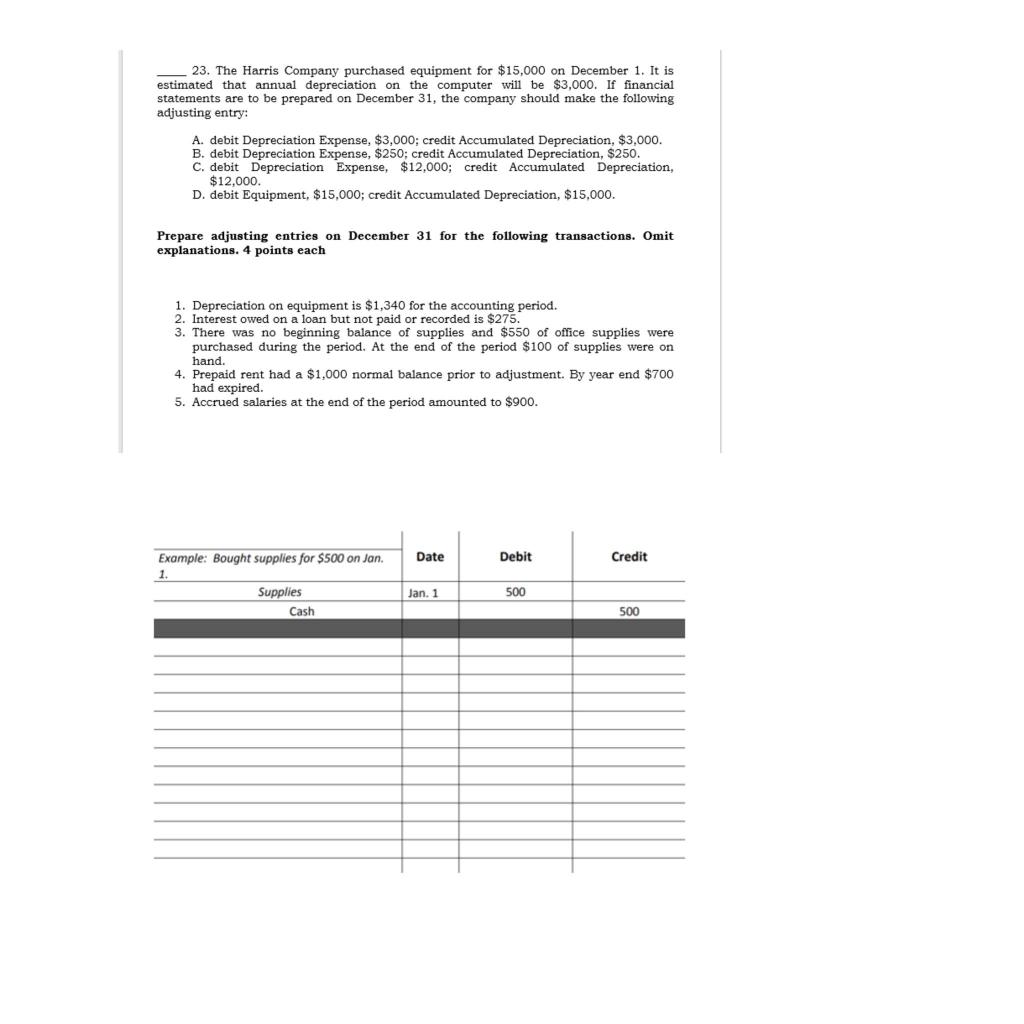

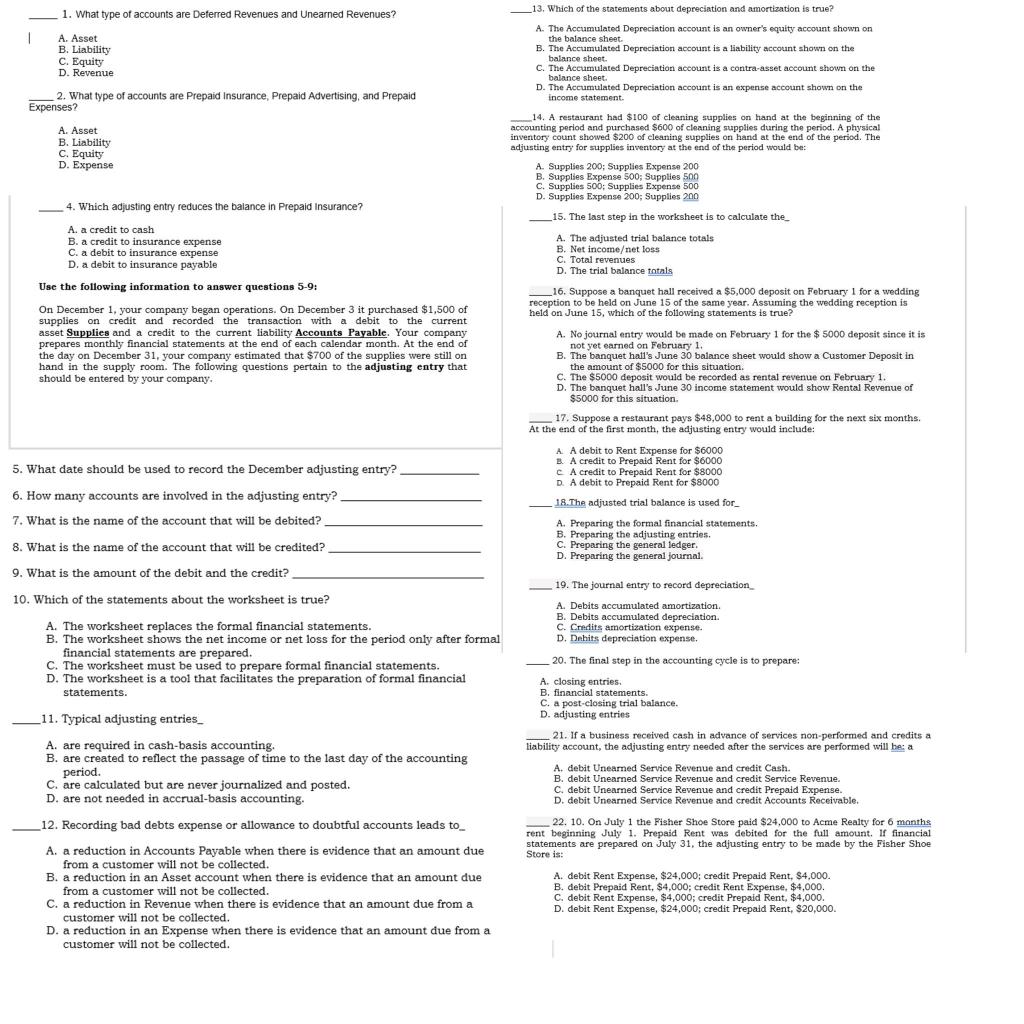

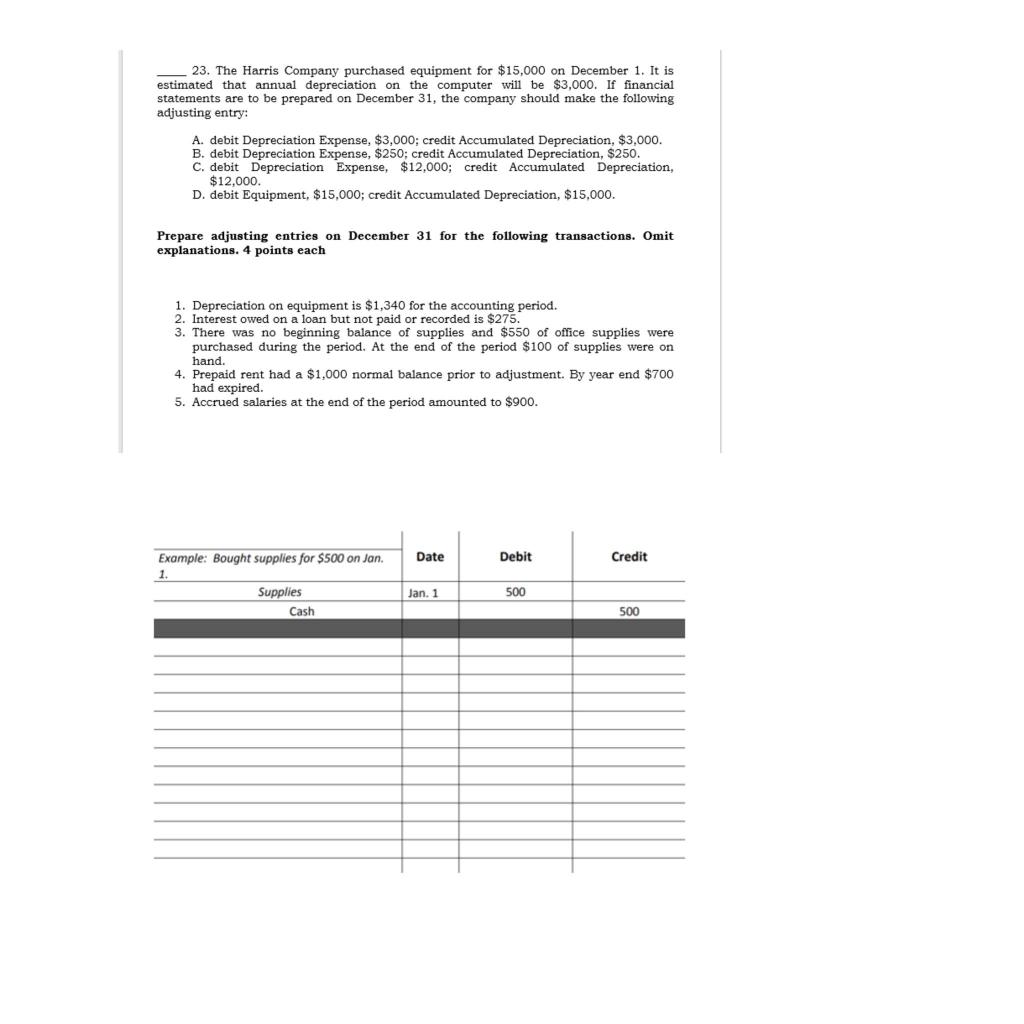

1. What type of accounts are Deferred Revenues and Unearned Revenues? 1 A. Asset B. Liability C. Equity D. Revenue 2. What type of accounts are Prepaid Insurance, Prepaid Advertising, and Prepaid Expenses? _13. Which of the statements about depreciation and amortization is true? A. The Accumulated Depreciation account is an owner's equity account shown on the balance sheet. B. The Accumulated Depreciation account is a liability account shown on the balance sheet. C. The Accumulated Depreciation account is a contra-asset account shown on the balance sheet. D. The e Depreciation account is an expense account shown on the income statement. 14. A restaurant had $100 of cleaning supplies on hand at the beginning of the accounting period and purchased $600 of cleaning supplies during the period. A physical inventory count showed $200 of cleaning supplies on hand at the end of the period. The adjusting entry for supplies inventory at the end of the period would be: A. Supplies 200; Supplies Expense 200 B. Supplies Expense 500; Supplies 500 C. Supplies 500; Supplies Expense 500 D. Supplies Expense 200; Supplies 200 15. The last step in the worksheet is to calculate the A. Asset B. Liability C. Equity D. Expense 4. Which adjusting entry reduces the balance in Prepaid Insurance? A. The adjusted trial balance totals B. Net incomeet loss C. Total revenues D. The trial balance Antals A. a credit to cash B. a credit to insurance expense C. a debit to insurance expense D. a debit to insurance payable Use the following information to answer questions 5-9: On December 1, your company began operations. On December 3 it purchased $1,500 of supplies on credit and recorded the transaction with a debit to the current asset Supplies and a credit to the current liability Accounts Payable. Your company prepares monthly financial statements at the end of each calendar month. At the end of the day on December 31, your company estimated that $700 of the supplies were still on hand in the supply room. The following questions pertain to the adjusting entry that should be entered by your company. . 16. Suppose a banquet hall received a $5,000 deposit on February 1 for a wedding reception to be held on June 15 of the same year. Assuming the wedding reception is held on June 15, which of the following statements is true? A. No journal entry would be made on February 1 for the $ 5000 deposit since it is not yet earned on February 1. B. The banquet hall's June 30 balance sheet would show a Customer Deposit in the amount of $5000 for this situation. C. The $5000 deposit would be recorded as rental revenue on February 1. D. The banquet hall's June 30 income statement would show Rental Revenue of $5000 for this situation 17. Suppose a restaurant pays $48,000 to rent a building for the next six months. At the end of the first month, the adjusting entry would include: A A debit to Rent Expense for $6000 E. A credit to Prepaid Rent for $6000 C A credit to Prepaid Rent for $8000 D. A debit to Prepaid Rent for $8000 18.The adjusted trial balance is used for A. Preparing the formal financial statements. B. Preparing the adjusting entries. C. Preparing the general ledger D. Preparing the general journal. 5. What date should be used to record the December adjusting entry? 6. How many accounts are involved in the adjusting entry? 7. What is the name of the account that will be debited? 8. What is the name of the account that will be credited? 9. What is the amount of the debit and the credit? 19. The journal entry to record depreciation A. Debits accumulated amortization B. Debits accumulated depreciation. C. Credits amortization expense. D. Dahits depreciation expense. 10. Which of the statements about the worksheet is true? ? A. The worksheet replaces the formal financial statements. B. The worksheet shows the net income or net loss for the period only after formal financial statements are prepared. C. The worksheet must be used to prepare formal financial statements. D. The worksheet is a tool that facilitates the preparation of formal financial statements. 11. Typical adjusting entries_ A. are required in cash-basis accounting, B. are created to reflect the passage of time to the last day of the accounting period. c. are calculated but are never journalized and posted. D. are not needed in accrual-basis accounting. 20. The final step in the accounting cycle is to prepare: A. closing entries. B. financial statements. c. a post-closing trial balance. D. adjusting entries 21. If a business received cash in advance of services non-performed and credits a liability account, the adjusting entry needed after the services are performed will be: a A. debit Unearned Service Revenue and credit Cash. B. debit Unearned Service Revenue and credit Service Revenue. C. debit Unearned Service Revenue and credit Prepaid Expense. D. debit Unearned Service Revenue and credit Accounts Receivable. ___ 22. 10. On July 1 the Fisher Shoe Store paid $24,000 to Acme Realty for 6 months rent beginning July 1. Prepaid Rent was debited for the full amount. If financial statements are prepared on July 31, the adjusting entry to be made by the Fisher Shoe Store is: 12. Recording bad debts expense or allowance to doubtful accounts leads to A. a reduction in Accounts Payable when there is evidence that an amount due from a customer will not be collected. B. a reduction in an Asset account when there is evidence that an amount due from a customer will not be collected. C. a reduction in Revenue when there is evidence that an amount due from a customer will not be collected. D. a reduction in an Expense when there is evidence that an amount due from a customer will not be collected. A. debit Rent Expense, $24,000; credit Prepaid Rent, $4.000. B. debit Prepaid Rent, $4,000; credit Rent Expense. $4,000. C. debit Rent Expense, $4,000; credit Prepaid Rent, $4,000. D. debit Rent Expense, $24,000; credit Prepaid Rent, $20,000. 23. The Harris Company purchased equipment for $15,000 on December 1. It is estimated that annual depreciation on the computer will be $3,000. If financial statements are to be prepared on December 31, the company should make the following adjusting entry: A. debit Depreciation Expense, $3,000; credit Accumulated Depreciation, $3,000. B. debit Depreciation Expense, $250; credit Accumulated Depreciation, $250. C. debit Depreciation Expense, $12,000; credit Accumulated Depreciation, $12,000. D. debit Equipment, $15,000; credit Accumulated Depreciation, $15,000. Prepare adjusting entries on December 31 for the following transactions. Omit explanations. 4 points each 1. Depreciation on equipment is $1,340 for the accounting period. 2. Interest owed on a loan but not paid or recorded is $275. 3. There was no beginning balance of supplies and $550 of office supplies were purchased during the period. At the end of the period $100 of supplies were on 4. Prepaid rent had a $1,000 normal balance prior to adjustment. By year end $700 had expired. 5. Accrued salaries at the end of the period amounted to $900. hand. Date Debit Credit Example: Bought supplies for $500 on Jan. 1. Supplies Cash Jan. 1 500 500