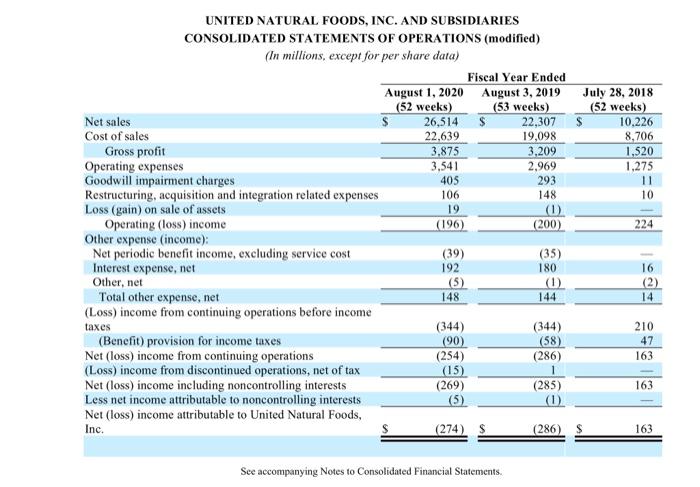

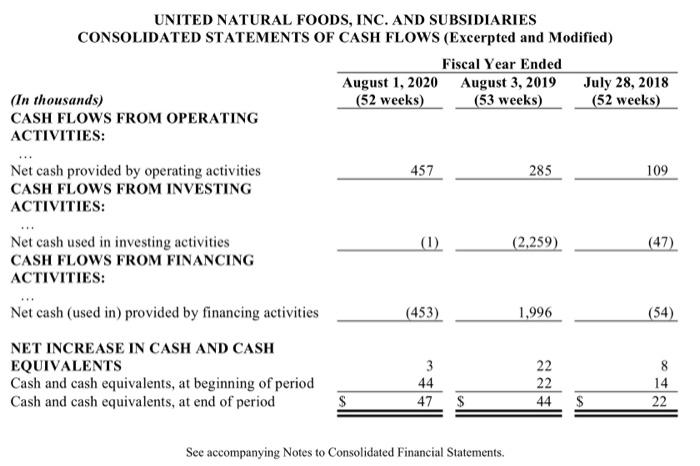

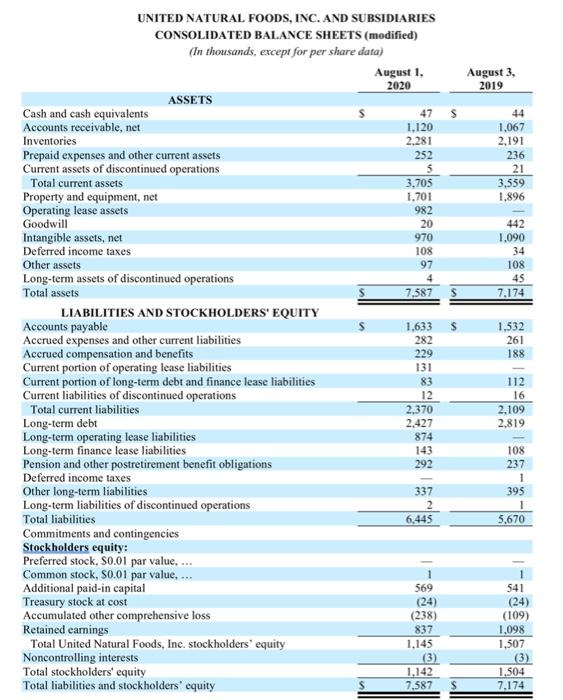

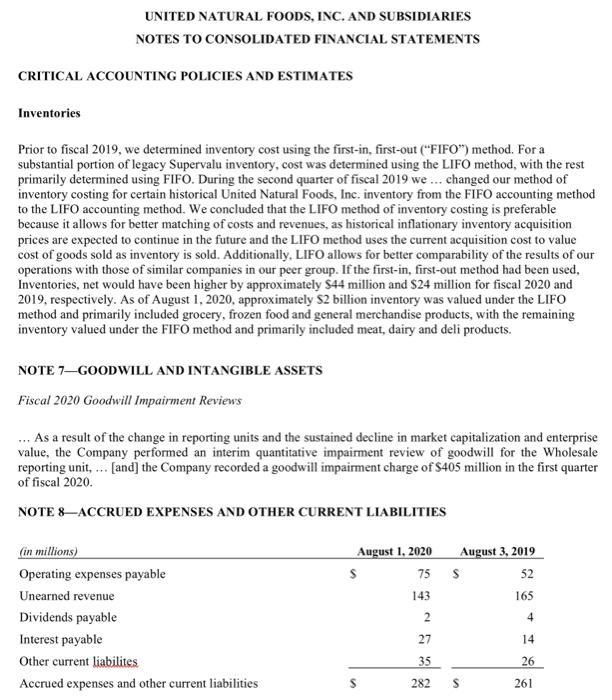

1. What were dividends declared for the year ended August 1, 2020? 2. Assume that during the year, United Natural Foods made several small acquisitions which had the effect of increasing goodwill by $17. In addition, they sold their Hornbacher's retail operations (including its goodwill). This was the only acquired business sold during the year. If United Natural Foods received $40 for Hornbacher's goodwill, how much gain or loss did they record on the sale of the goodwill? Hint 1: This problem is only about the goodwill sold - other assets sold as part of the disposition of Hornbacher are not relevant and can be ignored. Hint 2: Goodwill is not depreciated or amortized, but it may be impaired. UNITED NATURAL FOODS, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS (modified) (In millions, except for per share data) Fiscal Year Ended August 1, 2020 August 3, 2019 July 28, 2018 (52 weeks) (53 weeks) (52 weeks) Net sales 26,514 $ 22,307 $ 10.226 Cost of sales 22,639 19,098 8,706 Gross profit 3.875 3,209 1.520 Operating expenses 3,541 2,969 1,275 Goodwill impairment charges 405 293 11 Restructuring, acquisition and integration related expenses 106 148 10 Loss (gain) on sale of assets 19 (1) Operating (loss) income (196) (200) 224 Other expense (income); Net periodic benefit income, excluding service cost (39) (35) Interest expense, net 192 180 16 Other, net (5) (1) (2) Total other expense, .net 148 144 14 (Loss) income from continuing operations before income taxes (344) (344) 210 (Benefit) provision for income taxes (90) (58) 47 Net (loss) income from continuing operations (254) (286) 163 (Loss) income from discontinued operations, net of tax (15) Net (loss) income including noncontrolling interests (269) (285) 163 Less net income attributable to noncontrolling interests (5) (1) Net (loss) income attributable to United Natural Foods, Inc. (274) $ (286). S 163 S See accompanying Notes to Consolidated Financial Statements. UNITED NATURAL FOODS, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS (Excerpted and Modified) Fiscal Year Ended August 1, 2020 August 3, 2019 July 28, 2018 (In thousands) (52 weeks) (53 weeks) (52 weeks) CASH FLOWS FROM OPERATING ACTIVITIES: 457 285 109 (1) (2,259) (47) Net cash provided by operating activities CASH FLOWS FROM INVESTING ACTIVITIES: Net cash used in investing activities CASH FLOWS FROM FINANCING ACTIVITIES: Net cash (used in) provided by financing activities NET INCREASE IN CASH AND CASH EQUIVALENTS Cash and cash equivalents, at beginning of period Cash and cash equivalents, at end of period (453) 1,996 (54) 22 3 44 47 S 22 8 14 22 $ 44 S See accompanying Notes to Consolidated Financial Statements. August 3, 2019 44 1,067 2,191 236 21 3.559 1.896 442 1,090 34 108 45 7.174 UNITED NATURAL FOODS, INC. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (modified) (In thousands, except for per share data) August 1, 2020 ASSETS Cash and cash equivalents 475 Accounts receivable, net 1.120 Inventories 2.281 Prepaid expenses and other current assets 252 Current assets of discontinued operations 5 Total current assets 3.705 Property and equipment, net 1.701 Operating lease assets 982 Goodwill 20 Intangible assets, net 970 Deferred income taxes 108 Other assets 97 Long-term assets of discontinued operations Total assets 7,5875 LIABILITIES AND STOCKHOLDERS' EQUITY Accounts payable 1.633 s Accrued expenses and other current liabilities 282 Accrued compensation and benefits 229 Current portion of operating lease liabilities 131 Current portion of long-term debt and finance lease liabilities 83 Current liabilities of discontinued operations 12 Total current liabilities 2,370 Long-term debt 2,427 Long-term operating lease liabilities 874 Long-term finance lease liabilities 143 Pension and other postretirement benefit obligations 292 Deferred income taxes Other long-term liabilities 337 Long-term liabilities of discontinued operations 2 Total liabilities 6,445 Commitments and contingencies Stockholders equity: Preferred stock, S0.01 par value.... Common stock, S0.01 par value, 1 Additional paid-in capital 569 Treasury stock at cost (24) Accumulated other comprehensive loss (238) Retained earnings 837 Total United Natural Foods, Inc. stockholders' equity 1.145 Noncontrolling interests (3) Total stockholders' equity 1.142 Total liabilities and stockholders' equity 7,587 S 1,532 261 188 112 16 2.109 2,819 108 237 1 395 1 5.670 541 (24) (109) 1,098 1.507 (3) 1.504 7.174 UNITED NATURAL FOODS, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS CRITICAL ACCOUNTING POLICIES AND ESTIMATES Inventories Prior to fiscal 2019, we determined inventory cost using the first-in, first-out ("FIFO) method. For a substantial portion of legacy Supervalu inventory, cost was determined using the LIFO method, with the rest primarily determined using FIFO. During the second quarter of fiscal 2019 we... changed our method of inventory costing for certain historical United Natural Foods, Inc. inventory from the FIFO accounting method to the LIFO accounting method. We concluded that the LIFO method of inventory costing is preferable because it allows for better matching of costs and revenues, as historical inflationary inventory acquisition prices are expected to continue in the future and the LIFO method uses the current acquisition cost to value cost of goods sold as inventory is sold. Additionally, LIFO allows for better comparability of the results of our operations with those of similar companies in our peer group. If the first-in, first-out method had been used, Inventories, net would have been higher by approximately 544 million and S24 million for fiscal 2020 and 2019, respectively. As of August 1, 2020. approximately $2 billion inventory was valued under the LIFO method and primarily included grocery, frozen food and general merchandise products, with the remaining inventory valued under the FIFO method and primarily included meat, dairy and deli products. NOTE 7GOODWILL AND INTANGIBLE ASSETS Fiscal 2020 Goodwill Impairment Reviews ... As a result of the change in reporting units and the sustained decline in market capitalization and enterprise value, the Company performed an interim quantitative impairment review of goodwill for the Wholesale reporting unit, ... [and] the Company recorded a goodwill impairment charge of S405 million in the first quarter of fiscal 2020. NOTE 8-ACCRUED EXPENSES AND OTHER CURRENT LIABILITIES August 1, 2020 $ 75 August 3, 2019 52 165 143 (in millions) Operating expenses payable Unearned revenue Dividends payable Interest payable Other current liabilites Accrued expenses and other current liabilities 4 2 27 14 35 26 S 282 s 261