Answered step by step

Verified Expert Solution

Question

1 Approved Answer

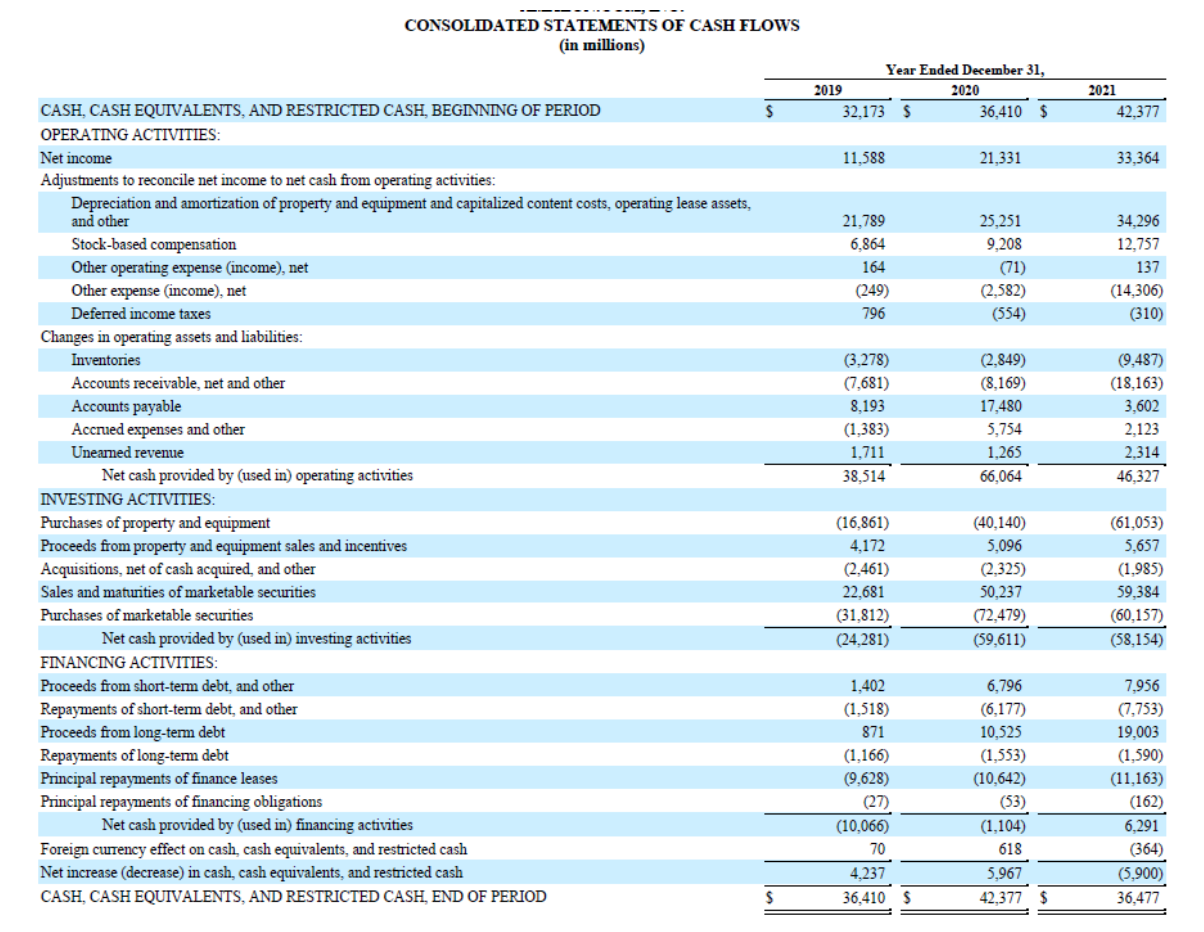

1. What working capital accounts have significant changes over the three-year period? Discuss what these changes might imply about working capital management for this firm.

1. What working capital accounts have significant changes over the three-year period? Discuss what these changes might imply about working capital management for this firm.

2. Which phase of the company's life cycle is it in (introduction, growth, maturity, decline). Discuss the reasons for your conclusion.

CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions) Year Ended December 31, 2019 2020 2021 CASH, CASH EQUIVALENTS, AND RESTRICTED CASH, BEGINNING OF PERIOD $ 32,173 $ 36,410 $ 42,377 OPERATING ACTIVITIES: Net income 11,588 21,331 33,364 Adjustments to reconcile net income to net cash from operating activities: Depreciation and amortization of property and equipment and capitalized content costs, operating lease assets, and other 21,789 25,251 34,296 Stock-based compensation 6,864 9,208 12,757 Other operating expense (income), net 164 (71) 137 Other expense (income), net (249) (2,582) (14,306) Deferred income taxes Changes in operating assets and liabilities: Inventories Accounts receivable, net and other 796 (554) (310) (3,278) (2,849) (9,487) (7,681) (8,169) (18,163) Accounts payable 8,193 17,480 3,602 Accrued expenses and other (1,383) 5,754 2,123 Unearned revenue 1,711 1,265 2,314 Net cash provided by (used in) operating activities 38,514 66,064 46,327 INVESTING ACTIVITIES: Purchases of property and equipment (16,861) (40,140) (61,053) Proceeds from property and equipment sales and incentives 4,172 5,096 5,657 Acquisitions, net of cash acquired, and other (2,461) (2,325) (1,985) Sales and maturities of marketable securities 22,681 50,237 59,384 Purchases of marketable securities (31,812) (72,479) (60,157) Net cash provided by (used in) investing activities (24,281) (59,611) (58,154) FINANCING ACTIVITIES: Proceeds from short-term debt, and other 1,402 6,796 7,956 Repayments of short-term debt, and other (1,518) (6,177) (7,753) Proceeds from long-term debt Repayments of long-term debt Principal repayments of finance leases Principal repayments of financing obligations Net cash provided by (used in) financing activities 871 10,525 19,003 (1,166) (1,553) (1,590) (9,628) (10,642) (11,163) (27) (53) (162) (10,066) (1,104) 6,291 Foreign currency effect on cash, cash equivalents, and restricted cash Net increase (decrease) in cash, cash equivalents, and restricted cash CASH, CASH EQUIVALENTS, AND RESTRICTED CASH, END OF PERIOD 70 4,237 618 (364) 5,967 (5,900) S 36,410 $ 42,377 $ 36,477

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Working Capital Changes Calculation 1 Change in Inventories 2020 2849 million 2019 3278 million 429 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started