1) Which companies appear to be more profitable over the last four years.

2) based on the profitability ratios , if you were an investor , which company would you invest in ? Explain?

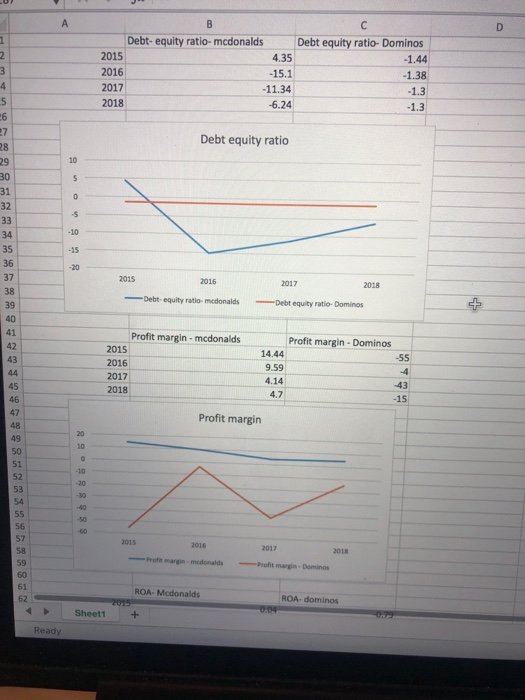

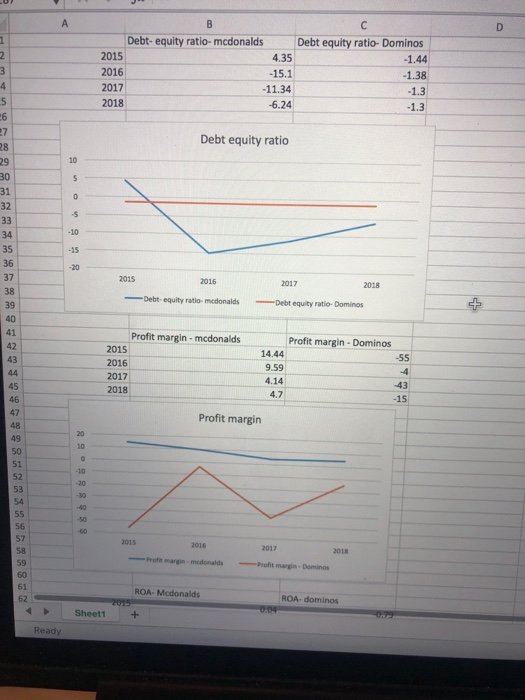

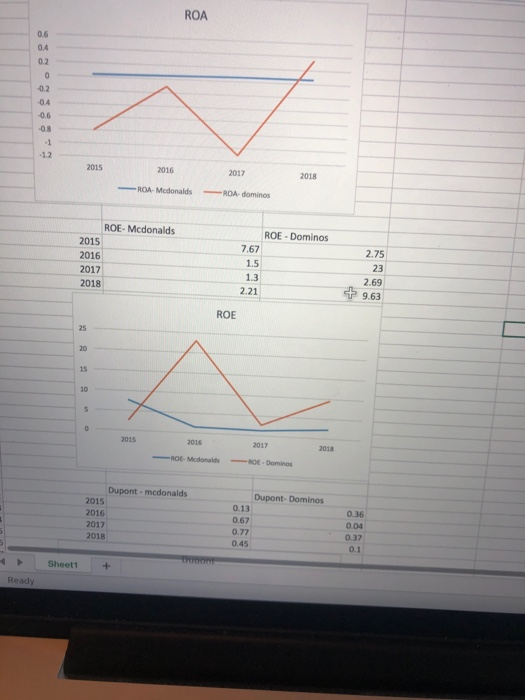

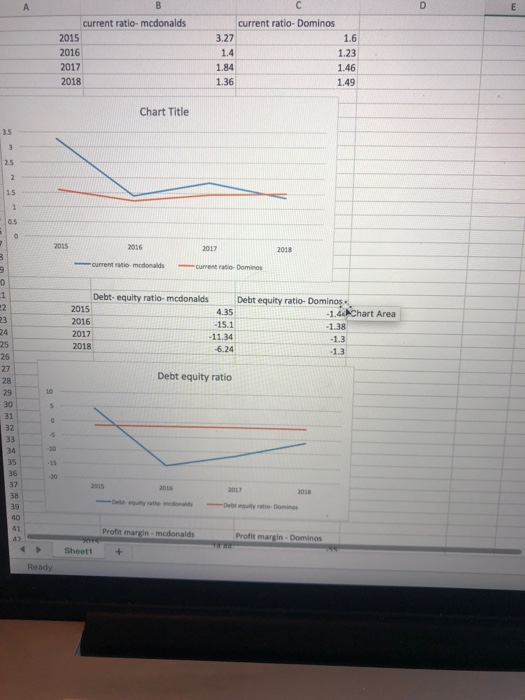

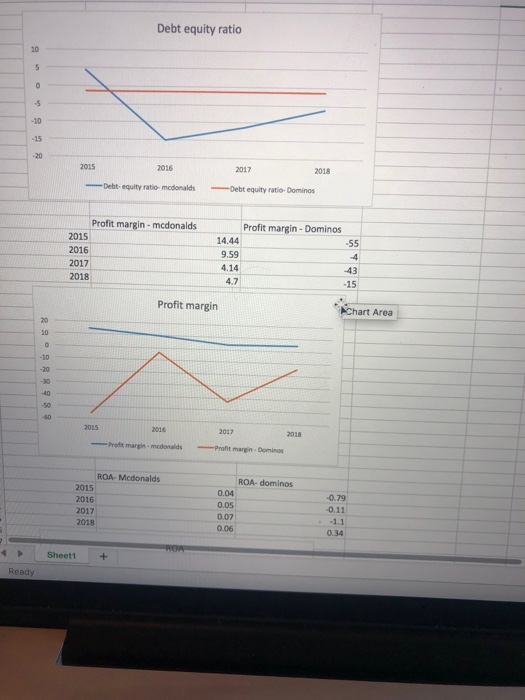

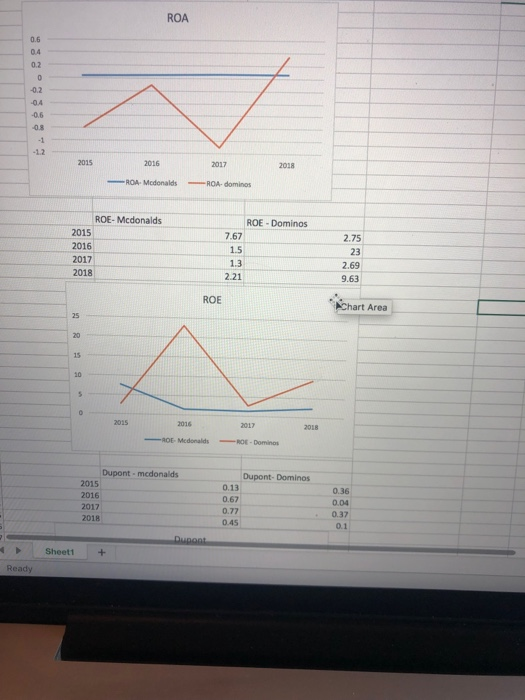

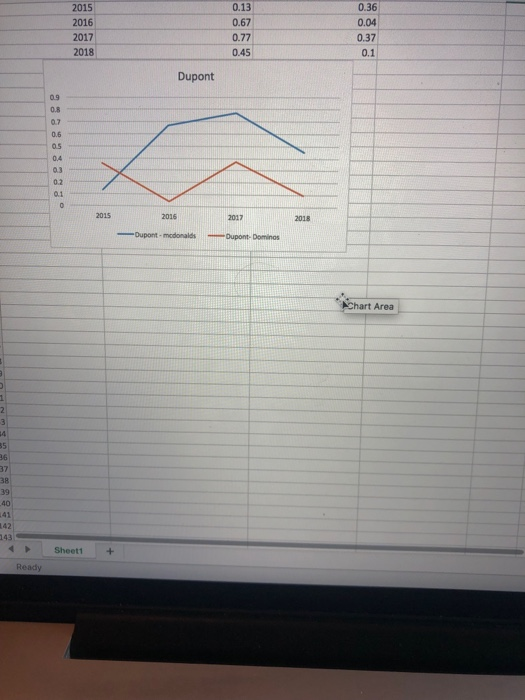

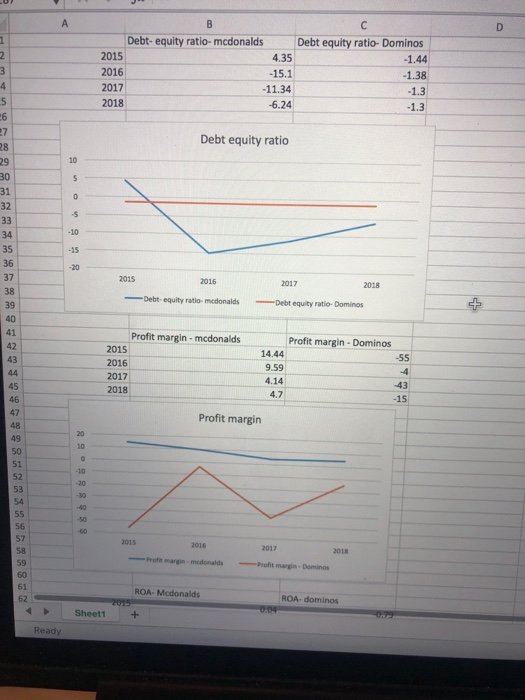

A B C D 1 Debt- equity ratio- mcdonalds Debt equity ratio- Dominos 2 2015 4.35 -1.44 3 2016 -15.1 -1.38 4 2017 -11.34 -1.3 5 2018 -6.24 -1.3 26 27 Debt equity ratio 28 10 29 30 31 33 -10 34 -15 36 -20 37 2015 2016 2017 2018 Debt- equity ratio- medonalds Debt eguity ratio- Dominos 39 40 41 Profit margin- mcdonalds Profit margin- Dominos 2015 14.44 -55 43 2016 9.59 4 44 2017 4.14 43 2018 4.7 -15 46 47 Profit margin 20 49 10 -10 -20 -30 -40 -50 -60 2015 2016 2017 2018 Proft margin-medonalds Profit magin Dominos 60 61 ROA- Mcdonalds 2015 ROA- dominos 004 Sheet1 0-79 + Ready 4 no A 2%858 % ROA 0.6 0.4 0.2 0 -0.2 -04 -0.6 -0.8 -1 -1.2 2015 2016 2017 2018 ROA-Medonalds ROA- dominos ROE- Mcdonalds ROE Dominos 2015 7.67 2.75 2016 1.5 23 2017 1.3 2.69 2018 2.21 9.63 ROE 25 20 15 10 2015 2016 2017 2018 ROE Mcdonalds ROE-Dominos Dupont-mcdonalds 2015 Dupont- Dominos 0.13 0.36 2016 0.67 0.04 2017 0.77 0.37 2018 0.45 0.1 onont Sheet1 Ready un D A E current ratio-Dominos current ratio- mcdonalds 2015 3.27 1.6 2016 1.4 1.23 2017 1.84 1.46 2018 1.36 1.49 Chart Title 35 25 1.5 0.5 2015 2016 2017 2018 current ratio- medonalds curent ratio- Dominos 1 Debt- equity ratio- mcdonalds Debt equity ratio- Dominos 7 2015 -1.44Chart Area - 1.38 4.35 23 2016 -15.1 24 2017 -11.34 -1.3 25 2018 6.24 -1.3 26 27 Debt equity ratio 28 29 10 30 31 32 33 34 35 -15 -20 37 2015 2016 2017 2018 38 -Debt equity ratio mcdonalds Debt equity ratio Dominos 39 40 41 Profit margin-mcdonalds. Profit margin-Dominos 42 Sheett Ready Debt equity ratio 10 -10 -15 -20 2016 2017 2018 2015 Debt equity ratio- Dominos Debt equity ratio- mcdonalds Profit margin- mcdonalds Profit margin-Dominos 2015 14.44 -55 2016 4 9.59 2017 4.14 43 2018 -15 4.7 Profit margin AChart Area 20 20 30 40 -50 40 2015 2016 2017 2018 Profe margin-medonalds Profit margin Domings ROA- Mcdonalds ROA- dominos 2015 0.04 -0.79 2016 0.05 0.11 2017 0.07 -1.1 2018 0.06 0.34 ROA Sheett + Ready ROA 0.6 0.4 0.2 0.2 -0.6 -0.8 -1 -1.2 2016 2015 2017 2018 ROA Mcdonalds ROA- dominos ROE- Mcdonalds ROE-Dominos 2015 7.67 2.75 2016 1.5 23 2017 1.3 2.69 2018 2.21 9.63 ROE AChart Area 25 20 15 10 2015 2016 2017 2018 -ROE Mcdonalds ROE-Domings Dupont mcdonalds 2015 Dupont- Dominos 0.13 0.36 2016 0.67 0.04 2017 0.77 0.37 2018 0.45 0.1 Dupont Sheett Ready 0.36 0.13 2015 2016 0.67 0.04 2017 0.77 0.37 2018 0.45 0.1 Dupont 0.9 0.8 0.7 0.6 0.5 0.4 0.3 021 0.1 2015 2016 2017 2018 Dupont-modonalds Dupont- Domings Chart Area 2 3 4 5 36 37 38 39 40 41 142 143 Sheet1 Ready