Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Which legal entity is generally best suited for going public? A) Corporation. B) General Partnership. C) LLC. D) Limited Liability Partnership. E) All

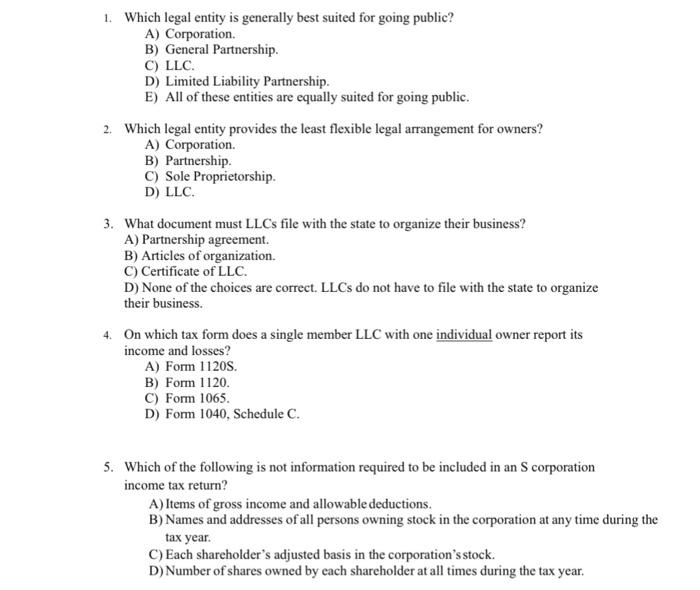

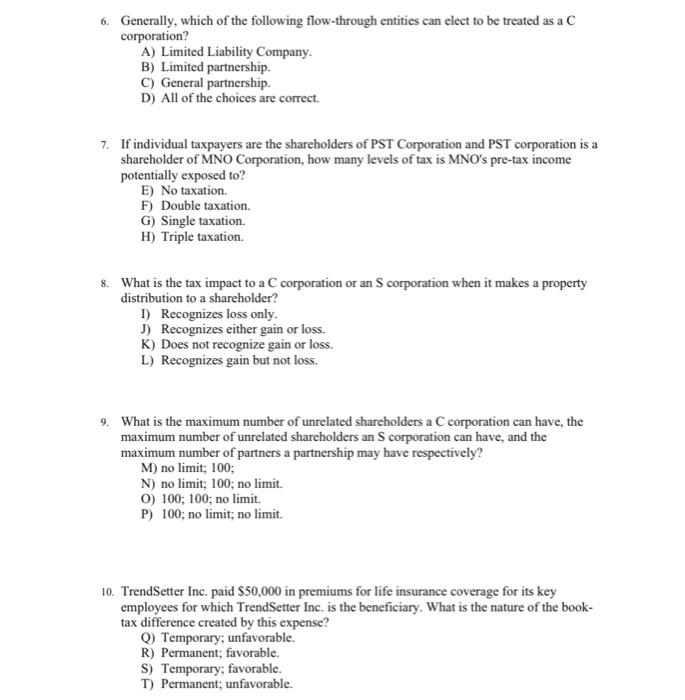

1. Which legal entity is generally best suited for going public? A) Corporation. B) General Partnership. C) LLC. D) Limited Liability Partnership. E) All of these entities are equally suited for going public. 2. Which legal entity provides the least flexible legal arrangement for owners? A) Corporation. B) Partnership. C) Sole Proprietorship. D) LLC. 3. What document must LLCS file with the state to organize their business? A) Partnership agreement. B) Articles of organization. C) Certificate of LLC. D) None of the choices are correct. LLCS do not have to file with the state to organize their business. 4. On which tax form does a single member LLC with one individual owner report its income and losses? A) Form 1120S. B) Form 1120. C) Form 1065. D) Form 1040, Schedule C. 5. Which of the following is not information required to be included in an S corporation income tax return? A) Items of gross income and allowable deductions. B) Names and addresses of all persons owning stock in the corporation at any time during the tax year. C) Each shareholder's adjusted basis in the corporation's stock. D) Number of shares owned by cach shareholder at all times during the tax year. 6. Generally, which of the following flow-through entities can elect to be treated as a C corporation? A) Limited Liability Company. B) Limited partnership. C) General partnership. D) All of the choices are correct. 7. If individual taxpayers are the shareholders of PST Corporation and PST corporation is a shareholder of MNO Corporation, how many levels of tax is MNO's pre-tax income potentially exposed to? E) No taxation. F) Double taxation. G) Single taxation. H) Triple taxation. 8. What is the tax impact to a C corporation or an S corporation when it makes a property distribution to a shareholder? I) Recognizes loss only. J) Recognizes either gain or loss. K) Does not recognize gain or loss. L) Recognizes gain but not loss. 9. What is the maximum number of unrelated shareholders a C corporation can have, the maximum number of unrelated shareholders an S corporation can have, and the maximum number of partners a partnership may have respectively? M) no limit; 100; N) no limit; 100; no limit. 0) 100; 100; no limit. P) 100; no limit; no limit. 10. TrendSetter Inc. paid $50,000 in premiums for life insurance coverage for its key employees for which TrendSetter Inc. is the beneficiary. What is the nature of the book- tax difference created by this expense? Q) Temporary; unfavorable. R) Permanent; favorable. S) Temporary; favorable. T) Permanent; unfavorable.

Step by Step Solution

★★★★★

3.59 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

1 Which legal entity is generally best suited for going public Answer ACorporation Explanation Corporations have the governing framework in place to make an initial public offering a success To make t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started