Question

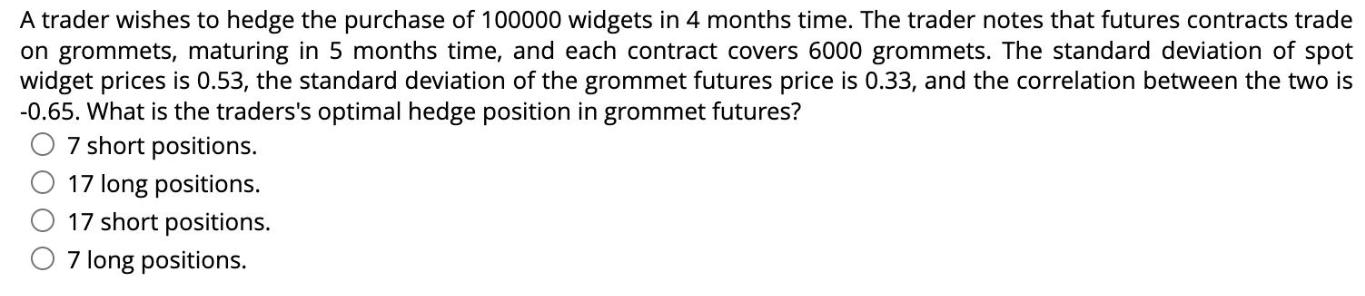

A trader wishes to hedge the purchase of 100000 widgets in 4 months time. The trader notes that futures contracts trade on grommets, maturing

A trader wishes to hedge the purchase of 100000 widgets in 4 months time. The trader notes that futures contracts trade on grommets, maturing in 5 months time, and each contract covers 6000 grommets. The standard deviation of spot widget prices is 0.53, the standard deviation of the grommet futures price is 0.33, and the correlation between the two is -0.65. What is the traders's optimal hedge position in grommet futures? 7 short positions. 17 long positions. 17 short positions. 7 long positions.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below The optimal hedge position in grommet f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Physics

Authors: Jearl Walker, Halliday Resnick

8th Extended edition

471758019, 978-0471758013

Students also viewed these Physics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App