Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Which of the following best describes the goal of the firm? a. the maximization of shareholder wealth b. the maximization of the total book

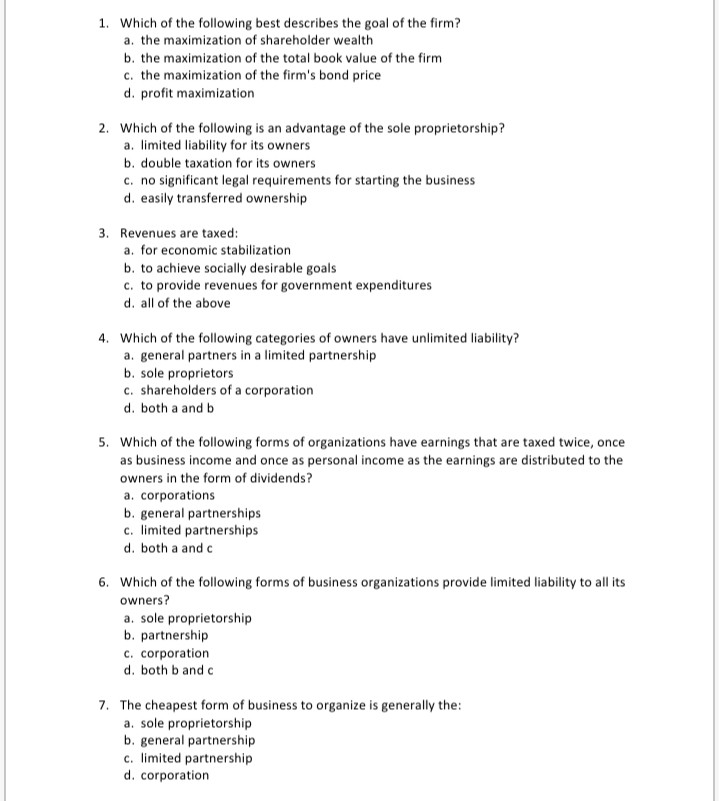

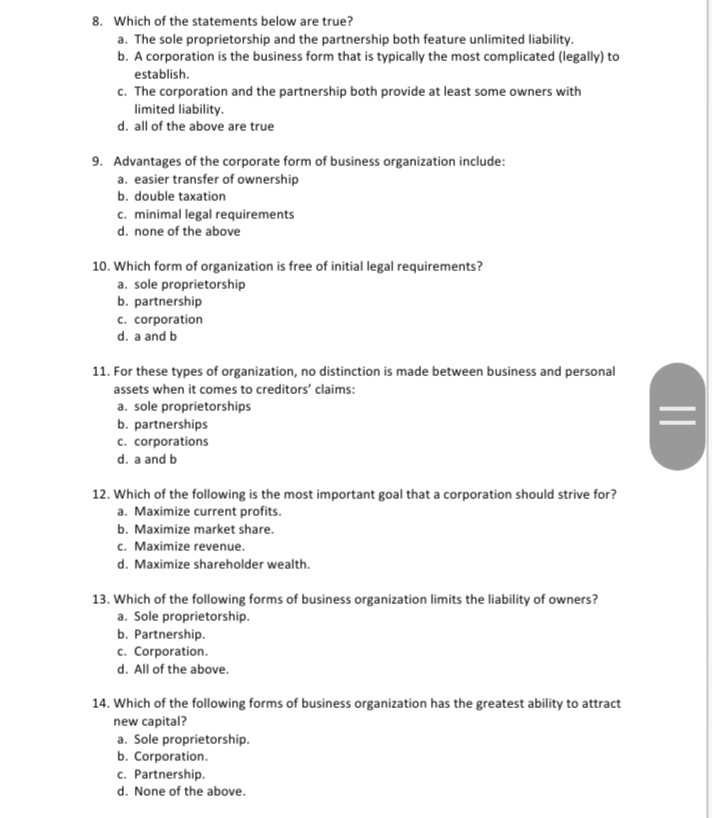

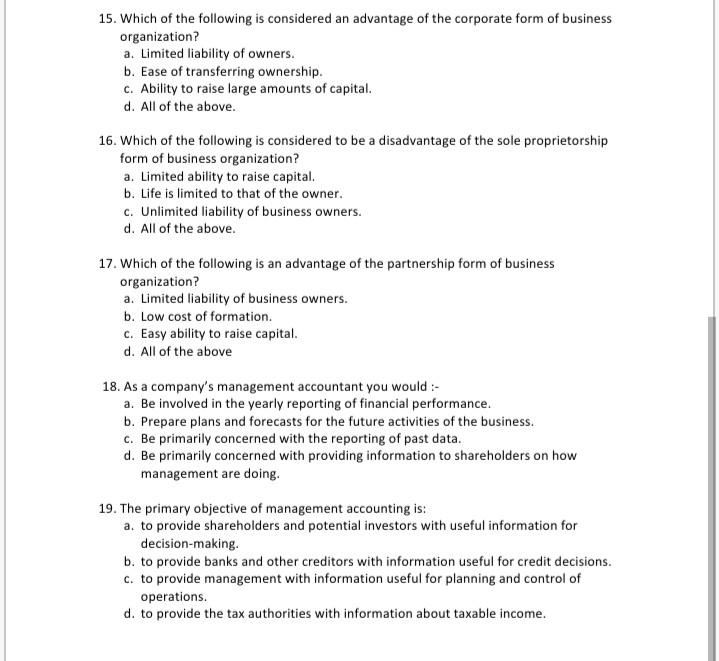

1. Which of the following best describes the goal of the firm? a. the maximization of shareholder wealth b. the maximization of the total book value of the firm c. the maximization of the firm's bond price d. profit maximization 2. Which of the following is an advantage of the sole proprietorship? a. limited liability for its owners b. double taxation for its owners c. no significant legal requirements for starting the business d. easily transferred ownership 3. Revenues are taxed: a. for economic stabilization b. to achieve socially desirable goals c. to provide revenues for government expenditures d. all of the above 4. Which of the following categories of owners have unlimited liability? a. general partners in a limited partnership b. sole proprietors C. shareholders of a corporation d. both a and b 5. Which of the following forms of organizations have earnings that are taxed twice, once as business income and once as personal income as the earnings are distributed to the owners in the form of dividends? a corporations b. general partnerships c. limited partnerships d. both a and c 6. Which of the following forms of business organizations provide limited liability to all its owners? a. sole proprietorship b. partnership c. corporation d. both b and 7. The cheapest form of business to organize is generally the: a. sole proprietorship b. general partnership c. limited partnership d. corporation 8. Which of the statements below are true? a. The sole proprietorship and the partnership both feature unlimited liability. b. A corporation is the business form that is typically the most complicated (legally) to establish. C. The corporation and the partnership both provide at least some owners with limited liability. d. all of the above are true 9. Advantages of the corporate form of business organization include: a. easier transfer of ownership b. double taxation c. minimal legal requirements d. none of the above 10. Which form of organization is free of initial legal requirements? a. sole proprietorship b. partnership C. corporation d. a and b 11. For these types of organization, no distinction is made between business and personal assets when it comes to creditors' claims: a. sole proprietorships b. partnerships C. corporations d. a and b = 12. Which of the following is the most important goal that a corporation should strive for? a. Maximize current profits. b. Maximize market share. C. Maximize revenue. d. Maximize shareholder wealth. 13. Which of the following forms of business organization limits the liability of owners? a. Sole proprietorship. b. Partnership. C. Corporation. d. All of the above. 14. Which of the following forms of business organization has the greatest ability to attract new capital? a. Sole proprietorship. b. Corporation. c. Partnership. d. None of the above. 15. Which of the following is considered an advantage of the corporate form of business organization? a. Limited liability of owners. b. Ease of transferring ownership. C. Ability to raise large amounts of capital. d. All of the above. 16. Which of the following is considered to be a disadvantage of the sole proprietorship form of business organization? a. Limited ability to raise capital. b. Life is limited to that of the owner. c. Unlimited liability of business owners. d. All of the above. 17. Which of the following is an advantage of the partnership form of business organization? a. Limited liability of business owners. b. Low cost of formation. c. Easy ability to raise capital. d. All of the above 18. As a company's management accountant you would :- a. Be involved in the yearly reporting of financial performance. b. Prepare plans and forecasts for the future activities of the business. c. Be primarily concerned with the reporting of past data. d. Be primarily concerned with providing information to shareholders on how management are doing. 19. The primary objective of management accounting is: a. to provide shareholders and potential investors with useful information for decision-making. b. to provide banks and other creditors with information useful for credit decisions. c. to provide management with information useful for planning and control of operations. d. to provide the tax authorities with information about taxable income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started