Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Which of the following best describes the goal of the firm? a. the maximization of shareholder wealth b. the maximization of the total book

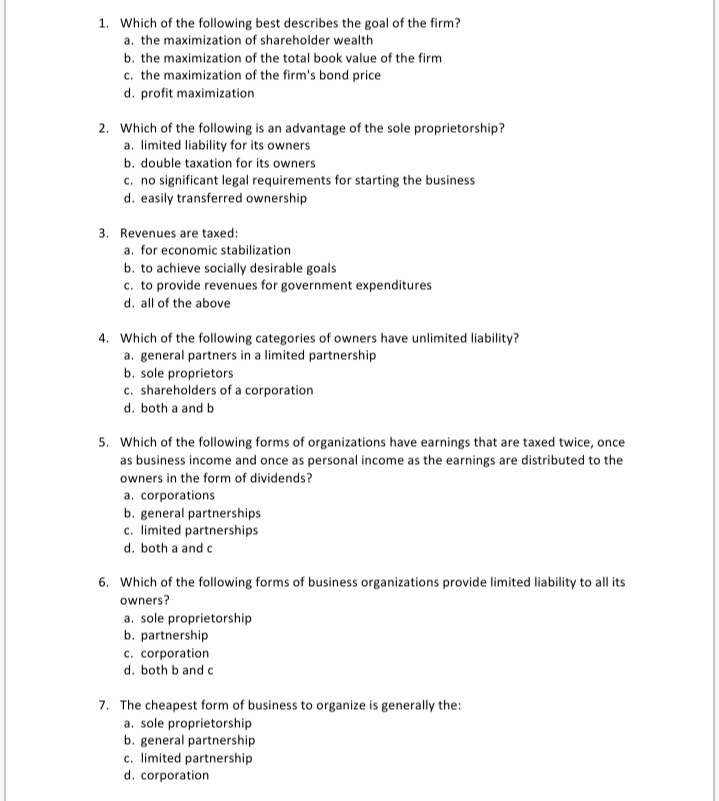

1. Which of the following best describes the goal of the firm? a. the maximization of shareholder wealth b. the maximization of the total book value of the firm c. the maximization of the firm's bond price d. profit maximization 2. Which of the following is an advantage of the sole proprietorship? a. limited liability for its owners b. double taxation for its owners c. no significant legal requirements for starting the business d. easily transferred ownership 3. Revenues are taxed: a. for economic stabilization b. to achieve socially desirable goals c. to provide revenues for government expenditures d. all of the above 4. Which of the following categories of owners have unlimited liability? a. general partners in a limited partnership b. sole proprietors C. shareholders of a corporation d. both a and b 5. Which of the following forms of organizations have earnings that are taxed twice, once as business income and once as personal income as the earnings are distributed to the owners in the form of dividends? a corporations b. general partnerships c. limited partnerships d. both a and c 6. Which of the following forms of business organizations provide limited liability to all its owners? a. sole proprietorship b. partnership c. corporation d. both b and 7. The cheapest form of business to organize is generally the: a. sole proprietorship b. general partnership c. limited partnership d. corporation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started