Question

1. Which of the following best explains why minimizing costs has potentially serious shortcomings as a means of maximizing owners' equity? A. Minimizing costs allows

1. Which of the following best explains why minimizing costs has potentially serious shortcomings as a means of maximizing owners' equity?

A. Minimizing costs allows for the payment of larger dividends to company owners. B. It's difficult to maximize market share without increasing spending. C. Without spending money on R&D to improve its products, a firm won't survive long in the constantly evolving economy.

D. Spending lavishly can impress potential customers.

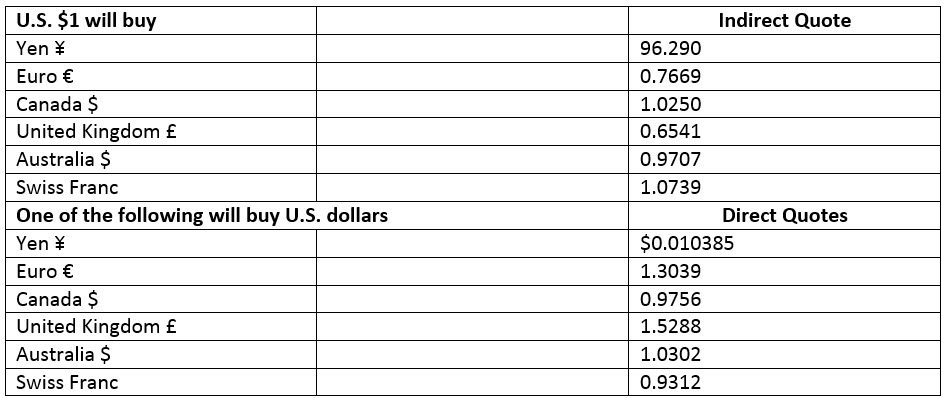

2. You plan to go on a trip to Europe and want to have 4,000 euros available to spend on the trip.

Using the currency rates found in this table, how many U.S. dollars will you need to convert to euros?

A. $5,184 B. $4,832 C. $4,935

D. $5,216

3. Apogee Widgets, Inc., has filed for Chapter 7 bankruptcy. Assets available to pay off creditors after liquidation totaled $2.1 million. Administrative costs associated with the bankruptcy proceedings amounted to $40,500; wages due to 400 employees were $1 million; unpaid expenses incurred after the bankruptcy filing but before appointment of the trustee were $20,500; property taxes past due were $195,000; and unsecured creditor claims were $1.5 million. In what order and what amount should the proceeds be distributed by the trustee?

A. $195,000 for property taxes, $40,500 for administrative expenses associated with the bankruptcy proceedings, $20,500 for unpaid expenses incurred after the filing of the bankruptcy petition but before appointment of the trustee, $800,000 for wages due to employees, and $1,044,000 to unsecured creditors on a prorated basis

B. $195,000 for property taxes, $40,500 for administrative expenses associated with the bankruptcy proceedings, $20,500 for unpaid expenses incurred after the filing of the bankruptcy petition but before appointment of the trustee, $1,000,000 for wages due to employees, and $844,000 to unsecured creditors on a prorated basis

C. $40,500 for administrative expenses associated with the bankruptcy proceedings, $195,000 for property taxes, $20,500 for unpaid expenses incurred after the filing of the bankruptcy petition but before appointment of the trustee, $800,000 for wages due to employees, and $1,044,000 to unsecured creditors on a prorated basis

D. $40,500 for administrative expenses associated with the bankruptcy proceedings, $20,500 for unpaid expenses incurred after the filing of the bankruptcy petition but before appointment of the trustee, $195,000 for property taxes, $1,000,000 for wages due to employees, and $844,000 to unsecured creditors on a prorated basis

Please answer all questions. Thank you kindly.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started