Answered step by step

Verified Expert Solution

Question

1 Approved Answer

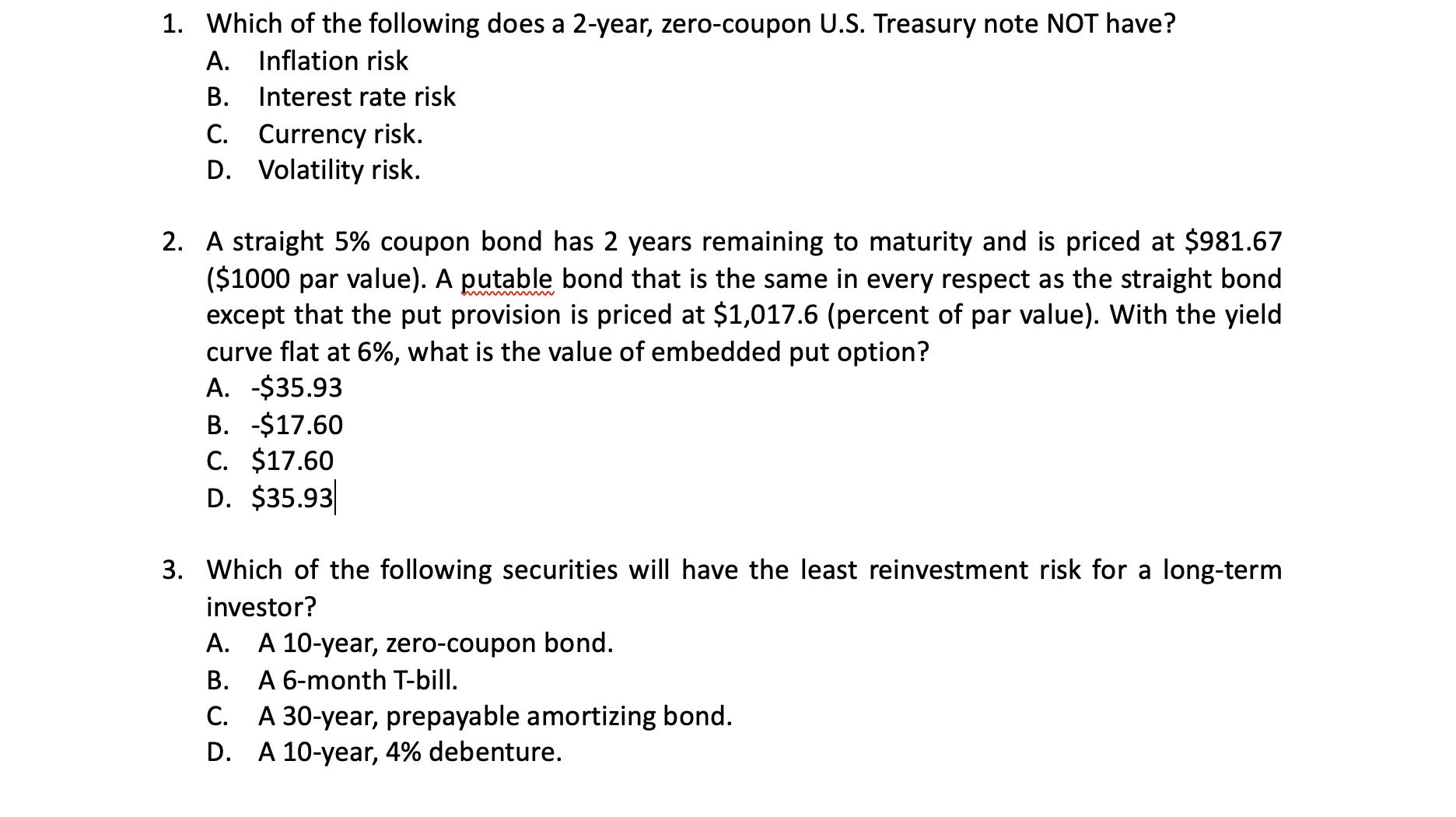

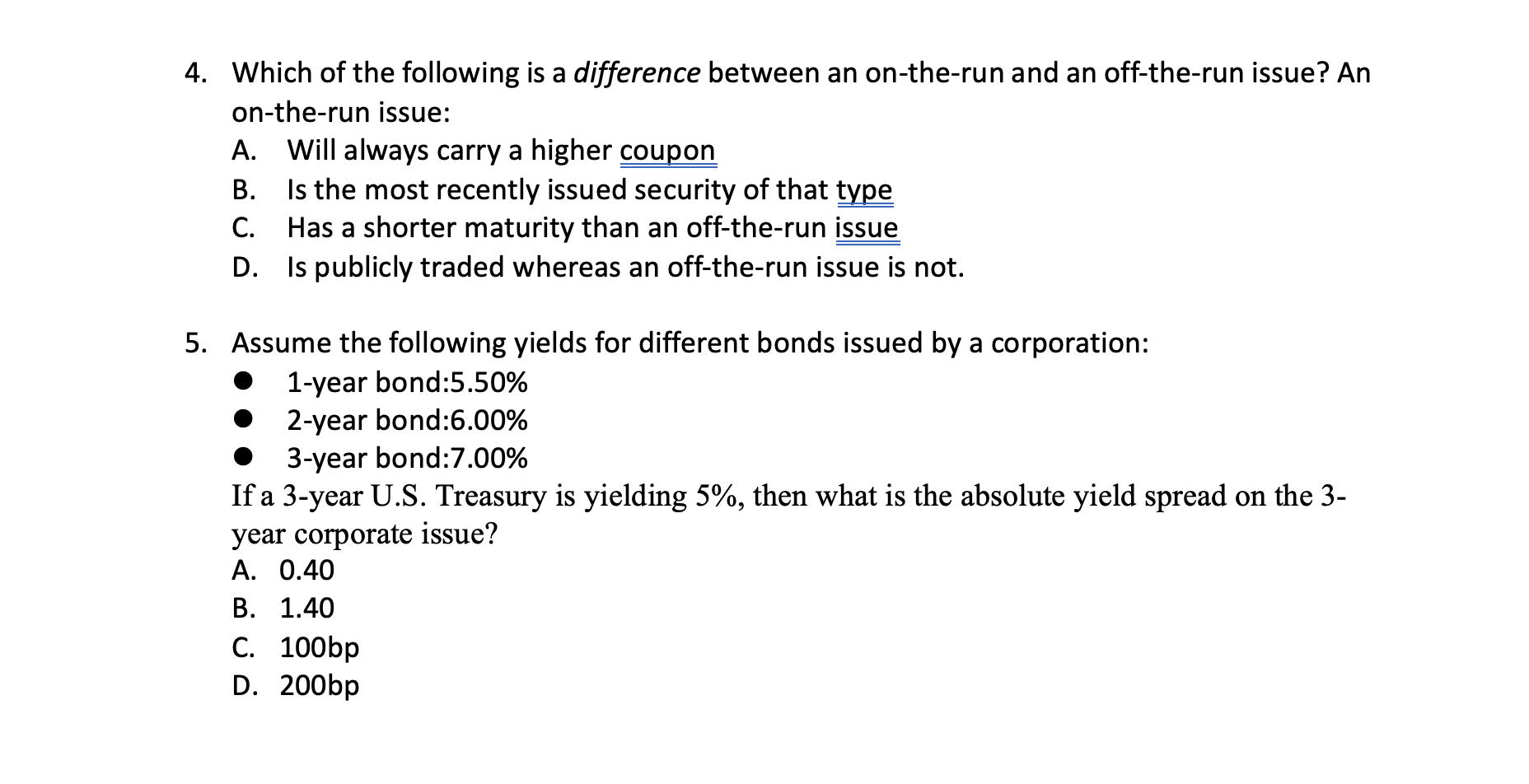

1. Which of the following does a 2-year, zero-coupon U.S. Treasury note NOT have? A. Inflation risk B. Interest rate risk C. Currency risk.

1. Which of the following does a 2-year, zero-coupon U.S. Treasury note NOT have? A. Inflation risk B. Interest rate risk C. Currency risk. D. Volatility risk. 2. A straight 5% coupon bond has 2 years remaining to maturity and is priced at $981.67 ($1000 par value). A putable bond that is the same in every respect as the straight bond except that the put provision is priced at $1,017.6 (percent of par value). With the yield curve flat at 6%, what is the value of embedded put option? A. -$35.93 B. -$17.60 C. $17.60 D. $35.93 3. Which of the following securities will have the least reinvestment risk for a long-term investor? A. A 10-year, zero-coupon bond. B. A 6-month T-bill. C. A 30-year, prepayable amortizing bond. D. A 10-year, 4% debenture. 4. Which of the following is a difference between an on-the-run and an off-the-run issue? An on-the-run issue: A. Will always carry a higher coupon B. Is the most recently issued security of that type C. Has a shorter maturity than an off-the-run issue D. Is publicly traded whereas an off-the-run issue is not. 5. Assume the following yields for different bonds issued by a corporation: 1-year bond:5.50% 2-year bond:6.00% 3-year bond:7.00% If a 3-year U.S. Treasury is yielding 5%, then what is the absolute yield spread on the 3- year corporate issue? A. 0.40 B. 1.40 C. 100bp D. 200bp

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below 1 The correct answer is C Currency risk ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started