Question

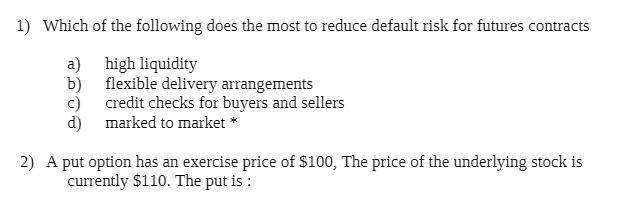

1) Which of the following does the most to reduce default risk for futures contracts a) high liquidity b) flexible delivery arrangements c) credit

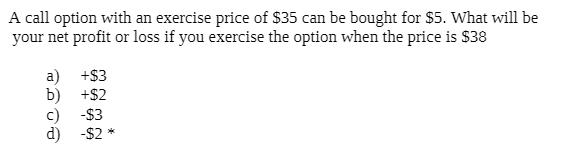

1) Which of the following does the most to reduce default risk for futures contracts a) high liquidity b) flexible delivery arrangements c) credit checks for buyers and sellers d) marked to market * 2) A put option has an exercise price of $100, The price of the underlying stock is currently $110. The put is : A call option with an exercise price of $35 can be bought for $5. What will be your net profit or loss if you exercise the option when the price is $38 a) +$3 b) +$2 -$3 c) d) -$2 *

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Auditing and Assurance Services

Authors: Timothy Louwers, Robert Ramsay, David Sinason, Jerry Straws

6th edition

978-1259197109, 77632281, 77862341, 1259197107, 9780077632281, 978-0077862343

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App