Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Which of the following is INCORRECT? A. All of a stock's risk could be unsystematic b. A negative beta stock has an expected return

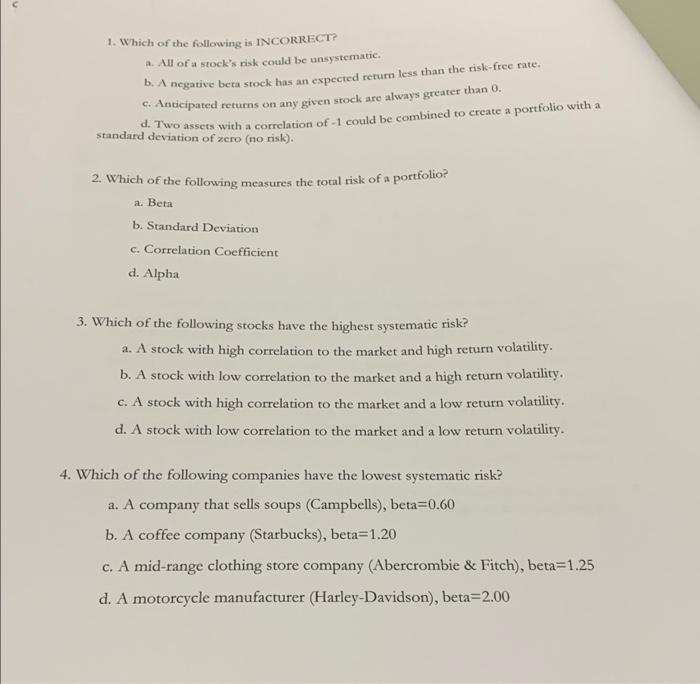

1. Which of the following is INCORRECT? A. All of a stock's risk could be unsystematic b. A negative beta stock has an expected return less than the risk-free rate. c. Anticipated returns on any given stock are always greater than 0. do Two assets with a correlation of -1 could be combined to create a portfolio with a standard deviation of zero (no risk). 2. Which of the following measures the total risk of a portfolio a. Beta b. Standard Deviation c. Correlation Coefficient d. Alpha 3. Which of the following stocks have the highest systematic risk? a. A stock with high correlation to the market and high return volatility. b. A stock with low correlation to the market and a high return volatility. c. A stock with high correlation to the market and a low return volatility. d. A stock with low correlation to the market and a low return volatility. 4. Which of the following companies have the lowest systematic risk? a. A company that sells soups (Campbells), beta=0.60 b. A coffee company (Starbucks), beta=1.20 c. A mid-range clothing store company (Abercrombie & Fitch), beta=1.25 d. A motorcycle manufacturer (Harley-Davidson), beta=2.00

1. Which of the following is INCORRECT? A. All of a stock's risk could be unsystematic b. A negative beta stock has an expected return less than the risk-free rate. c. Anticipated returns on any given stock are always greater than 0. do Two assets with a correlation of -1 could be combined to create a portfolio with a standard deviation of zero (no risk). 2. Which of the following measures the total risk of a portfolio a. Beta b. Standard Deviation c. Correlation Coefficient d. Alpha 3. Which of the following stocks have the highest systematic risk? a. A stock with high correlation to the market and high return volatility. b. A stock with low correlation to the market and a high return volatility. c. A stock with high correlation to the market and a low return volatility. d. A stock with low correlation to the market and a low return volatility. 4. Which of the following companies have the lowest systematic risk? a. A company that sells soups (Campbells), beta=0.60 b. A coffee company (Starbucks), beta=1.20 c. A mid-range clothing store company (Abercrombie & Fitch), beta=1.25 d. A motorcycle manufacturer (Harley-Davidson), beta=2.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started