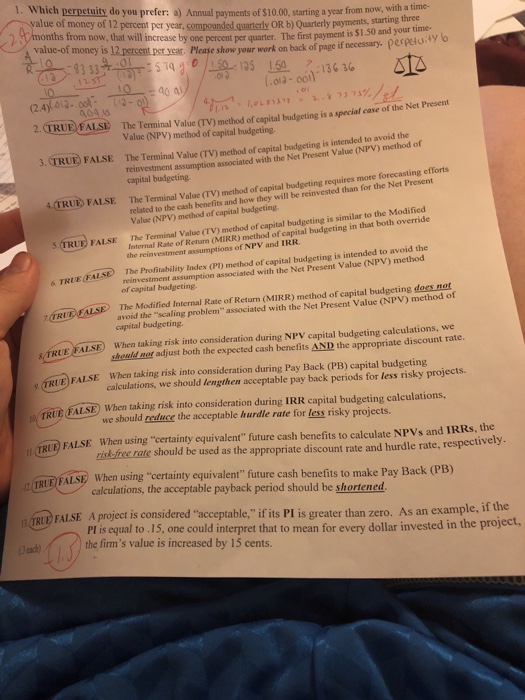

1. Which perpetuity do you prefer: a) Annual payments of $10.00, starting a year from now, with a alue of money of 12 percent per year compounded quarterly OR b) Quarterly payments, starting three value-of money is w, that will increase by one percent per quarter. The first payment is $1.50 and your time percent per year. Please show your work on back of page if necessary. perpeu ty o the Net Present 2 (TRUE FALSI The Terminal Value (TV) method of capital budgeting is a special case o Value (NPV) method of capital budgeting 3. TRUE FALSE The Terminal Value (TV) method of capital badgeting is intended to avoid the reinvestment assumption associated with the Net Present Value (NPV) method of capital budgeting 4 TRUD FALSE The Terminal Value (TV) method of capital budgeting requires more forecasting efforts related to the cash benefits and how they will be reinvested than for the Net Present Value (NPV) method of capital budgeting. ar to tho Modifid Isternal Rate of Return (MIRR) method of capital budgeting in that both override the reinvestment assumptions of NPV and IRR TRUE FALSD The Profitability Index (P) method of capital budgeting is intended to avoid the reinvestment assumption associated with the Net Present Value (NPV) method of capital budgeting. The Modified Internal Rate of Return (MIRR) method of capital budgeting dees not avoid the "scaling problem" associated with the Net Present Value (NPV) method o capital budgeting When taking risk into consideration during NPV capital budgeting calculations, we should not adjust both the expected cash benefits AND the appropriate discount rate. E FALSE REFALSE When taking risk into consideration during Pay Back (PB) capital budgeting calculations, we should lengthen acceptable pay back periods for less risky projects. RLR FALSE When taking risk into consideration during IRR capital budgeting calculations, we should reduce the acceptable hurdle rate for less risky projects. TRU FALSE When using "certainty equivalent" future cash benefits to calculate NPVs and IRRs, the riskfre rate should be used as the appropriate discount rate and hurdle rate, respectively. calculations, the acceptable payback period should be shortened Pl is equal to .15, one could interpret that to mean for eve FALSE When using "certainty equivalent" future cash benefits to make Pay Back TRl (PB) TRUD FALSE A project is considered "acceptable," if its PI is greater than zero. As an example, if the the firm's value is increased by 15 cents. ry dollar invested in the project