Answered step by step

Verified Expert Solution

Question

1 Approved Answer

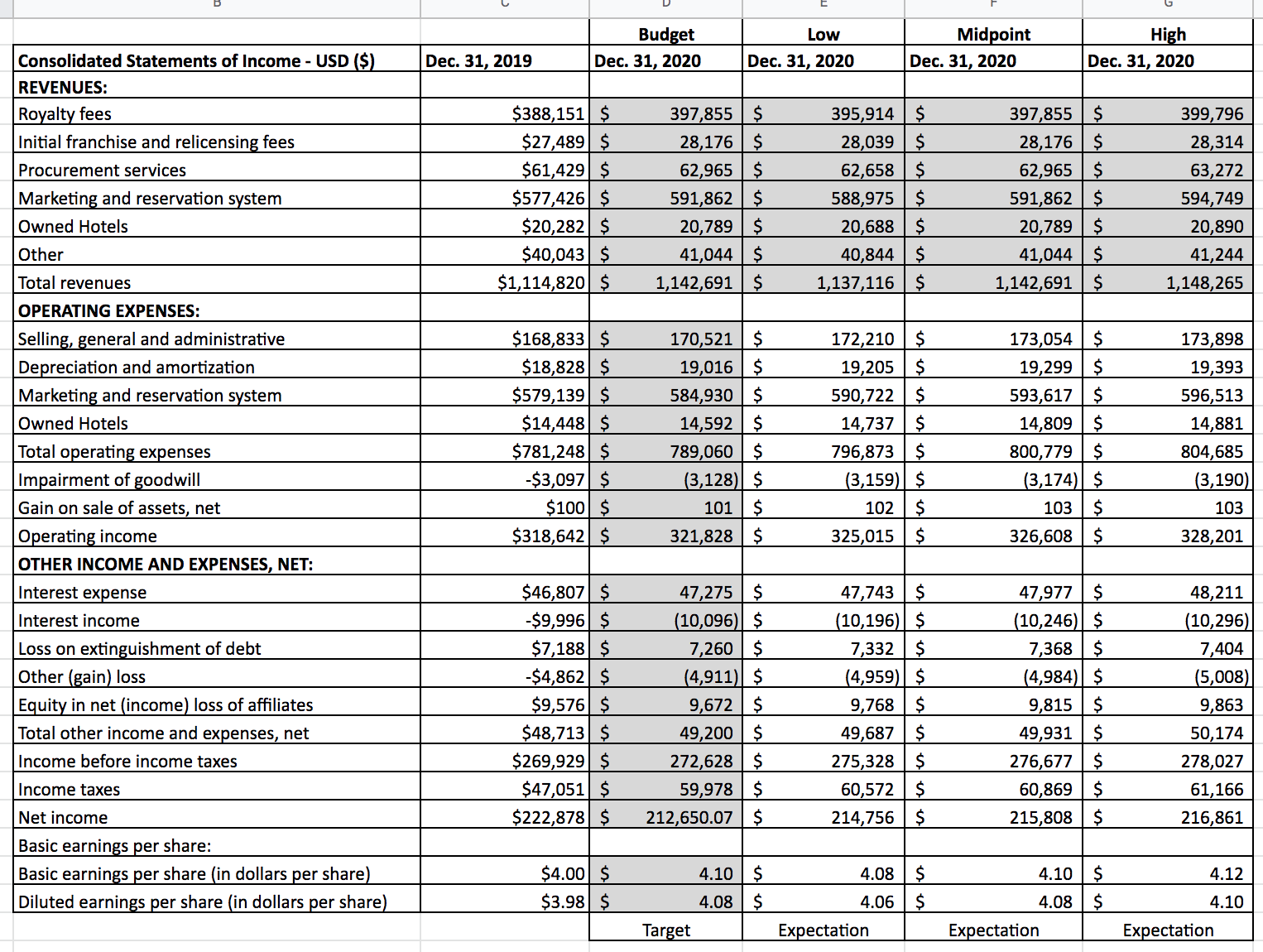

1. Which revenue category is the most important to forecast accurately? Explain your rationale for your selection and how you developed your three estimates thoroughly.

1. Which revenue category is the most important to forecast accurately? Explain your rationale for your selection and how you developed your three estimates thoroughly.

2. Which expense category is the most important to forecast accurately? Explain your rationale for your selection and how you developed your three estimates thoroughly.

Budget Low Consolidated Statements of Income - USD ($) Dec. 31, 2019 Dec. 31, 2020 Dec. 31, 2020 Midpoint Dec. 31, 2020 High Dec. 31, 2020 REVENUES: Royalty fees $388,151 $ 397,855 $ 395,914 $ 397,855 $ 399,796 Initial franchise and relicensing fees $27,489 $ 28,176 $ 28,039 $ 28,176 $ 28,314 Procurement services $61,429 $ 62,965 $ 62,658 $ 62,965 $ 63,272 | Marketing and reservation system $577,426 $ 591,862 $ 588,975 $ 591,862 $ 594,749 Owned Hotels $20,282 $ 20,789 $ 20,688 $ 20,789 $ 20,890 Other Total revenues OPERATING EXPENSES: $40,043 $ 41,044 $ 40,844 $ 41,044 $ 41,244 $1,114,820 $ 1,142,691 $ 1,137,116 $ 1,142,691 $ 1,148,265 Selling, general and administrative $168,833 $ 170,521 $ 172,210 $ 173,054 $ 173,898 Depreciation and amortization $18,828 $ 19,016 $ 19,205 $ 19,299 $ 19,393 Marketing and reservation system $579,139 $ 584,930 $ 590,722 $ 593,617 $ 596,513 Owned Hotels $14,448 $ 14,592 $ 14,737 $ 14,809 $ 14,881 Total operating expenses $781,248 $ 789,060 $ 796,873 $ 800,779 $ 804,685 Impairment of goodwill -$3,097 $ (3,128) $ (3,159) $ (3,174) $ (3,190) Gain on sale of assets, net $100 $ 101 $ 102 $ 103 $ Operating income $318,642 $ 321,828 $ 325,015 $ 326,608 $ 103 328,201 OTHER INCOME AND EXPENSES, NET: Interest expense $46,807 $ 47,275 $ 47,743 $ 47,977 $ Interest income -$9,996 $ (10,096) $ (10,196) $ (10,246) $ 48,211 (10,296) Loss on extinguishment of debt $7,188 $ 7,260 $ 7,332 $ 7,368 $ 7,404 Other (gain) loss -$4,862 $ (4,911) $ (4,959) $ (4,984) $ (5,008) Equity in net (income) loss of affiliates $9,576 $ 9,672 $ 9,768 $ 9,815 $ 9,863 Total other income and expenses, net $48,713 $ 49,200 $ 49,687 $ 49,931 $ 50,174 Income before income taxes $269,929 $ 272,628 $ 275,328 $ 276,677 $ 278,027 Income taxes Net income $47,051 $ 59,978 $ 60,572 $ 60,869 $ 61,166 $222,878 $ 212,650.07 $ 214,756 $ 215,808 $ 216,861 Basic earnings per share: Basic earnings per share (in dollars per share) $4.00 $ Diluted earnings per share (in dollars per share) $3.98 $ 4.10 $ 4.08 $ 4.08 $ 4.06 $ 4.10 $ 4.08 $ 4.12 4.10 Target Expectation Expectation Expectation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started