Question

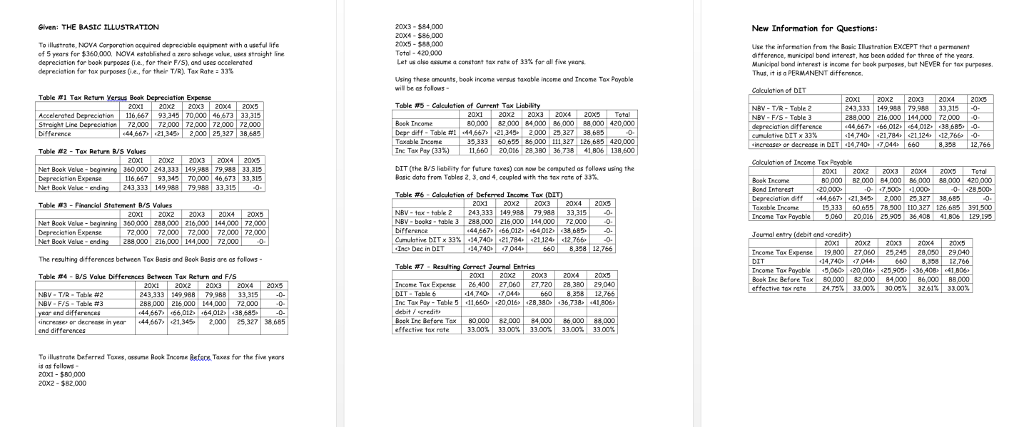

1 WHY are the journal entry debits and credits to DIT exactly the same in Requirement #3 for all five years as they were in

1 WHY are the journal entry debits and credits to DIT exactly the same in Requirement #3 for all five years as they were in the Basic Illustration? Your answer must be 30 words or less!

2 WHY is the Income Tax Payable amount for 20X1, 20X3, and 20X4 smaller in Requirement #3 than in the Basic Illustration even though Book Income Before Tax is identical? Again, your answer must be 30 words or less!

3 Why is Income Tax Payable for 20X1 a total of $6,600 less for Requirement #3 compared to the Basic Illustration ($11,660 $5,060 = $6,600)? Your answer should be in the form of a mathematical proof as to what is causing the $6,600 difference.

4 WHY (i.e., what caused) the effective tax rate to be 30.05% in 20X3 rather than 33.00%? Be sure your calculation shows how the 30.05% is determined - this does NOT mean your answer is you divide Income Tax Expense by Book Income Before Tax. The issue to address is WHY it is 30.05% rather than 33.00%. Your answer should be in the form of a mathematical explanation of what is causing the 2.95% difference.

Given: THE Astc tLLUSTRATION 203-$84,000 20x4 $86,000 200x5-S88,000 Totol 40.000 Let us also assume a constant 5 x rate of 33% for all five rin New Information for Questions To illustrate, NOVA Corporation ocquired depreciable oqupment with a ueful ife of 5 years fer $360,000 NOVA established a zero schage value, uses straight ine depreciation for book purgozes 0., for ther FIS), and uses occelerated depreciation for tax purposes (i.e., for their T/R). Tax Rate 33% use the information fron the Basic Illustration EXCEPT thet a permenent difference, rancipal bond int st, has been 0dded for Three of the years. Municipal bond interest is income fer beok purposes, but NEVER for tx purpeses hus, it is aPERMANENT differencs. Using these mounts, book income versus tabie income 0 income Tox Poroble will be os follows Table #1 Tax Return Toble 5-Calculetien of Current Tax LisbiGYy NBV-T/R-Toble 2 Accelerated Depreciation116 6 93345 0,000463 33315 Streght Line 243,333 149,988 79,988 33,315 0 288000 2160144000 2000 0 Baek rcone bear diff. Tabe #1.44,667b1+21345-2000 80,000 82,000 84,000 86,00088,000 420,000 2000 72000 720 2 000 72 000 44,667 1342000 25,327 38,685 depreciat on difference 25327 38685 35.333 60655-86000. 111327-26,685. 420,000 1,660 20,06283BO 36,738 41,80 138,800 Inc Tax Pay (33 Net Book Velue Depreciation Expense Net Book DIT (the B/S liabiity for future tanes) conow be camputed as fellaws using the Basic data frem Tooles 2. 3. ond 4coupled wit* the tx nme of 33%, 16 657 9370,000 46673 33,3 Boak Tcome 80000 Deprecation dff -44,667'21,3-2.000-25327-38,655 Table 3-Phanciol Statement B/S Values NBV- Net Book Velue Depreciation Expense Net Book Velue 2OXI 20X2 | 20X3 | 20X4 | 20X5 60000-288,000 210,000 144,00 72,00 2,000 72,000 72,000 72,000 72,000 44 66766 012 64012 38 6850. Cumulative bTTx 33%. . 14.740,-21.784..21,124'-t2 766 19,800 7 2 cone Tox Expense Trcome Ta. Porable effective tox rate 28,00 29040 The resulting dfferences between Tox Besis and Beok Basis are as follows 1,060 20,016-2390536,408,-41 B06 88,000 20X1 20X2 20X3 20X4 | 20X5 243333 349 988 79.988 33,315-0- Incone Tax Expse26400 27D627,7208,30 29,040 24.75% | 33.00% 30.05% | 32.01% | 33.00 288 000 26 000 Inc Tax Pay-Table 5-11,6&D-20,016 .28,380 . 36738>-41,806 -44,667-|6,012. .64012) | , 38,685-1-0- | 44,667s |21.345 2,000 | 25,327 | 38.685 increze, er decreas. in yer Lre Before 33.00% | 33.00% , 3300% To illustrate Deferred Toxes, osume Rook Inconx Befscx Taxes for the five yors fellows 20x1-$80000 20x2-$82000 Given: THE Astc tLLUSTRATION 203-$84,000 20x4 $86,000 200x5-S88,000 Totol 40.000 Let us also assume a constant 5 x rate of 33% for all five rin New Information for Questions To illustrate, NOVA Corporation ocquired depreciable oqupment with a ueful ife of 5 years fer $360,000 NOVA established a zero schage value, uses straight ine depreciation for book purgozes 0., for ther FIS), and uses occelerated depreciation for tax purposes (i.e., for their T/R). Tax Rate 33% use the information fron the Basic Illustration EXCEPT thet a permenent difference, rancipal bond int st, has been 0dded for Three of the years. Municipal bond interest is income fer beok purposes, but NEVER for tx purpeses hus, it is aPERMANENT differencs. Using these mounts, book income versus tabie income 0 income Tox Poroble will be os follows Table #1 Tax Return Toble 5-Calculetien of Current Tax LisbiGYy NBV-T/R-Toble 2 Accelerated Depreciation116 6 93345 0,000463 33315 Streght Line 243,333 149,988 79,988 33,315 0 288000 2160144000 2000 0 Baek rcone bear diff. Tabe #1.44,667b1+21345-2000 80,000 82,000 84,000 86,00088,000 420,000 2000 72000 720 2 000 72 000 44,667 1342000 25,327 38,685 depreciat on difference 25327 38685 35.333 60655-86000. 111327-26,685. 420,000 1,660 20,06283BO 36,738 41,80 138,800 Inc Tax Pay (33 Net Book Velue Depreciation Expense Net Book DIT (the B/S liabiity for future tanes) conow be camputed as fellaws using the Basic data frem Tooles 2. 3. ond 4coupled wit* the tx nme of 33%, 16 657 9370,000 46673 33,3 Boak Tcome 80000 Deprecation dff -44,667'21,3-2.000-25327-38,655 Table 3-Phanciol Statement B/S Values NBV- Net Book Velue Depreciation Expense Net Book Velue 2OXI 20X2 | 20X3 | 20X4 | 20X5 60000-288,000 210,000 144,00 72,00 2,000 72,000 72,000 72,000 72,000 44 66766 012 64012 38 6850. Cumulative bTTx 33%. . 14.740,-21.784..21,124'-t2 766 19,800 7 2 cone Tox Expense Trcome Ta. Porable effective tox rate 28,00 29040 The resulting dfferences between Tox Besis and Beok Basis are as follows 1,060 20,016-2390536,408,-41 B06 88,000 20X1 20X2 20X3 20X4 | 20X5 243333 349 988 79.988 33,315-0- Incone Tax Expse26400 27D627,7208,30 29,040 24.75% | 33.00% 30.05% | 32.01% | 33.00 288 000 26 000 Inc Tax Pay-Table 5-11,6&D-20,016 .28,380 . 36738>-41,806 -44,667-|6,012. .64012) | , 38,685-1-0- | 44,667s |21.345 2,000 | 25,327 | 38.685 increze, er decreas. in yer Lre Before 33.00% | 33.00% , 3300% To illustrate Deferred Toxes, osume Rook Inconx Befscx Taxes for the five yors fellows 20x1-$80000 20x2-$82000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started