Question

1. Why does PSHAX have such a high turnover rate? A. The fund consists mostly of short-term bonds. Since the bonds mature very quickly, the

1. Why does PSHAX have such a high turnover rate?

A. The fund consists mostly of short-term bonds. Since the bonds mature very quickly, the money is constantly being reinvested in other short-term bonds, in such a way that the portfolio is constantly changing.

B. The managers cant make up their minds about which securities to buy and sell. Each manager is pulling in a different direction, and the result is lots of trading in the fund.

C. The bonds in the fund are very high risk bonds, and having a high default rate on individual bonds causes the fund to have a high turnover rate.

D. The shares of the bond fund are traded many times a day and that leads to a very high turnover rate.

2. Which fund is considered riskier and why?

A. PSHAX the funds super high turnover rate makes it very risky.

B. BHYAX the funds holding are mostly junk bonds which have the highest chance of default.

C. PSHAX since the bonds in the fund have very short maturity dates, the interest rate risk (the risk that the value of the fund will drop if interest rates rise) is higher.

D. BHYAX the funds holding are mostly high yield bonds, which are bonds of the highest credit rating, and have the biggest potential of being the most profitable, and thus, also the most risky.

Both answers would be greatly appreciated

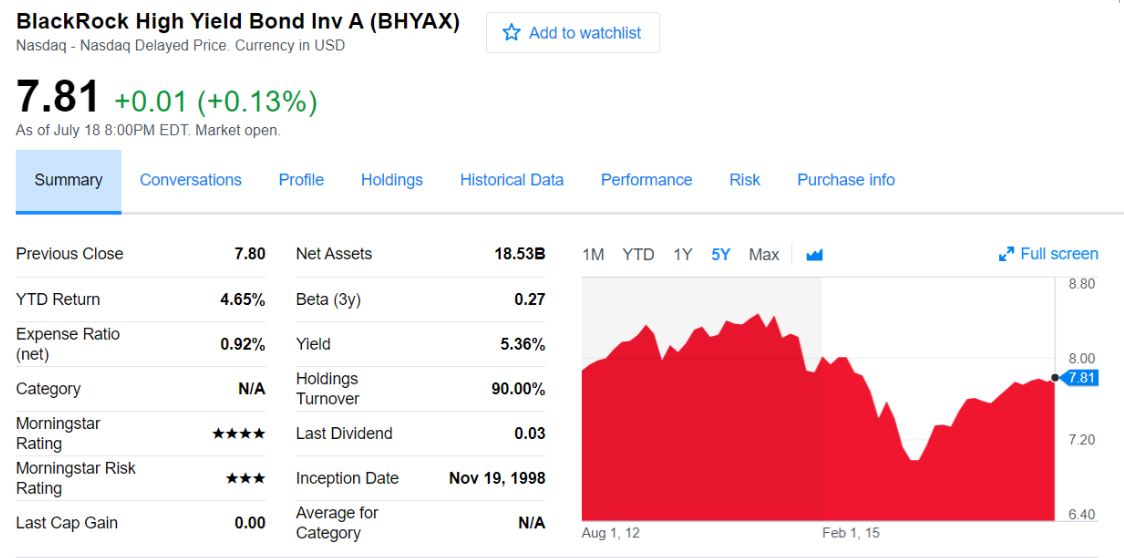

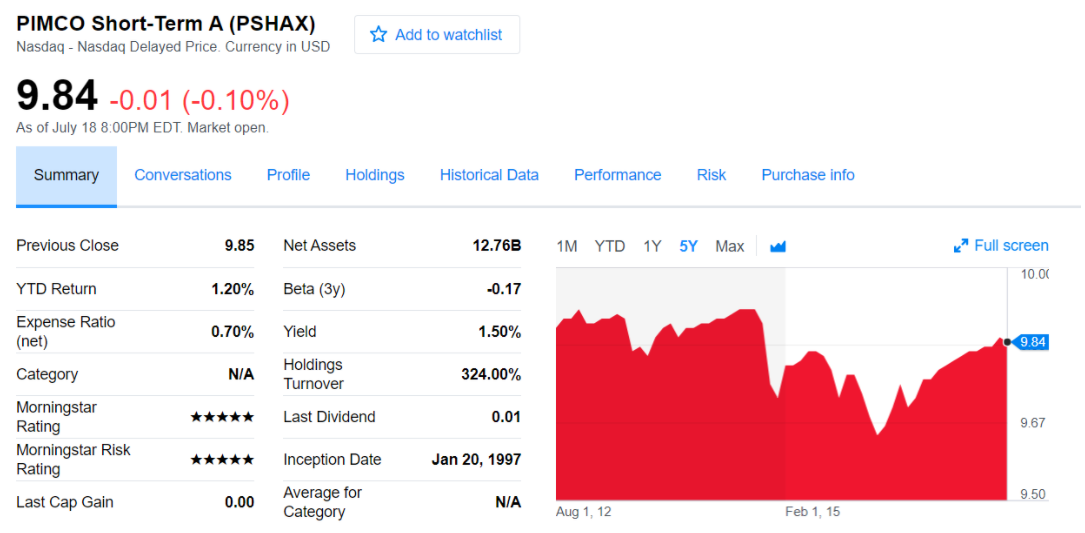

BlackRock High Yield Bond Inv A (BHYAX) Nasdaq - Nasdaq Delayed Price. Currency in USD Add to watchlist 7.81 +0.01 (+0.13%) As of July 18 8:00PM EDT, Market open. Summary Conversations Profile Holdings Historical Data Performance Risk Purchase info Previous Close 7.80 Net Assets 18.53B 1M YTD 1Y 5Y Max * Full screen 8.80 YTD Return 4.65% Beta (3) 0.27 Expense Ratio (net) 0.92% Yield 5.36% 8.00 7.81 Category N/A Holdings Turnover 90.00% **** Last Dividend 0.03 720 Morningstar Rating Morningstar Risk Rating *** Inception Date Nov 19, 1998 6.40 Last Cap Gain 0.00 Average for Category N/A Aug 1, 12 Feb 1, 15 PIMCO Short-Term A (PSHAX) Nasdaq - Nasdaq Delayed Price. Currency in USD Add to watchlist 9.84 -0.01 (-0.10%) As of July 18 8:00PM EDT. Market open. Summary Conversations Profile Holdings Historical Data Performance Risk Purchase info Previous Close 9.85 Net Assets 12.76B 1M YTD 14 5Y Max Full screen 10.00 YTD Return 1.20% Beta (3) -0.17 Expense Ratio (net) 0.70% Yield 1.50% 9.84 N/A Holdings Turnover 324.00% ***** Last Dividend 0.01 9.67 Category Morningstar Rating Morningstar Risk Rating Last Cap Gain ***** Inception Date Jan 20, 1997 9.50 0.00 Average for Category N/A Aug 1, 12 Feb 1, 15Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started