Answered step by step

Verified Expert Solution

Question

1 Approved Answer

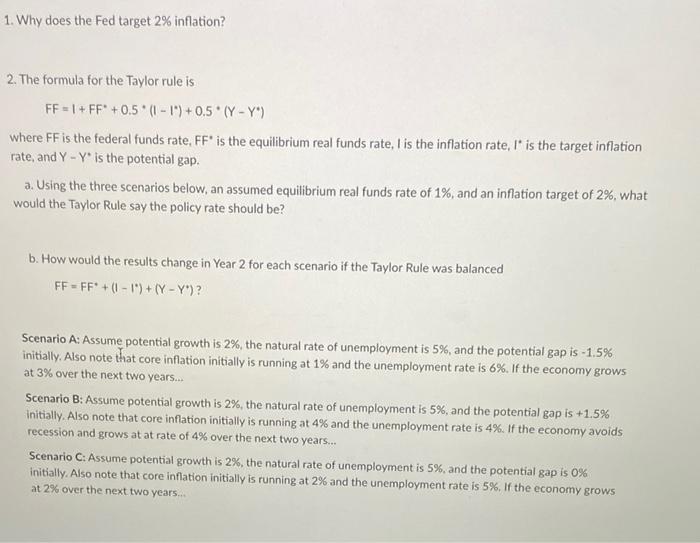

1. Why does the Fed target 2% inflation? 2. The formula for the Taylor rule is FF=1+ FF +0.5*(1-1) +0.5*(Y-Y*) where FF is the

1. Why does the Fed target 2% inflation? 2. The formula for the Taylor rule is FF=1+ FF +0.5*(1-1) +0.5*(Y-Y*) where FF is the federal funds rate, FF* is the equilibrium real funds rate, I is the inflation rate, I is the target inflation rate, and Y-Y is the potential gap. a. Using the three scenarios below, an assumed equilibrium real funds rate of 1%, and an inflation target of 2%, what would the Taylor Rule say the policy rate should be? b. How would the results change in Year 2 for each scenario if the Taylor Rule was balanced FF FF + (1-1) + (Y-Y')? Scenario A: Assume potential growth is 2%, the natural rate of unemployment is 5%, and the potential gap is -1.5% initially. Also note that core inflation initially is running at 1% and the unemployment rate is 6%. If the economy grows at 3% over the next two years... Scenario B: Assume potential growth is 2%, the natural rate of unemployment is 5%, and the potential gap is +1.5% initially. Also note that core inflation initially is running at 4% and the unemployment rate is 4%. If the economy avoids recession and grows at at rate of 4% over the next two years... Scenario C: Assume potential growth is 2%, the natural rate of unemployment is 5%, and the potential gap is 0% initially. Also note that core inflation initially is running at 2% and the unemployment rate is 5%. If the economy grows at 2% over the next two years...

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Why does the Fed target 2 inflation The Fed targets 2 inflation for several reasons Price Stabilit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started