Question

1. Why is income statement important to shareholders? 2. As the Financial Director of A Hotel, how will the projected net income in year 2021

1. Why is income statement important to shareholders?

2. As the Financial Director of A Hotel, how will the projected net income in year 2021 affect you?

3. Calculate the changes of both the projected sales and net income of 2021 as compared to the actual of 2020.

4. Analyze the results of question 3.

5. Based on the analysis, is/are there any impact(s) on the shareholders?

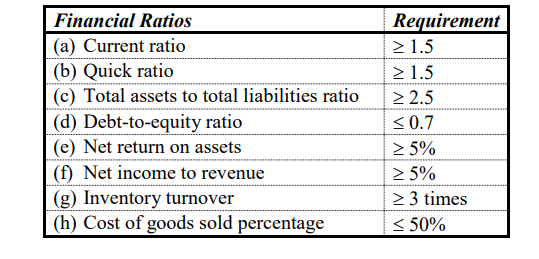

A Hotel is now required to raise additional capital fund through debt financing. The bank will require its potential clients to meet a series of financial ratios based on their projected financial results of next year in order to determine the eligibility for obtaining the long-term bank loan.

6. Give the five (5) needs of capital funding.

7. With reference to the financial ratios requirement indicated below by the bank, calculate all the ratios for A Hotel.

8. Do all the ratios meet the requirement of the bank?

9. Will it be eligible to obtain a long-term bank loan?

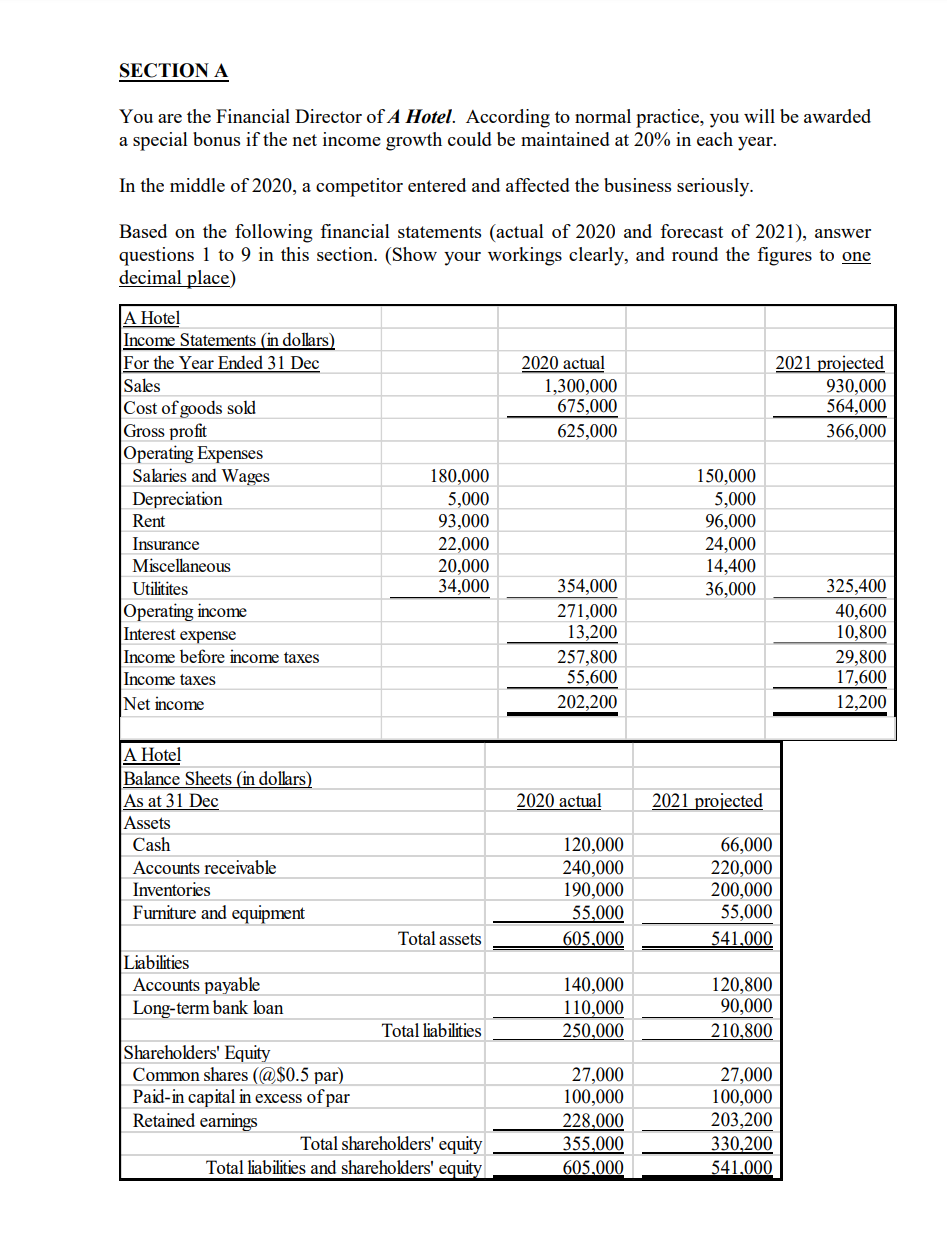

SECTION A You are the Financial Director of A Hotel. According to normal practice, you will be awarded a special bonus if the net income growth could be maintained at 20% in each year. In the middle of 2020, a competitor entered and affected the business seriously. Based on the following financial statements (actual of 2020 and forecast of 2021), answer questions 1 to 9 in this section. (Show your workings clearly, and round the figures to one decimal place) 2020 actual 1,300,000 675,000 625,000 2021 projected 930,000 564,000 366,000 A Hotel Income Statements in dollars) For the Year Ended 31 Dec Sales Cost of goods sold Gross profit Operating Expenses Salaries and Wages Depreciation Rent Insurance Miscellaneous Utilitites Operating income Interest expense Income before income taxes Income taxes Net income 180,000 5,000 93,000 22,000 20,000 34,000 150,000 5,000 96,000 24,000 14,400 36,000 354,000 271,000 13,200 257,800 55,600 202,200 325,400 40,600 10,800 29,800 17,600 12,200 2020 actual 2021 projected 120,000 240,000 190,000 55,000 605,000 66,000 220,000 200,000 55,000 541,000 A Hotel Balance Sheets (in dollars) As at 31 Dec Assets Cash Accounts receivable Inventories Furniture and equipment Total assets Liabilities Accounts payable Long-term bank loan Total liabilities Shareholders' Equity Common shares (@$0.5 par) Paid-in capital in excess of par Retained earnings Total shareholders' equity Total liabilities and shareholders' equity 140,000 110,000 250,000 120,800 90,000 210,800 27,000 100,000 228,000 355.000 605.000 27,000 100,000 203,200 330,200 541,000 Financial Ratios (a) Current ratio (b) Quick ratio (c) Total assets to total liabilities ratio (d) Debt-to-equity ratio (e) Net return on assets (f) Net income to revenue (g) Inventory turnover (h) Cost of goods sold percentage Requirement > 1.5 > 1.5 > 2.5 5% > 5% > 3 timesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started